As U.S. policymakers ramp up tariffs on imported vehicles, auto parts, and construction materials in 2025, insurers are increasingly feeling the downstream impact on claims costs and profitability. While the consumer-facing effects are gradually unfolding, insurers are already moving behind the scenes — adjusting rate filings, underwriting practices, and reserves to manage the ripple effects of these trade measures.

In this post, the experts at our actuarial consulting firm provide a snapshot of carrier responses and market implications.

The Economic Backdrop

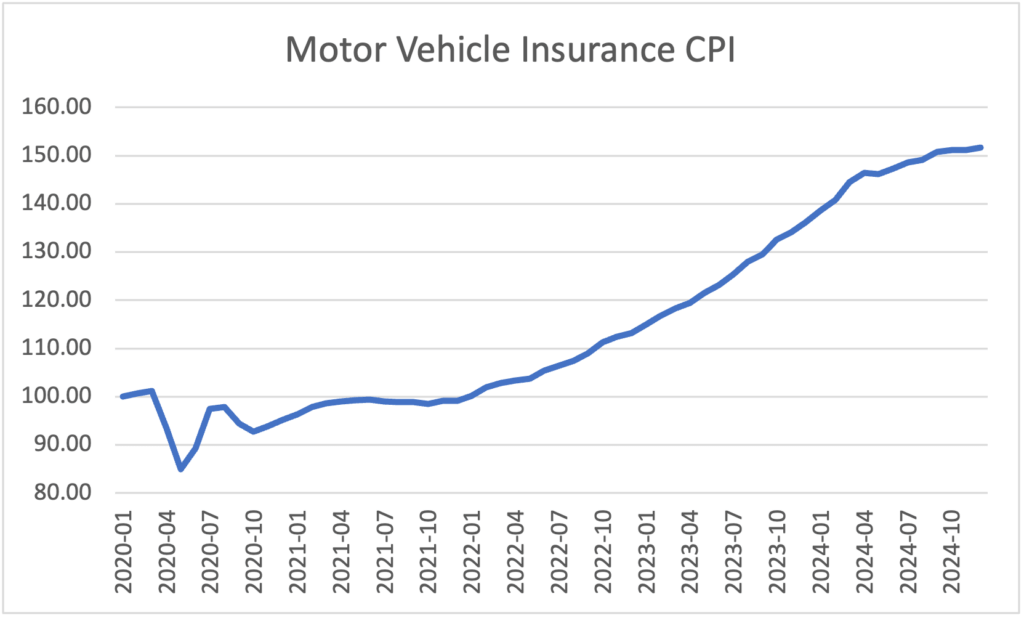

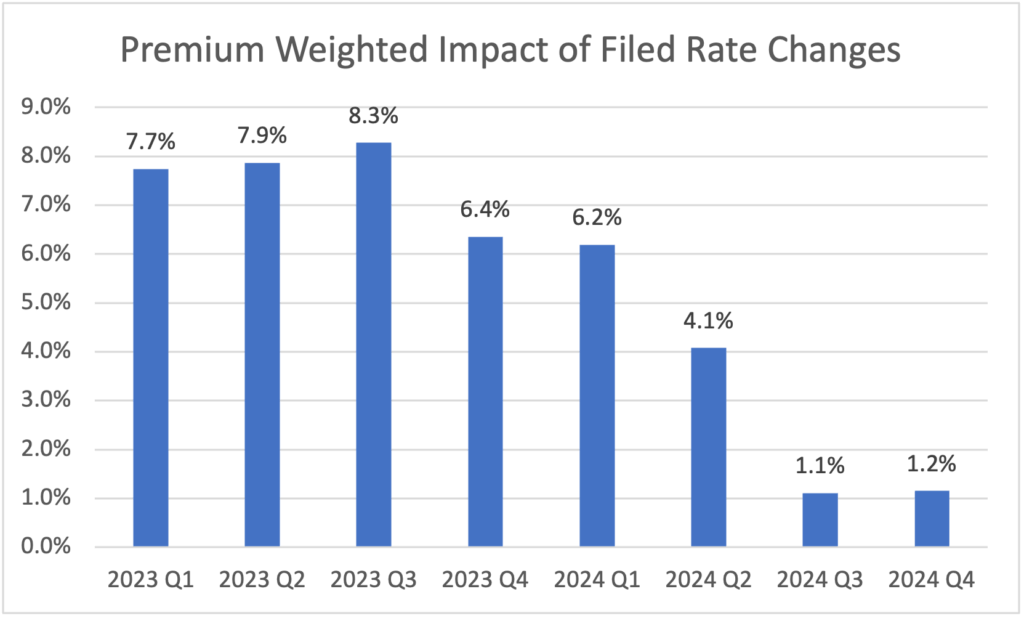

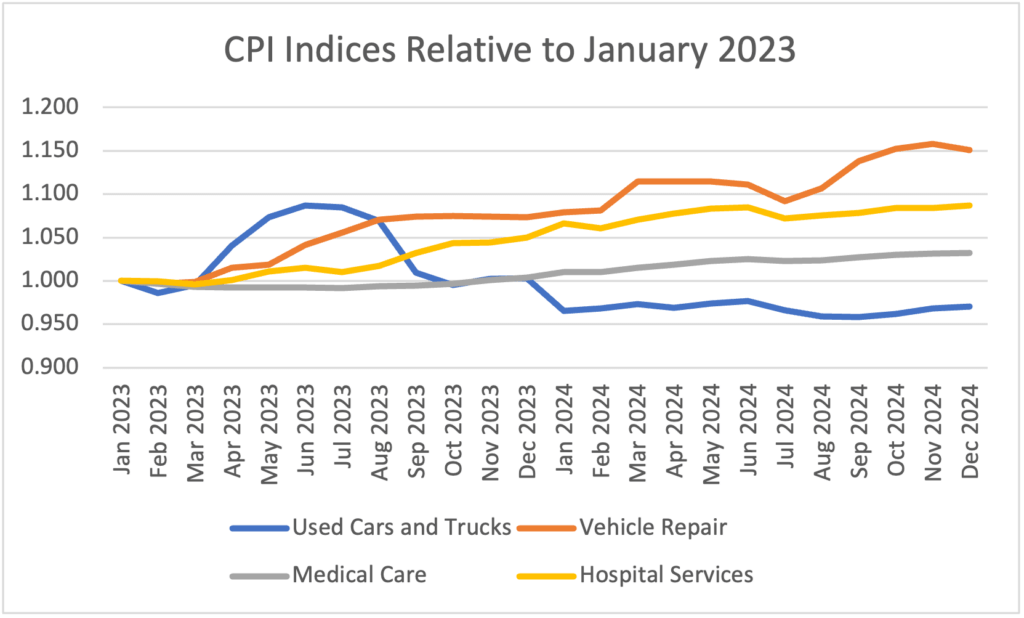

The 2025 tariffs — covering vehicles, auto components, and certain building materials — are expected to amplify inflationary pressures in property and auto repair costs. According to an analysis by the Swiss Re Institute[1] prepared prior to tariff changes announced in early May 2025, the direct cost to U.S. personal auto insurers could reach $31–$61 billion annually. Prior announced tariffs shifted the rate filing landscape: Filings for lower auto insurance rates dropped from 482 in March to just 95 in April 2025 as carriers halted or reversed reductions. Carriers are also preparing for multi-year pricing adjustments as the full impact unfolds. In short, carriers are bracing for change.

Impacts Across All Lines of Business

The actuarial consulting experts at our firm are keeping close watch on the language in filings to assess how carriers are responding to these landscape changes. Here are some of the noteworthy items we have seen in recent rate filings.

Auto Insurance

- Progressive (Q1 2025 filing)[2]

“Tariffs and other retaliatory actions will likely result in higher loss costs, which could result in a reduction in profitability and higher than currently anticipated rate increases throughout 2025 and 2026.”

- Allstate (Q1 2025 The Allstate Corporation Earnings Conference Call)[3]

“So, we’re going to manage through whatever the impacts of tariffs are, just as we did the inflation that came through the pandemic…And if we need to raise prices, we’ll raise prices…”

- Accuity Insurance Company (rate filings, Oregon & Virginia)[4]

- +5.5% one-time prospective loss change on property damage coverage

- +11.3% one-time prospective loss change on comprehensive & collision coverages

These adjustments reflect forward-looking pricing, not just historical loss trends — a key shift in how actuaries and product managers are modeling risk.

