In the contemporary insurance landscape, insurance carriers are often looking to expand into niche or specialized markets without needing to develop their own in-house expertise. However, often they lack the skill set, distribution networks, and/or local knowledge required to tap into these unique markets effectively. This is where ‘Program Managers’ step in as essential partners in the insurance industry.

Program Managers often specialize in specific lines of insurance or industry segments, which allows carriers to access these markets more effectively. Program Managers are entrusted with underwriting multiple insurance policies on behalf of the insurance companies they collaborate with, allowing them to evaluate price risks, issue policies, and make decisions about policy terms and conditions. This collaborative relationship unlocks a world of opportunities for insurance carriers, enabling them to expand their market reach without the need to build and maintain their own distribution networks.

As a result, insurance carriers are often faced with the challenge of effectively managing the diverse range of program managers also sometimes referred to as ‘Managing General Agents (MGAs)’. On the flip side, program managers grapple with the distinct challenge of gaining comprehensive access to an array of filings, forms, and rules that are pertinent to the numerous insurance carriers with whom they collaborate.

Unleashing Streamlined Capabilities for Enhanced Insurance Management

Acknowledging this pressing need, StateFilings.com has emerged as a game-changer in the industry, providing a cutting-edge insurance state filings software that solves the challenges of program managers and insurance carriers that result from their unique relationships. As an industry leader for rate, rule, and form filings, StateFilings.com’s secure web-based application offers a user-friendly interface that centralizes essential information, offering access to projects, filings, forms, rates/rules, and activities across all authorized accounts.

By utilizing StateFilings.com, insurance carriers, and program managers gain unparalleled insights and comprehensive tools to facilitate insurance management on behalf of their clients. Here are some of the key functionalities that StateFilings.com offers to empower program managers and insurance carriers within the insurance state filings software platform.

Benefits for Insurance Carriers

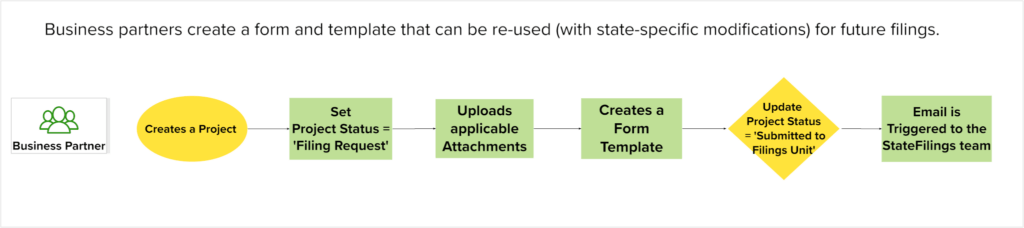

- Project Organization: On StateFilings.com, filings are organized by project. A project can include multiple states and lines of business associated with a single program. This structure enables insurance carriers to provide program managers access exclusively to the specific projects associated with their programs. During project creation, insurance carriers have the ability to select the projects to which program managers should be granted access. This ensures seamless collaboration and an organized workflow. In contrast, SERFF does not categorize filings by projects, introducing an extra layer of complexity to the collaboration process.

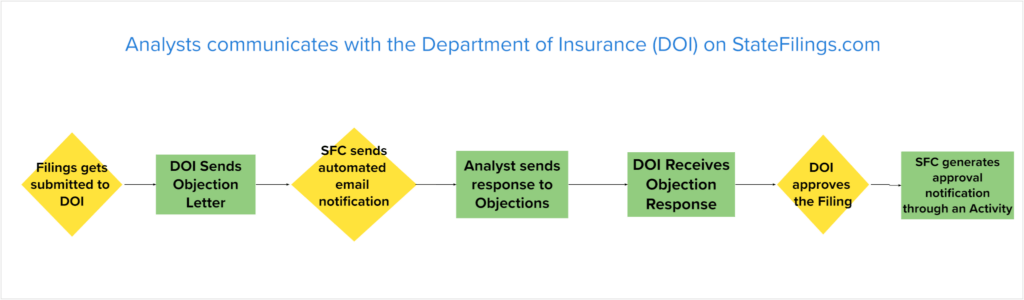

- Proactive Email Notification: Automated submission, approval, and objection notifications are dispatched to insurance company employees and program managers with filing access, ensuring they receive real-time updates on project and filing activities. This allows insurance company personnel to monitor program filings in the insurance state filing software while relieving them of the burden of keeping program managers informed.

- Robust Search Engine: StateFilings.com features a robust search engine, providing insurance company employees and program managers with quick access to relevant information. However, this functionality comes with a built-in safeguard – program managers can only search for items to which they have access, ensuring data integrity. This feature not only enhances efficiency but also maintains security by limiting access to authorized data, safeguarding sensitive information, and ensuring compliance with data privacy regulations.

- Comprehensive Access to Forms and Rate/Rule Library: The insurance state filings software interface offers insurance company employees access to their extensive library of forms and rate/rules along with a user-friendly search feature. The ability to search by various criteria like states, dates, and TOIs empowers company personnel with the information they need at their fingertips, facilitating faster decision-making by reducing the time and effort required to find pertinent resources.

Benefits for Program Managers

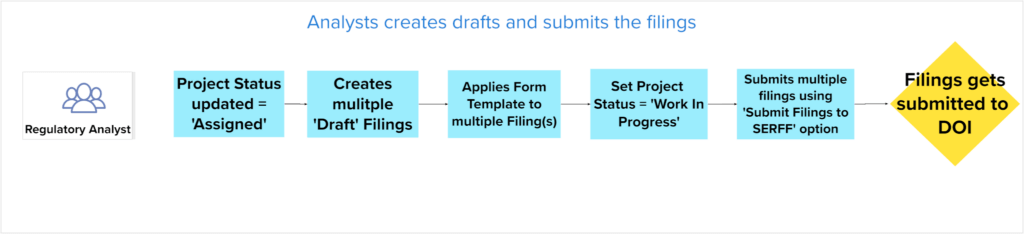

- Unified Login: Each program manager is granted a single, unique login with read-only access to their designated projects which can be selected from multiple insurance carriers. This personalized approach ensures that program managers can efficiently manage their responsibilities without having to rely on insurance carriers for updates on their filings. In contrast, utilizing SERFF to access filings requires program managers to manage multiple logins, one for each insurance company they collaborate with, resulting in added complexity and inefficiency within the process.

- Real-Time Email Alerts: Automated email notifications offer real-time project submission and approval updates to program managers, and program managers can receive automated email alerts when objections are received. This ensures that program managers can respond swiftly to any issues, ensuring project progress stays on track and reducing delays.

- Empowering Search Engine: The search engine facilitates easy access to projects, filings, objections, forms, and rules, enhancing program managers’ efficiency. Restricting search capabilities to only accessible items maintains data integrity and security, ensuring that program managers can confidently work within their designated programs.

- Tailored Access to Forms and Rate/Rule Library: This feature empowers program managers to access the approved materials for their specific programs, providing an organized view of both countrywide and state-specific versions of forms. This feature simplifies resource management, supports compliance, and streamlines decision-making.

The featured functionalities of the insurance state filings software hold immense significance for both insurance carriers and program managers, directly addressing critical challenges within the insurance industry.

In this new era of insurance management, StateFilings.com stands out as the go-to solution, providing program managers and insurance carriers with the tools they need to navigate the dynamic landscape and thrive in a competitive market. The platform’s commitment to excellence and customer-centricity cements its position as an invaluable asset to program managers, insurance carriers, and the entire insurance ecosystem.

Contact us to see a demo of our insurance state filings software: StateFilings.com.