How to Navigate California Personal Auto Rate Increases

- Written By Dee Dee Mays

Personal auto writers in California have been abuzz with news of the recent rate increase approved for Allstate Northbrook Indemnity Company. This is the first rate increase approved by the California Department of Insurance (“CDI”) on any type of personal auto program since April 2020. There are many filings still pending. Here are insights on common questions our insurance filings support team hears from insurers:

How did Allstate get their filing approved so quickly?

That is the $165 million dollar question. The Allstate filing was submitted on June 30, 2022, well after many other filings that remain pending. Consumer Watchdog sent a letter to Commissioner Lara urging him to reject the filing, but does not appear to have submitted a formal petition to intervene. In October 2021, the Commissioner mentioned Allstate as one of three companies that needed to provide additional COVID-19 refunds to their policyholders. At this time, there is no publicly available information indicating that Allstate has issued any additional refunds subsequent to Commissioner Lara’s letter.

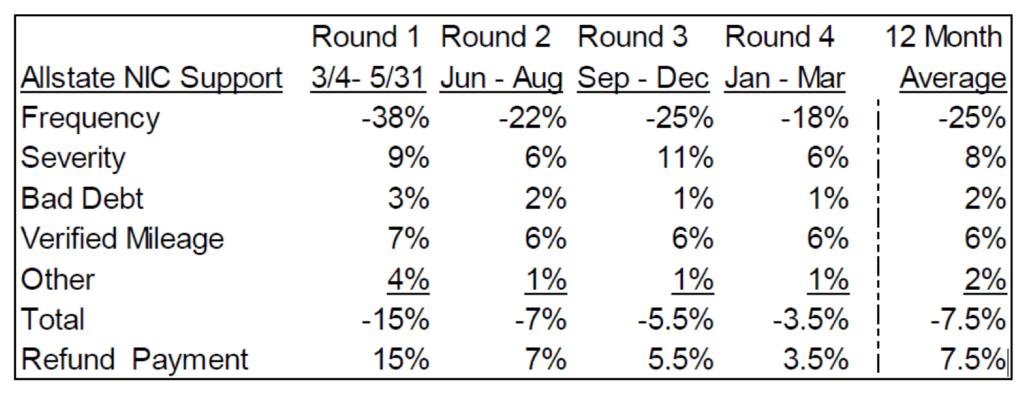

Allstate provided the following information on refunds to date in their approved filing:

In the final correspondence on the approved filing, that was submitted on the day before the filing was approved, Allstate confirmed that the next rate filing for their program in California would include the removal of their remaining affinity group rating program. This affinity group is for Specialized Professionals. Allstate’s approved manual includes a 4% discount for policies where the “named insured/applicant or spouse is a degreed professional in one of the following occupational groups: Education or Library Science, Science, Engineering, or Information Technology.” This “two-tiered system” was one of the concerns mentioned in the Consumer Watchdog letter.

Is it true that an increase greater than 6.9% requires a public hearing?

No. This is a common misconception. In fact, any filing can result in a public hearing, if a consumer group petitions to intervene and the Commissioner grants their request for a hearing. California Insurance Code 1861.05(c) includes the following [if] “the proposed rate adjustment exceeds 7% of the then applicable rate for personal lines or 15% for commercial lines … the commissioner must hold a hearing upon a timely request. “ In practice, consumer groups petition to intervene on filings with changes lower than 7% as well as higher.

There are currently 51 rate increase filings pending with the CDI. Of those, 5 have proposed increases of more than 7%.The oldest pending filing was submitted in October 2019.

If I have a rate change pending, can I revise it to propose a higher rate change?

Yes. This is similar to submitting a new filing and will result in the new change being added to a future public notice list, usually within two to three weeks after the change is submitted. The filing cannot be approved any earlier than the 46th day after public notice, which gives a consumer time to petition to intervene on the filing. Progressive initially submitted their filing for a 6.9% rate increase on January 7, 2022. This change appeared on the January 21, 2022 public notice list. Progressive amended their filing on September 30, 2022 to propose a 19.3% increase. his change appeared on the October 14, 2022 public notice list. After no correspondence from the CDI since Progressive submitted the letter to waive the deemer date on March 9, 2022, the CDI issued an objection letter on November 3, 2022 with an November 18, 2022 due date.

