State Filings Statistics and Trends through March 2024 Now Available

- Written By Brett Horoff

Perr&Knight has released the March 2024 edition of State Filings Pulse, a quarterly publication that provides the insurance industry with insight into filing approvals in each state. These up-to-date filing statistics enable companies to observe the latest state filing trends more effectively.

Want to explore State Filings Pulse? To obtain a free copy of the publication on a quarterly basis, please register at the following link: https://www.perrknight.com/insights/guides-white-papers/state-filings-pulse/.

Information from 900,000+ filings

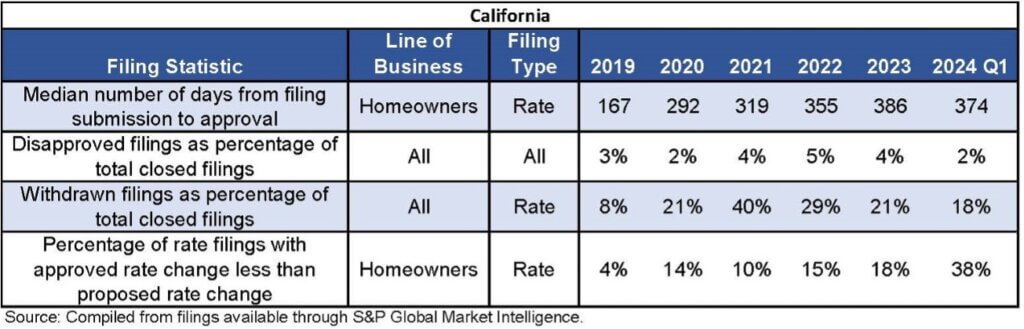

State Filings Pulse contains statistics, by state, for calendar years 2019 through March 2024, including:

- Median number of days from filing submission to approval

- Disapproved filings as percentage of total closed filings

- Withdrawn filings as percentage of total closed filings

- Percentage of rate filings with approved rate change less than proposed rate change

The filing statistics are displayed on a combined basis for all property and casualty (P&C), filings excluding workers compensation, mortgage guaranty, financial guaranty, and title filings.

Additionally, the filing statistics are broken out separately for homeowners, personal auto, and other filings, which primarily include commercial products. They are also shown by filing type, rate filings, and excluding rate filings where rate filings are defined as filings that have a non-zero rate impact.

Below is a sampling of the filing statistics for California.

How does State Filings Pulse help insurance companies?

As a leading provider of actuarial consulting and state filings services, we are often asked questions such as:

- How long does it take to obtain approval of a filing in a state?

- Will the state disapprove or request a withdrawal of a filing?

- What is the probability the state will request a reduction in the proposed rate change?

Our experienced state filings team keeps close track of statistics regarding approvals, rejections, and state-specific regulatory requirements. This knowledge empowers us to help our clients improve speed-to-market by ensuring that every filing meets supporting documentation and rate requirements, thereby reducing the risk of an objection.

By compiling and sharing this useful information, we aim to support insurance companies, insurtechs, and others within the industry in gaining a broader perspective on the state filings process.

Download Your Copy of State Filings Pulse

All the information above – plus many more state-specific statistics – is now available in the March 2024 State Filings Pulse publication. Please use the following link to obtain your free copy of State Filings Pulse HERE.