P&C Carriers: A Strategy for Entering the A&H Market

- Written By Susan Cornett

By Susan Cornett, FMLI, AIRC, CFE

P&C insurance carriers recognize the opportunity to expand product lines and increase revenue by expanding into Accident & Health products. However, the differences between P&C and A&H product development are significant and what applies to P&C may not apply to A&H from a regulatory standpoint. Understanding those differences will allow P&C carriers to enter the A&H market with faster speed-to-market along with high-quality products.

During decades of providing insurance product development and actuarial support for insurance companies across the US, Perr&Knight has zeroed in on a low-risk A&H entry product for P&C: blanket accident policies.

Why develop a blanket accident policy?

Commercial entities, schools, universities, and other organizations often need supplemental blanket A&H policies to fill gaps in medical coverage to further support their staff or students. With fewer mandated benefits, these policies are the perfect starting place for P&C companies looking to break into the A&H market and provide additional coverage options to existing clients. Blanket Accident policies also fit nicely with General Liability policies and allow brokers/agents to offer comprehensive insurance protection from a single carrier.

Differences between P&C and A&H product development

Established P&C carriers may think they have the requisite experience to develop A&H coverages. However, a few significant differences between these two types of insurance product development are worth noting.

- Rate support: Rate support requirements in A&H are different than P&C, usually requiring an actuarial memorandum describing the benefit in the rate structure as well as a signed certification attesting that the rates are reasonable in relation to benefits.

- Forms and rates standards: On the P&C side, rates tend to receive more scrutiny. On the A&H side, regulators examine policy forms more closely. Though some states are outliers, we find this is a reliable trend.

- Bureau forms: Many P&C carriers adopt ISO or other bureau forms as part of their P&C portfolio. For most lines, A&H doesn’t have this option. Most insurers rely upon proprietary forms.

- Statistical reporting: Data reporting is important on the P&C side. But except for a few lines of business, statistical reporting requirements aren’t widespread on the A&H side. Besides ad hoc data calls, most supplemental A&H coverages don’t require such detailed stat reporting.

- Rate certifications: Although a few states require certification of the rates or rate filings on the P&C side, some states require carriers to attest to their ability to meet target loss ratios for A&H lines.

- Variable benefits: A&H policies typically rely on the use of variable language to allow inclusion or exclusion of benefits, terms and conditions. It’s not unusual for a blanket A&H policy to be 50+ pages because the benefits are included in the policy and not attached as optional endorsements. From an implementation perspective, this means programming one form with many options instead of 75 forms with no options — another way these policies diverge from P&C.

- Verbiage differences: Terms and definitions vary between A&H and P&C. For example, P&C uses the phrase “loss costs” while A&H calls these “claim costs”. Unfamiliarity with terms could lead to filing errors.

Commonly asked questions

P&C carriers eager to enter A&H should know a few basic things before moving forward. Here are the most commonly asked questions from P&C insurers.

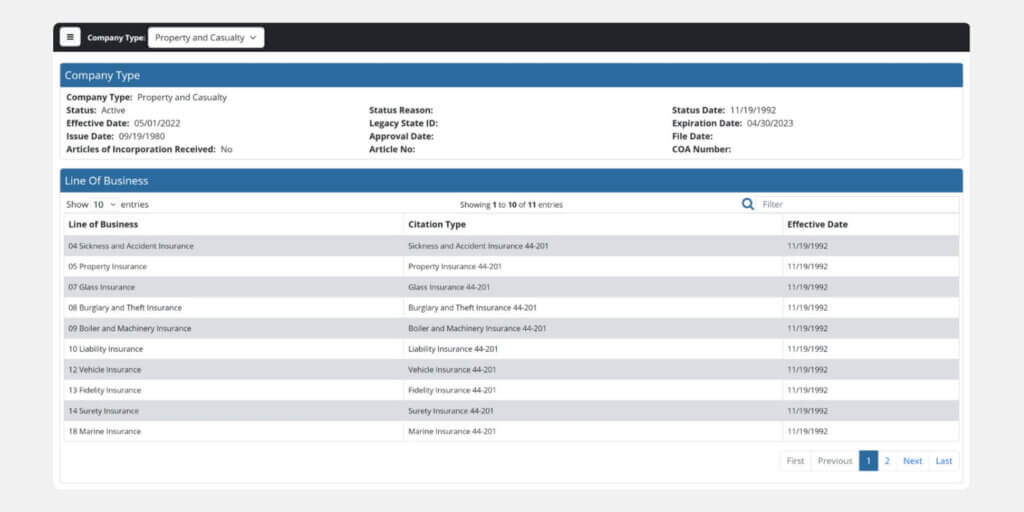

“Does our license cover A&H?” Short answer, maybe. P&C carriers may already have the ability to write A&H lines of business depending on what is included in their Certificate of Authority. Licensing requirements vary by state. Our licensing experts can help determine whether anything additional is needed. There are important differences in insurance product development and approvals, even for supplemental health policies, so P&C carriers should proceed with caution even if currently licensed to write the business.

“Can we offer blanket A&H on a non-admitted basis?” Simply, no. In the world of A&H, the concept of surplus lines is virtually non-existent. Companies may develop an A&H program thinking it will be available under surplus coverage guidelines, but state export lists rarely include any A&H coverage. The consequences for non-compliance can be steep and may jeopardize a company’s good reputation with state regulators.

“Can we ‘me too’ our A&H policy development?” Unlike P&C, “me too”-ing rating information from competitors’ existing programs is generally not acceptable. Different requirements for rate filing and support are a prime example of a P&C process that has no transferable correlation to A&H.

Start with blanket accident, then expand

After developing a blanket accident policy, companies can easily expand into other supplemental health lines. After getting your feet wet with blanket accident, product lines such as hospital indemnity, critical illness, disability income insurance, and gap medical generally follow the same product development process.

Work with experts

Developing a blanket accident policy may seem straightforward on the surface, but there are lots of opportunities to fall into little-known traps. Partnering with experienced insurance product development partners like Perr&Knight can save P&C carriers from wasting time and money on mistakes.

With our deep experience providing insurance product development and actuarial support services for carriers across both P&C and A&H lines, our professionals act as the “decoder ring” between the two. Working with knowledgeable professionals helps insurance companies step into a new world with greater confidence and ease.