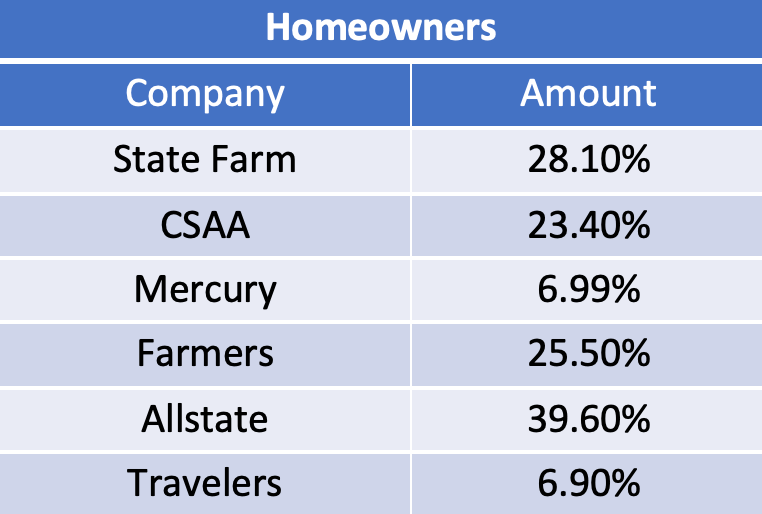

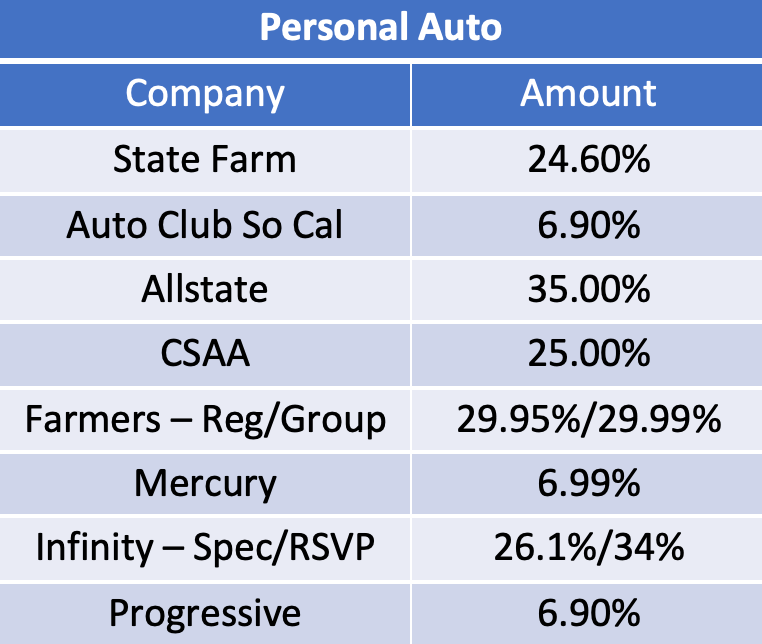

As mentioned in the Potential Impacts of the LA Fires on California’s Property Insurance Marketplace blog, the possibility for assessments from the California FAIR Plan loomed large. That fear has become a reality, as the FAIR Plan, on February 11, 2025, levied its first assessment to member companies since 1994. The assessment totaled $1 billion and will be assigned based on the market share of the member companies. For the largest insurers in the state like State Farm, these assessments add many millions of dollars to the already significant bills they owe in the aftermath of the fires. Now that assessments have been made, what does it mean for the state’s property insurers beyond just the large bill?

$1 Billion Today, More in the Future?

