By: Jennifer Choe and Juliann Schiano

March 2023 marked ten years since the Affordable Care Act (ACA) was signed into law, and much has changed over the last decade. Health coverage has evolved in response to ACA-related regulation, challenges associated with COVID-19, and a new post-pandemic “normal” that has impacted everything from employee working conditions to vacation plans.

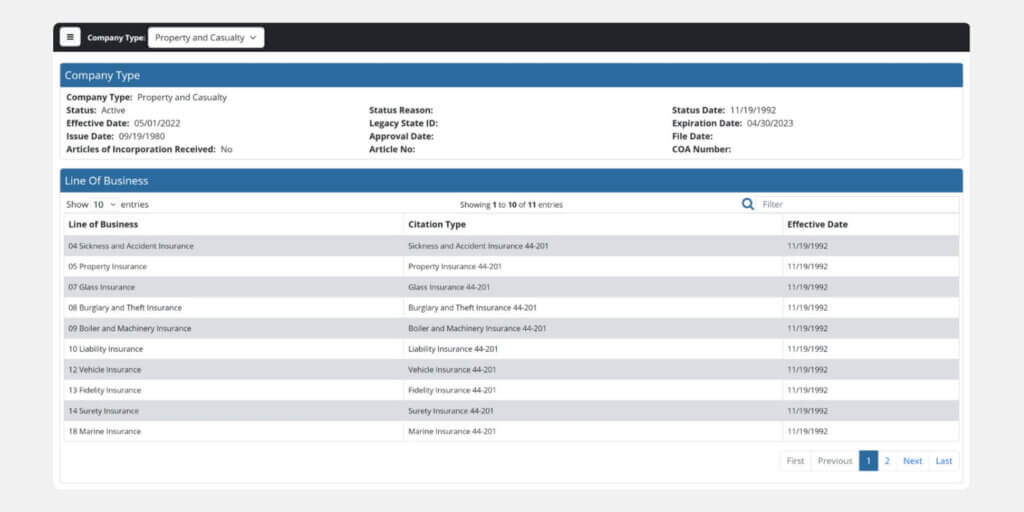

States are changing their requirements for health-related insurance products – and your company’s portfolio should reflect current regulations. For example, the excepted benefits in your current benefit structure may no longer be considered “excepted.” Another example is that rates in Washington state must be refiled every seven years.

As the leading providers of life and health actuarial consulting and product development to insurance companies throughout the nation, we are seeing some key trends in supplemental health coverage. If your company has not updated these products lately, now is the time to take another look.

Critical Illness

Health insurance providers are broadening the suite of what critical illness covers. Here are some opportunities that might enhance your portfolio:

- Extended hospital expense coverage

- Transportation benefits for travel to and from a hospital

- Reconstructive Surgery benefits if certain conditions are met

Accident

Supplemental health benefits due to accidents have changed in recent years as people are vacationing and working differently. Here are some emerging product types that our product design and actuarial consulting experts have identified:

- Accidental Death Recreational Vehicle Travel benefit if death occurs as a result of an injury while the insured is a driver or passenger in a recreational vehicle, while in a vehicle pulling a fifth wheel, or while at a campground

- Work From Home benefits such as alternative workspace, psychological trauma counseling, and temporary childcare

- Telecommuting Coverage benefit for insureds when they telecommute and work from home

Hospital Indemnity

New hospital indemnity coverages are also gaining traction:

- Pregnancy Indemnity coverage when the insured becomes confined in a hospital due to pregnancy

Life

Today’s supplemental products for life insurance further ease some of the burden on loved ones after a death. Here are some products that are gaining in popularity:

- Charitable Giving benefit that allows the owner to select a charitable beneficiary to receive a charitable gift amount defined as a percentage of the policy death benefit

- Final Expense coverage that provides a set death benefit and fixed premiums through a type of whole life insurance coverage and is intended to cover funeral and burial costs and medical bills such as hospital stays and nursing home expenses

- Travel or Reunion Expenses coverage for benefits or reimbursement for travel expenses so that family members may be able to attend the funeral

Other Supplemental Health Benefits

Finally, here are some additional emerging supplemental health benefits identified by our insurance product development experts that reflect the changing times:

- Telemedicine benefit to provide coverage for remote or virtual care from a physician

- Inflation Protection benefit, which automatically increases the benefit amounts with a certain percentage for each insured

- Military Pilot coverage, which provides a benefit for loss that occurs from a flight in a military airplane while the insured is acting in the capacity of pilot or crew member

- Firearm Accident benefit, which is paid when death or injury is caused by a firearm accident

- Term Life rider, which allows the insured to purchase additional term coverage on top of an existing life insurance policy

Partner with Experts to Update Your Portfolio

Updating your portfolio can be a time-consuming, detail-heavy process, especially if your company writes policies in multiple jurisdictions. Working with life and health actuarial consulting experts and experienced insurance product development teams like those at Perr&Knight can streamline your path to approvals.

Here are some of the services we offer to support insurance companies, insurtechs, and those looking to expand their product offerings in the A&H space.

Competitor studies: We have access to the most comprehensive filing database in the industry, enabling us to check policies and rates against comparable competitor filings. We use this insight to ensure coverages and rates align with industry standards and that our clients offer the most competitive programs possible.

Developing new forms and rates: We have resources that can help with creating appropriate policy forms and associated forms, as well as pricing benefits, including those for whole and term life.

Filing: Our state filings teams possess unmatched experience in filing forms and updates in all fifty-one jurisdictions. We can provide support to your filing department at whatever level you require.

Whether you want to refresh your company’s portfolio with new products to increase your competitive edge or update existing filings to ensure regulatory compliance, our life and health actuarial consulting teams can support the entire process of insurance product development, filing, and beyond.

Contact Perr&Knight today to start the conversation.