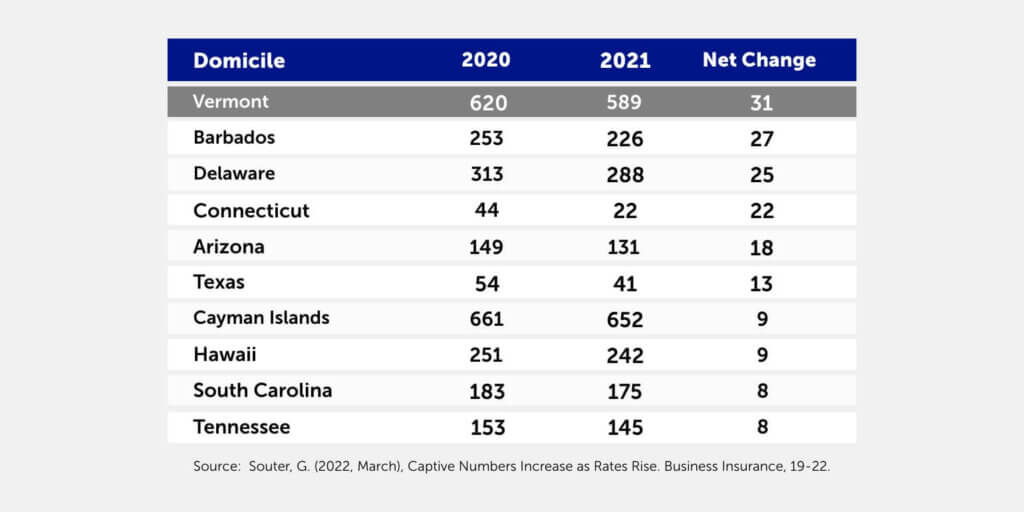

States throughout the US are seeing the number of captive formations skyrocket compared to the past. The 2021 year showed significant increases in the world’s largest captive domiciles. The number of Vermont-licensed captives grew by 31 in 2021, the largest net gain (new captives less dissolved captives) in the domicile’s long history. The table below shows the 10 domiciles with the largest gains over the 2021 year.

Two key trends in the current hard-market cycle are driving up the number of captive formations: (1) demand for cyber insurance; and (2) climate changes that have steadily driven up property premiums.

As times change, more businesses recognize the value of captive ownership. If your company has never considered self-insurance through captive insurance, now may be the time.

Cyber insurance has become a must-have protection for today’s businesses

Cyber insurance continues to be a hot topic in the industry. As malicious actors become more organized and their attacks more sophisticated, companies without cyber insurance are at risk for potentially devastating ransomware ambushes. Large companies and government entities have been bolstering their cybersecurity protections and can afford to pay cybersecurity analysts, an increasingly scarce resource, making it more challenging for hackers to hijack their data. As a result, bad actors are turning to easier targets: schools and universities, small- and medium-sized businesses, municipalities, and other organizations less equipped to mount a strong defense.

Organizations that previously felt they weren’t significant enough to warrant hacker attention are now prime targets.

As cyber premiums rise, more companies are self-insuring

Cyber insurance premiums nearly doubled industrywide in 2021, and the increases have continued through the first quarter of 2022. Organizations waking up to the need for cyber insurance are facing a catch-22 – they know they need it—but it’s costly.

Companies are forming captives or adding captive insurance to their plans to manage the high cost of cyber insurance premiums. But businesses that have never licensed a captive are often unsure where to begin. Speaking to the experienced actuaries at Perr&Knight is a great start. We’re available to answer questions and provide support through the process of obtaining a captive license.

Lack of historical data for cyber insurance

For companies that already have a captive in place and want to add cyber insurance, our actuarial consulting teams can help with this.

When adding coverage to a captive, companies must provide a business plan amendment to captive regulators, including estimated captive premiums. However, because cyber insurance is so new, the availability of historical data creates challenges determining premiums for this coverage.

Again, this is where working with experienced partners like Perr&Knight is advantageous. We have developed proven methods for estimating captive premiums based on decades of actuarial consulting expertise.

High property premiums lead to more captive formations

Property insurance is getting hit from multiple angles. Climate change is increasing the number of weather-related property claims. Tornadoes, floods, wildfires, and other significant weather incidents are happening with greater frequency and intensity—and in never-before-seen areas. These catastrophic events continue to drive the hard market, resulting in insurance affordability and availability issues for many companies.

Additionally, regions throughout the nation are experiencing a runup in insured property values. If a business hasn’t had an appraisal in a decade, they may suddenly find themselves paying substantially higher premium based on their property’s amended value.

Captive insurance can mitigate the affordability problem, which is why more businesses opt to self-insure with a captive.

A pre-feasibility study provides direction

Conducting a pre-feasibility study with an experienced actuarial consulting partner can help determine whether captive formation makes sense for your organization.

At Perr&Knight, we have developed methodologies to produce accurate pre-feasibility studies that provide insight into whether captive ownership makes sense for your business. A pre-feasibility study is not only a cost-effective means of gathering business intelligence; information contained in the study can serve as the basis for the actuarial feasibility study that captive regulators will require.

As times change, captives are here to stay

As the world shifts around us, companies recognize the potential benefits of captive insurance. If your company is considering captive ownership or is already well down the path of forming a captive, the team at Perr&Knight can answer questions, provide direction, and deliver insight into the best course of action.