Though the total assessment of $1 billion is significant, it does not necessarily mean that it is sufficient to cover all of the FAIR Plan’s costs. It is possible that the $1 billion amount was chosen specifically to coincide with the Commissioner’s September 3, 2024 Bulletin that laid out the rules for companies to recoup a portion of those assessments. That bulletin allows insurers to submit rule filings to the California Department of Insurance (“the CDI”) for approval to enable insurance companies to recoup up to 50% of those assessments in the form of a “temporary supplemental fee” that would be charged to policyholders over a period of 24 months. The FAIR Plan has said that roughly 97% of the claims submitted so far have been residential, which means the personal lines assessment is already close to that first billion. The FAIR Plan’s estimated exposure in the Palisades alone is $5 billion, so the potential threat of future assessments down the road is still very real. Once the assessments go beyond $1 billion in one calendar year, the bulletin allows that recoupment percentage to increase to 100%. Insurers may file to recoup as much as possible, so future assessments could add significant cost to the residential property premiums that are already straining consumers.

The CDI and the FAIR Plan are aware of the risk of future assessments and what it could mean for California residents, so the state has already begun enacting measures to try and make sure that doesn’t happen. For starters, Assembly Bill 226 (“the Bill”) was introduced by the state in January. The “FAIR Plan Stabilization Act” would allow the state to issue bonds to support the FAIR Plan to help it recover from large-scale disasters and increase its ability to pay claims. The bonds could help pay policyholders to begin rebuilding their lives, which is something that is sorely needed. The earlier the reconstruction efforts start, the better. It is unclear, however, how much the FAIR Plan might need in bonds, and it would not save insurance companies from the risks of future assessments. The Bill requires the FAIR Plan; if supported by bonds, lines of credit, or any other payment mechanism; to assess insurance companies “in the amounts and at the times necessary to timely pay in full all obligations.” So, while the BIll could help prevent further assessments in the short term, companies may still be exposed to more assessments in the long-term, and this time, it could come with interest.

Will Consumer Groups Stop Recoupments?

As mentioned, FAIR Plan assessment recoupments require a rule filing in order to implement the temporary supplemental fees and recoup their FAIR Plan assessments. Despite the very unique nature of these filings, they would still be subject to the public review period required by Proposition 103. The public review period allows an interested party, such as a consumer group, the opportunity to intervene on these filings. One consumer group that seems to have plans for review of these recoupment filings is Consumer Watchdog. In a public statement, Consumer Watchdog argues that insurance companies charging policyholders for FAIR Plan assessments is “contrary to the law” because the statute enacting the FAIR Plan requires insurers, not consumers to “participate proportionally in the “writings, expenses, profits, and losses” of the Fair Plan.” There is also a question about the legality of insurer’s abilities to implement the temporary fees if their reinsurance providers cover the FAIR Plan assessments as companies like Mercury General Corporation have indicated publically. The executive director of Consumer Watchdog is on record saying that they will “be exploring every legal option to protect (consumers) from those surcharges” (https://calmatters.org/economy/2025/02/homeowners-insurance-costs-rising-in-california-fair-plan/).

It seems like a safe bet that the FAIR Plan assessment filings will be challenged by the consumer groups, but how successful they will be in limiting or even stopping these FAIR Plan recoupments remains to be seen.

Do Commercial Carriers Understand Their Bill?

It is well known that the assessments are billed to insurers based on market share, but insurers should be mindful of how that market share is determined. This is especially true for commercial insurers who may have received a much larger bill than expected after seeing the commercial side received just 3% of the total assessment. The participation rates for the residential assessments can include allied lines premiums when calculating the participation rates, even though many carriers have premiums in that annual statement line that are exclusively commercial. This has led to situations where an insurer who only writes commercial business receives a much larger-than-expected bill because they are receiving a portion of the residential bill. Companies can send corrections to the FAIR Plan to get their participation rates adjusted, but they are only given 30 days to do so which means as of now, it is likely too late to correct for this most recent bill. Commercial carriers should be sure to make any necessary corrections to participation rates now to prevent overstated bills moving forward.

How Quickly Will Companies be Able to Implement the Temporary Fees?

While debates about the validity of the supplemental fees go on in the background, they will not deter companies from making FAIR Plan assessment filings. For the first billion in assessments, many commercial carriers may have assessment bills so small that it may not warrant the cost of implementing the supplemental fee. We expect that the vast majority of personal lines insurers in the state, however, will make filings to add the supplemental fees to their programs given the heavy weighting of assessments to residential the residential side.