Property / Homeowners Insurance

While less explicitly tied to tariffs, homeowners insurers are reacting to related cost pressures by reassessing replacement cost models, tightening underwriting guidelines (especially in catastrophe-exposed regions), and increasing deductibles or capping coverage on high-value items.

Market Implications

For insurance professionals, the tariff environment raises critical questions:

- How can pricing and reserving models capture prospective, rather than trailing, loss costs?

- Are underwriting strategies sufficiently agile in the face of shifting repair and rebuild expenses?

- How will state regulators respond to tariff-justified rate filings?

How an Actuarial Consulting Firm Like Perr&Knight Can Help

Navigating this new “tariff terrain” requires specialized expertise. Our actuarial and product design consulting services can help your organization in the following ways:

Advanced Actuarial Modeling: We project the impact of tariffs on expected future losses and expenses, considering externally available data and broader economic trends.

Innovative Product Design: We collaborate with your team to design and refine insurance products that address the evolving needs of your customers in this dynamic environment.

Strategic Pricing Solutions: We help you develop data-driven pricing strategies that balance the need for rate adequacy with market competitiveness.

Robust Reserving Methodologies: Our actuarial experts can assist you in establishing sound reserving practices that account for the uncertainties introduced by tariffs.

Regulatory Compliance Support: We provide comprehensive actuarial analysis and documentation to support your rate filings and ensure effective communication with regulatory authorities.

Partner with an Experienced Actuarial Consulting Firm

Don’t let the complexities of tariffs and their impact on the insurance industry leave you behind. Our team of experienced actuarial and product design consultants is ready to partner with insurance organizations of all sizes to develop proactive strategies for pricing and product development.

Collaborating with experienced actuaries and insurance product design experts can help you stay ahead of a shifting landscape and ensure your organization’s continued success in this evolving market.

Contact Perr&Knight today for a consultation and discover how our expertise can help you turn tariff-related challenges into strategic advantages.