Improving efficiency in state filings is becoming increasingly important for insurance companies in today’s competitive and regulatory-intensive landscape. Streamlining the filing process reduces operational costs and expedites product time-to-market, allowing companies to capitalize on market opportunities faster. Additionally, an efficient process minimizes regulatory risks, fostering compliance such to avoid potential penalties or reputational harm.

The launch of the System for Electronic Rate and Form Filing (“SERFF”) in 1998 represented a giant leap forward in efficiency. Members of an insurance company’s state filing departments could submit and track filings electronically, drastically reducing busywork and enabling teams to focus on bigger-picture thinking, like spotting trends and making sense of complex rate and rule filings.

Partnering with experts and leveraging easy-to-use state filing software reduces errors, enables better tracking of submissions, and accelerates the path to approval.

Swift Responses to Administrative Delays

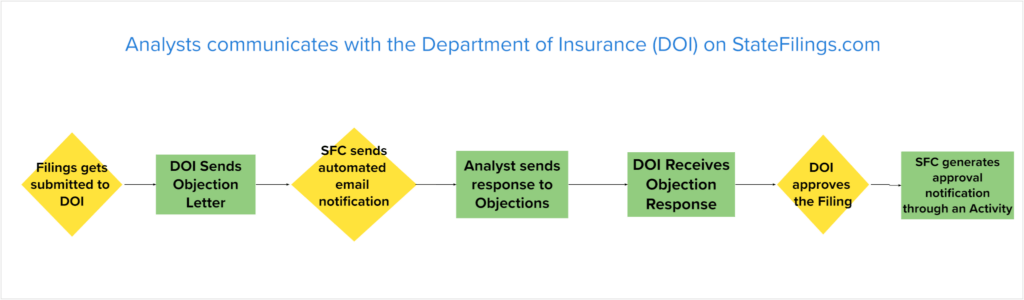

The COVID-19 pandemic introduced delays for the Department of Insurance’s (“DOI’s”) approval process, creating additional hurdles for insurers. The insurance filing support experts at Perr&Knight have longstanding relationships with all DOIs and can provide valuable insight into which ones are experiencing backlogs and how to minimize the expected time to gain approvals.

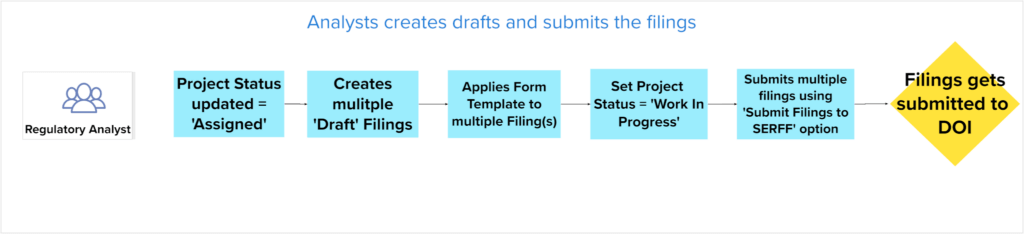

Two-way API-enabled communication between StateFilings.com and SERFF automates updates with status information, visible in real-time. This functionality empowers our filing support teams to identify delays immediately and rectify any issues.

Unparalleled Efficiency with Support from Digital Tools

The remote work era has underscored the importance of digital solutions that unify team members from wherever they are working. With seasoned, credentialed actuaries located across the country, Perr&Knight maintains a long history of collaboration between team members who are not in the same location everyday. This geographic dispersion enables us to deliver boots-on-the-ground support to clients nationwide and develops strong, local connections with regulators in various state DOIs.

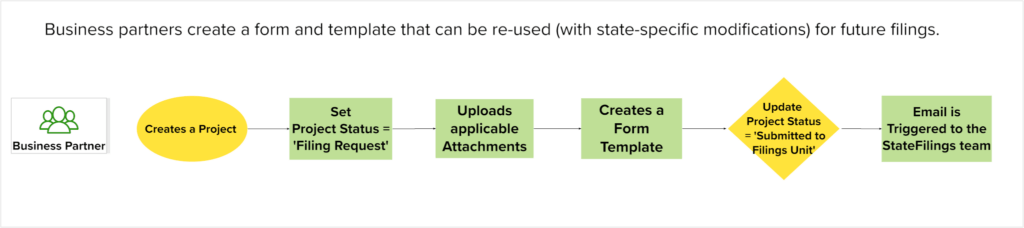

Perr&Knight uses StateFilings.com as a shared hub for submitting and tracking filings wherever our clients operate. StateFilings.com is a web-based software hosted on a secure server, allowing our teams and clients access to the software from any web-enabled device, allowing visibility into the filing(s) without having to dig through files on local devices or await a callback from another team member.

While person-to-person contact will always be welcome, the software is designed to enable teams to leverage advanced project management, research, and workflow assignment features that streamline collaboration and enhance productivity.

Gaining a Macro Perspective

To succeed in the complex world of insurance state filings, you must identify trends in DOI behavior and learn from rejection patterns. Our credentialed actuaries have decades of experience filing across lines of businesses throughout the nation. Not only do we monitor current trends, but our deep experience enables us to grasp the intricacies of DOI interactions and build robust relationships with DOIs – all benefits that help avoid costly errors and sidestep pitfalls on your path to approvals.

The Advantages of Partnering with Experts

Advanced technology can instantly elevate your day-to-day state filing operations. Still, there is no replacement for collaboration with seasoned experts who understand the nuances of filing across LOBs and jurisdictions.

Guided by deep industry expertise and supported by StateFilings.com – innovative insurance state filing software we developed for our own use – the experienced filing support team at Perr&Knight has optimized the process to keep insurance companies ahead of regulatory changes to speed their time-to-market.

At Perr&Knight, we recognize the value of human relationships in enhancing business processes. This is why we maintain strong professional relationships with the DOIs as well as our clients. By using technology to our advantage, we do what we do best: help our clients become more efficient and effective at managing state filings.

Contact Perr&Knight today to learn how we can help you master your state filings process.