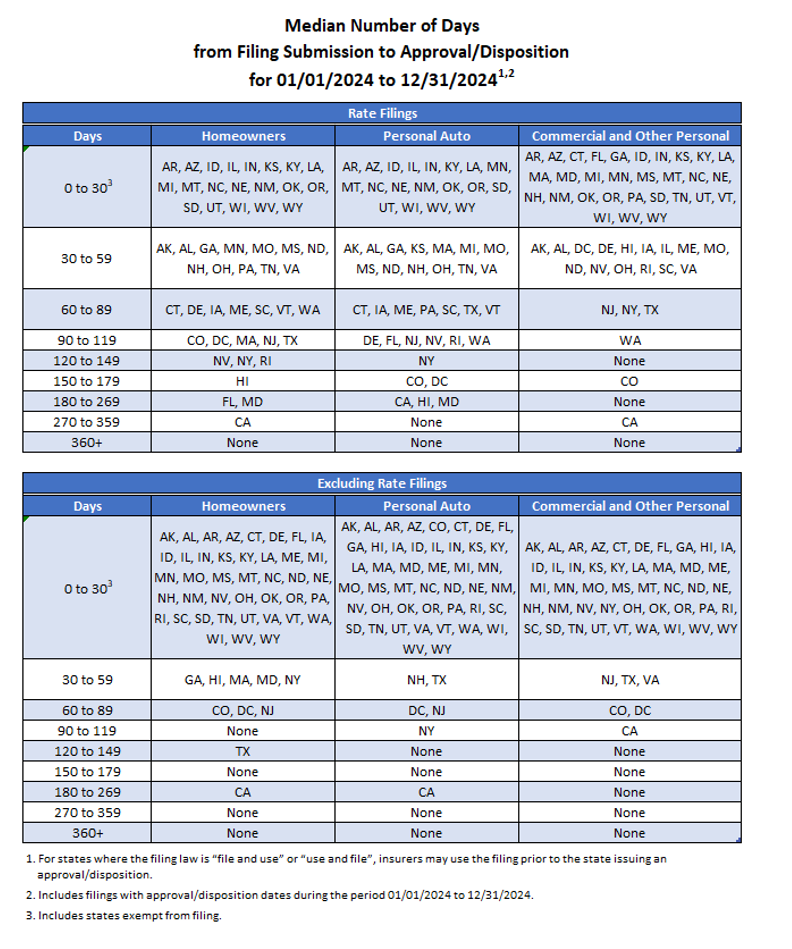

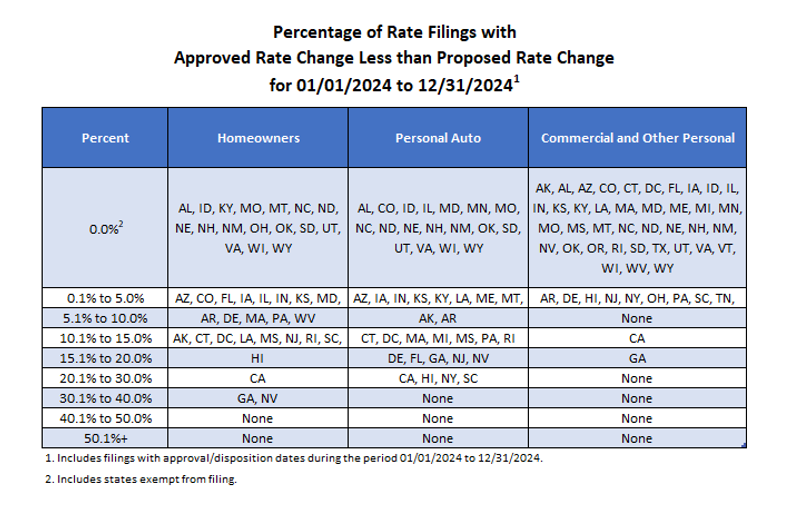

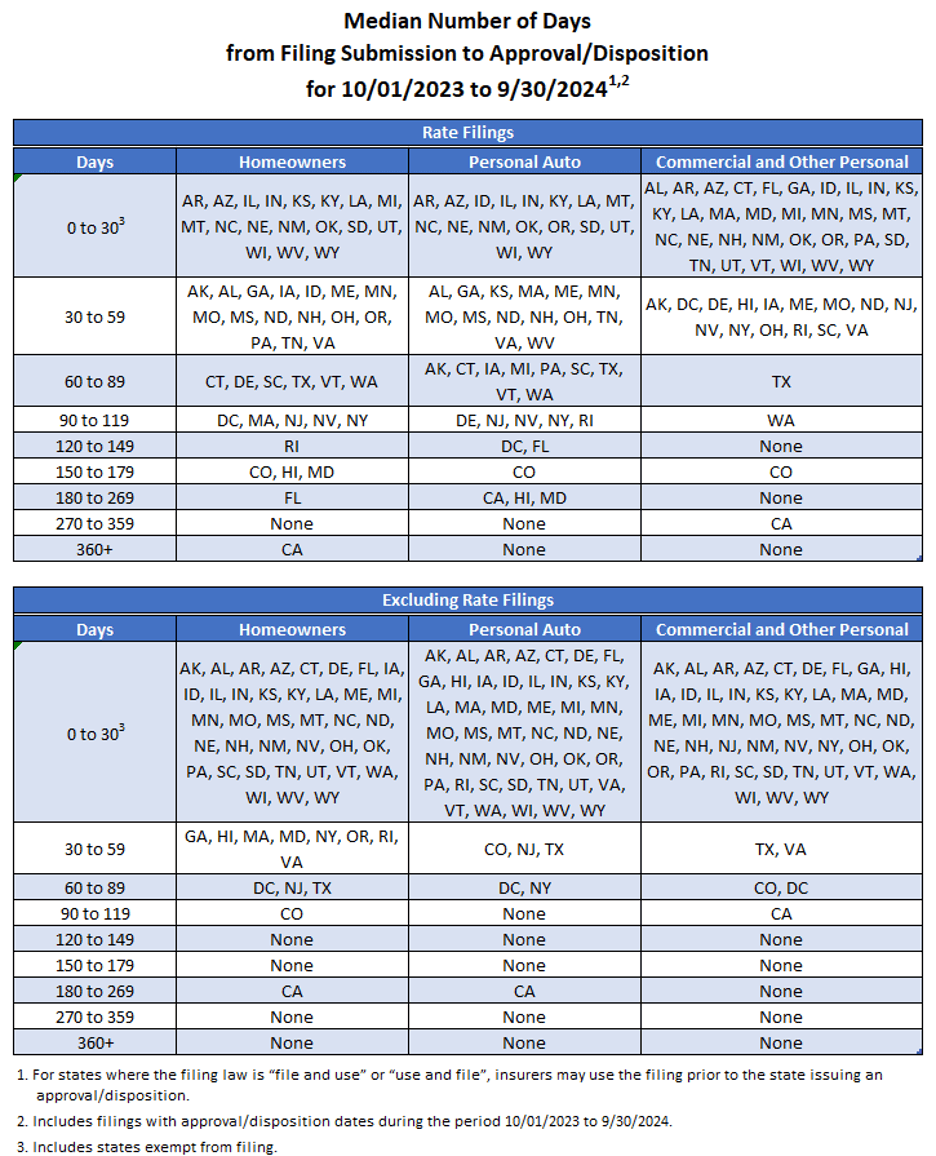

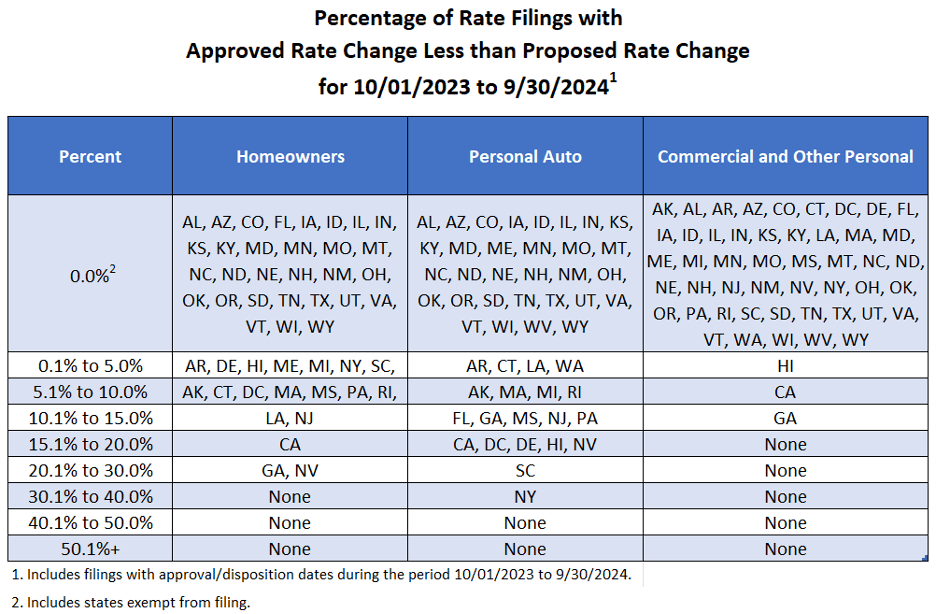

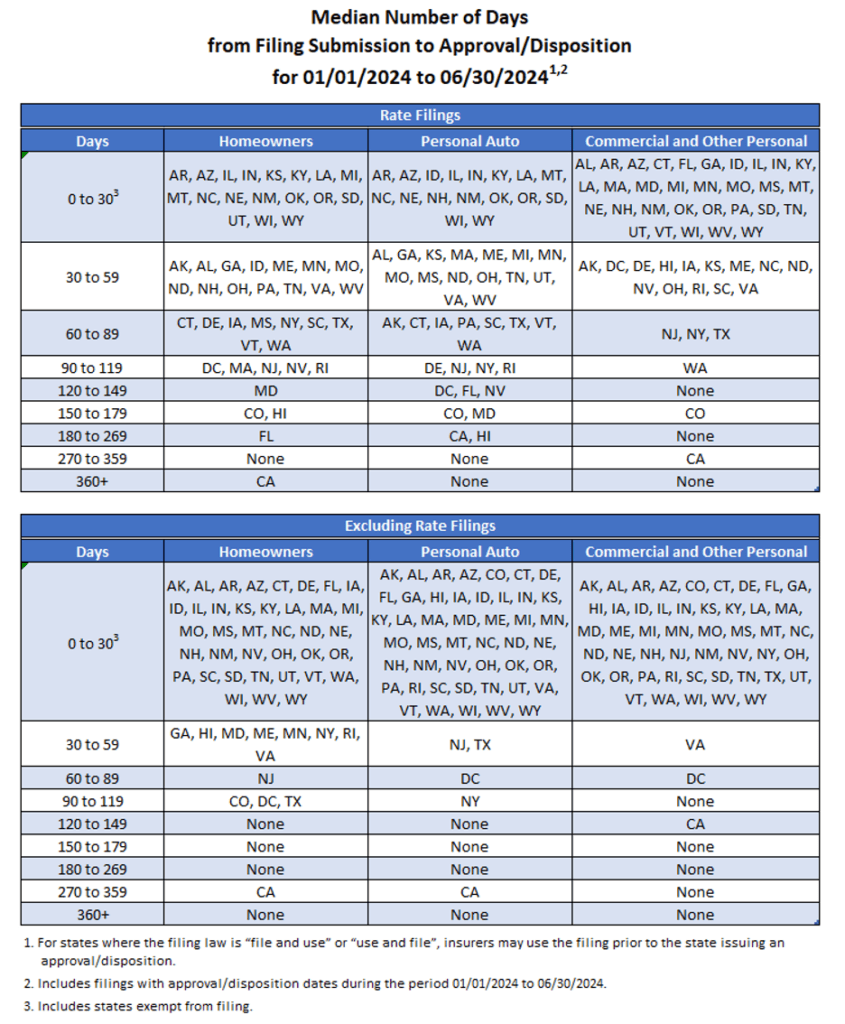

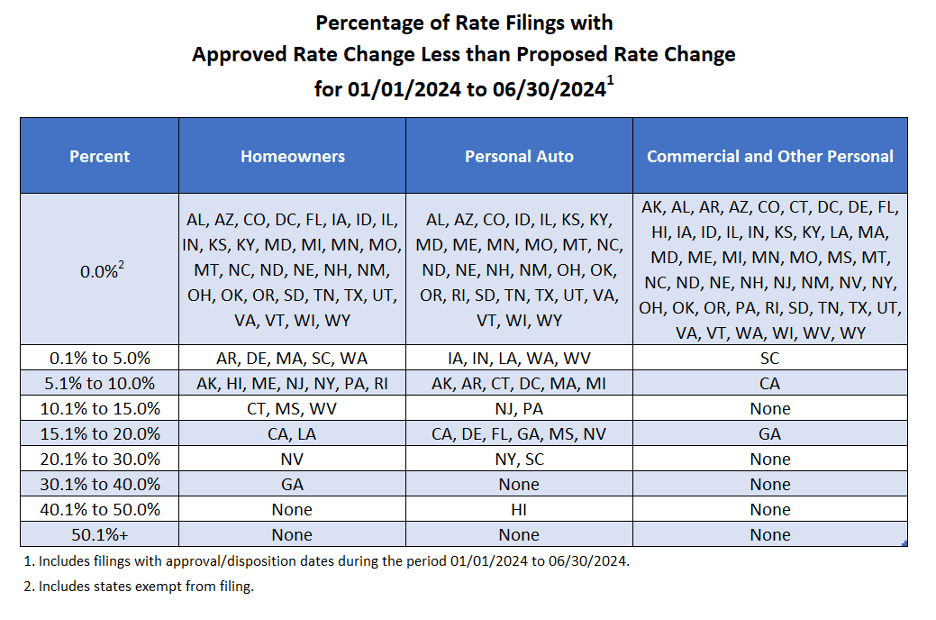

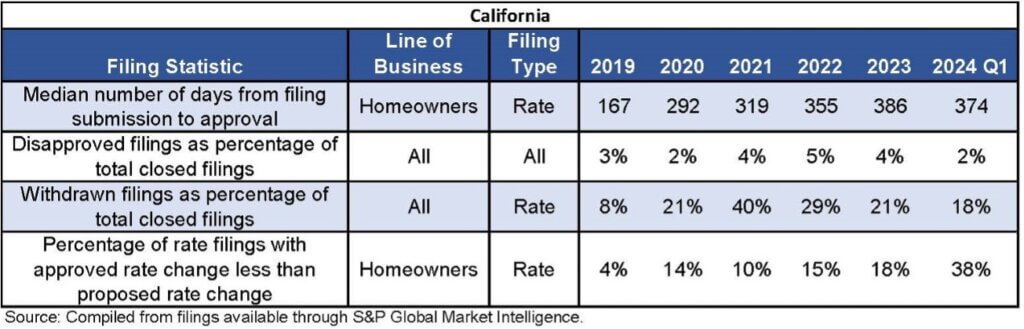

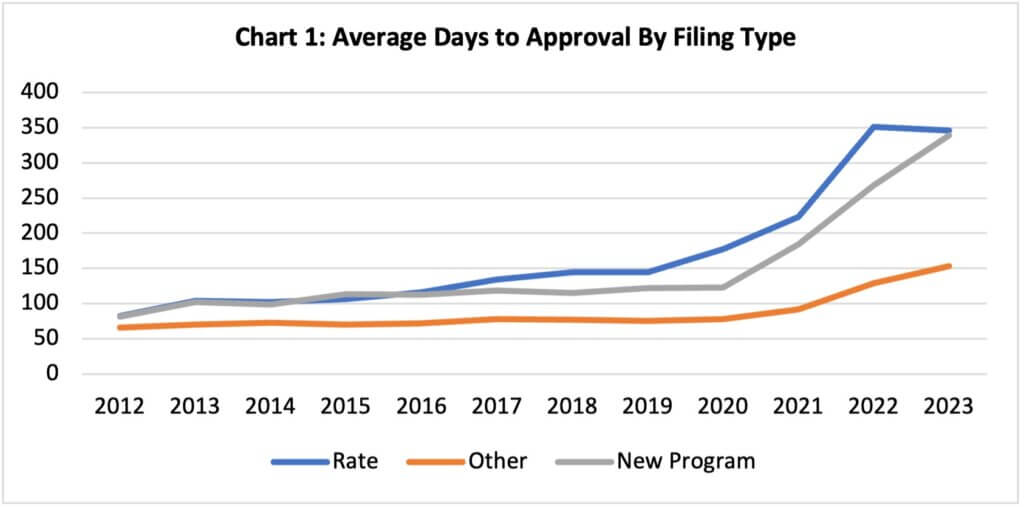

