As we mark Perr&Knight’s 30th anniversary, I find myself reflecting on the journey that brought us here. What began in a small, converted garage office in 1994 has grown into a thriving organization serving clients across the country with a team of more than 150 dedicated insurance professionals, including more than 30 credentialed actuaries. This milestone is not just a testament to our longevity but a celebration of the partnerships and shared successes that have shaped us over the years.

First and foremost, I want to express my deepest gratitude to our clients. Your trust and collaboration have been the cornerstone of our success. Many of you have been with us since the early days, and your belief in our vision has fueled our growth and innovation. It is your challenges and ambitions that inspire us to continually improve and adapt, and for that, we are very thankful.

I also want to take a moment to recognize the incredible team at Perr&Knight. Our employees are the heart of everything we do. Your dedication, expertise, and passion have made this company what it is today. Whether working behind the scenes to develop cutting-edge solutions or directly supporting our clients, each of you plays a vital role in our success. I am particularly grateful to those who have been with us for decades, as well as the fresh faces who bring new energy and ideas to our work.

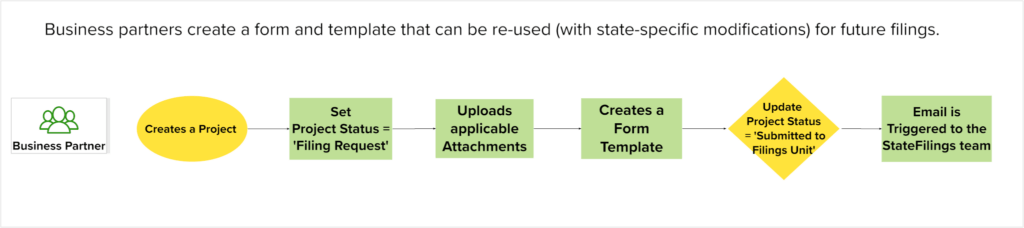

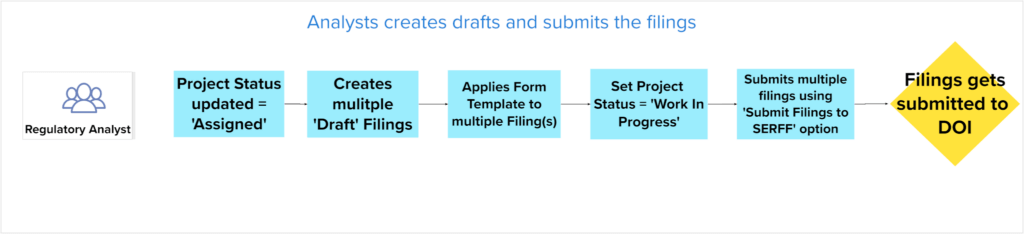

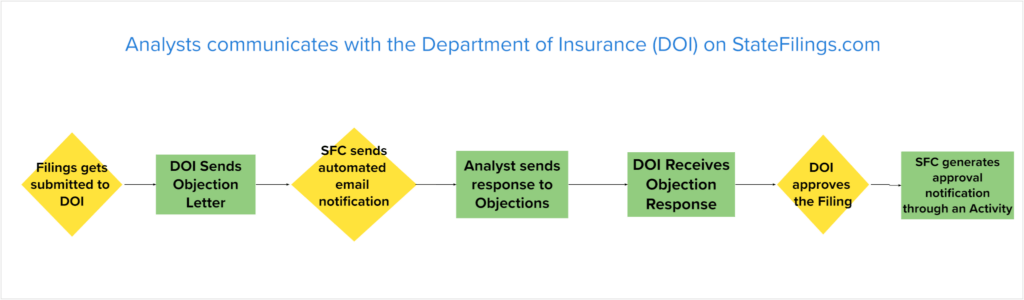

Over the past 30 years, we have seen remarkable changes in the insurance industry, and we have been fortunate to be at the forefront of many of them. From streamlining regulatory compliance processes to developing innovative actuarial and technology solutions, we have continually evolved to meet the needs of our clients. None of this would have been possible without the strong partnerships and shared commitment to excellence that define Perr&Knight.

Looking ahead, I am more excited than ever about the future. We remain committed to our mission of helping insurance companies operate more efficiently and effectively. As the industry continues to transform, we are ready to embrace new challenges and opportunities, guided by the same values and principles that have sustained us for three decades.

Thank you to everyone who has been part of this journey—our clients, our team, and our partners. This milestone belongs to all of you, and I am profoundly grateful for your contributions to our success.

Here’s to the next 30 years of innovation, growth, and partnership!

Scott Knight

Check out our 30th anniversary webpage where we highlight all our milestones from the past 30 years.