What usually happens if a consumer chooses to intervene on a filing?

Hearings are fairly rare, even after a consumer group petitions to intervene. Typically, the CDI will allow the consumer group to be involved in the filing review process and provide their feedback on the filed change. The CDI will hold one or more meetings with the insurance company and the consumer group to discuss the support for the changes and encourage the insurance company and the consumer group to come to agreement on a change and avoid the hearing process. The consumer group will then submit their invoice for their costs that, if approved by the CDI, are paid by the insurance company. The amount of compensation paid to intervenors from 2003 to 2020 is available at http://www.insurance.ca.gov/01-consumers/150-other-prog/01-intervenor/report-on-intervenor-program.cfm.

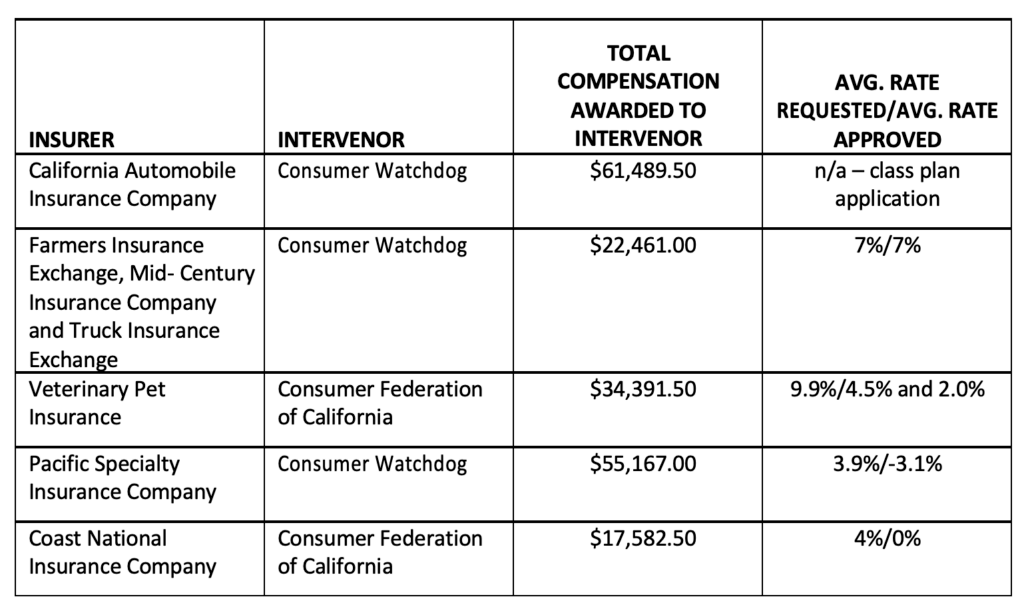

This shows the following amounts paid in 2020:

What happened with the Wawanesa personal auto rate increase filing?

As we mentioned in an earlier blog post on the moratorium, Wawanesa Insurance Company chose to reactivate the deemer on their filing, thus triggering a hearing. Our insurance filings support experts have recently learned from a representative of the CDI that “The Hearing for this matter was taken off calendar and a stipulated settlement agreement is being reviewed.”

What should my company do if we need a rate increase in California?

We have provided some additional ideas in our earlier blog. For example, consider accompanying class plan and rule revisions to improve segmentation and underwriting and to alleviate common concerns from the CDI. Regardless of how you proceed, having an insurance filings support expert with years of experience preparing personal auto rate filings in California could improve the time to approval and potentially save a company a substantial amount of money. Whether it is preparing the actual rate filing or performing a review of a rate filing prepared by the company, an expert can provide guidance that will increase the chance of having the most successful filing. There are many hot-button topics that may come up during a review of the filing. An expert can make you aware of these to reduce the potential for surprises.

Perr&Knight is a leading provider of actuarial and state filing services to insurers in California. Our actuarial consulting team actively follows the California market and is very familiar with all the filing requirements in the state. We prepare and submit more California filings than any other company. Our actuarial consulting experience includes expert testimony on rate filings and providing guidance to industry associations.