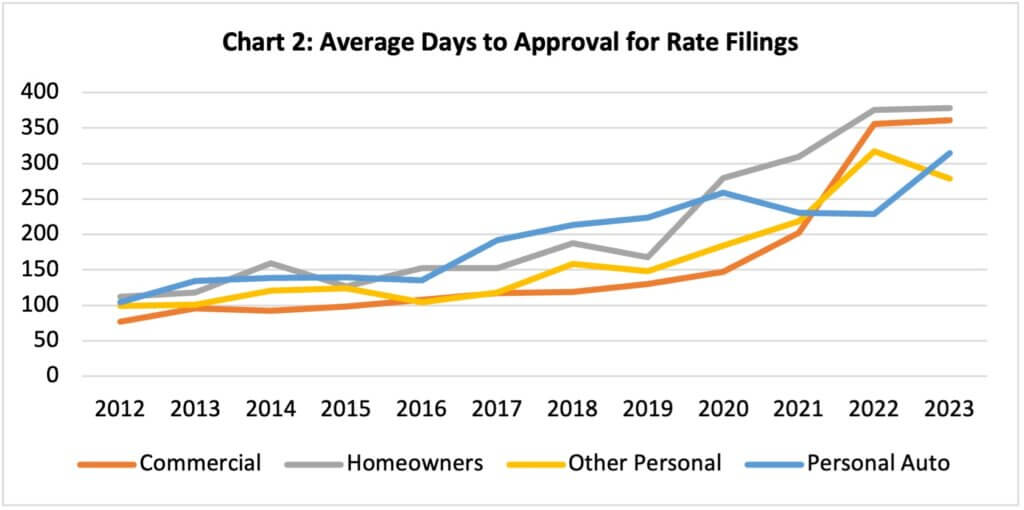

The current rules laid out by the CDI allow supplemental fees to be filed as a pass-through to reinsurers, so even companies with coverage for the assessments will likely make a filing to get as much back as possible for their reinsurance partners. This means that the CDI could be receiving a lot more filings than normal in a relatively short amount of time, with the potential to impact department review times, not only for these filings but for pending filings and/or subsequent filings unrelated to the FAIR Plan. The hope is that the clear filing requirements laid out by the CDI will make the filings easy to review and allow these filings to be reviewed quickly, but until the full scope of the filings is known, that remains only a hope. It is unclear what role public intervention on these filings will play, as well. With all these uncertainties, it is of the utmost importance that any filings submitted for these temporary supplemental fees be clear and complete to help facilitate the quickest possible review. The actuarial consultants at Perr&Knight have already been contacted by multiple companies about doing just that, and is well equipped to get companies on the road to offset the costs of the recent FAIR Plan assessments.

Contact the state filings experts at Perr&Knight today.