For insurance carriers, program administrators, MGAs, and the like, the accuracy of policy administration systems (“PAS”) is crucial, not only for profitability and policyholder retention, but also for compliance. Every form, notice, and rate/premium that leaves a PAS must align with what was filed with the Department of Insurance (“DOI”).

Regulatory scrutiny doesn’t end when a filing is approved. Through market conduct exams, regulators also scrutinize whether what was issued and charged matches the forms, rates and rules that were filed. The NAIC Market Regulation Handbook outlines standards insurance companies must adhere to, including: “All forms, including policies, contracts, riders, amendments, endorsement forms and certificates are filed with the insurance department…” and “The rates charged for the policy coverage are in accordance with filed rates…”.

This provides examiners with a clear playbook to follow during a market conduct exam: compare issued forms and rates to approved filings. Here’s what our insurance compliance consulting experts want you to know about taking a proactive approach to market conduct exams.

Why Testing Matters

Discrepancies between approved and utilized materials are among the most frequent findings our insurance consulting team has seen in market conduct exams. Common pitfalls include:

- Policies rated with unfiled factors or outdated tables

- Use of non-approved consent or disclosure forms

- Notices missing state-mandated language

When there is a gap between what is filed and issued, the consequences can be substantial, including policyholder restitution, interest, fines, mandated remediation, and reputational damage. The good news is: a disciplined program of regular testing closes the gap, facilitates compliance, and readies you for all types of market conduct activity.

Exempt From Filing Does Not Mean “Off The Hook”

Some lines of business are exempt from form and/or rate/rule filing requirements in certain states. That doesn’t mean state-specific coverage requirements don’t apply. Rather, it simply means the materials do not need to be filed with the DOI before they are issued. Insurers still carry the burden of making sure their materials comply with state requirements and they are still subject to regulatory scrutiny in the form of a market conduct exam.

When filing exemptions apply, rather than comparing issued forms and rates to approved filings, examiners will compare them to state insurance laws and regulations during the market conduct examination. If discrepancies are found, companies may still be subject to consequences.

How To Structure Regular Testing

Building a sustainable, repeatable testing program isn’t rocket science. In fact, during our decades of insurance consulting, our product design experts have identified these five key components that are essential to any testing program:

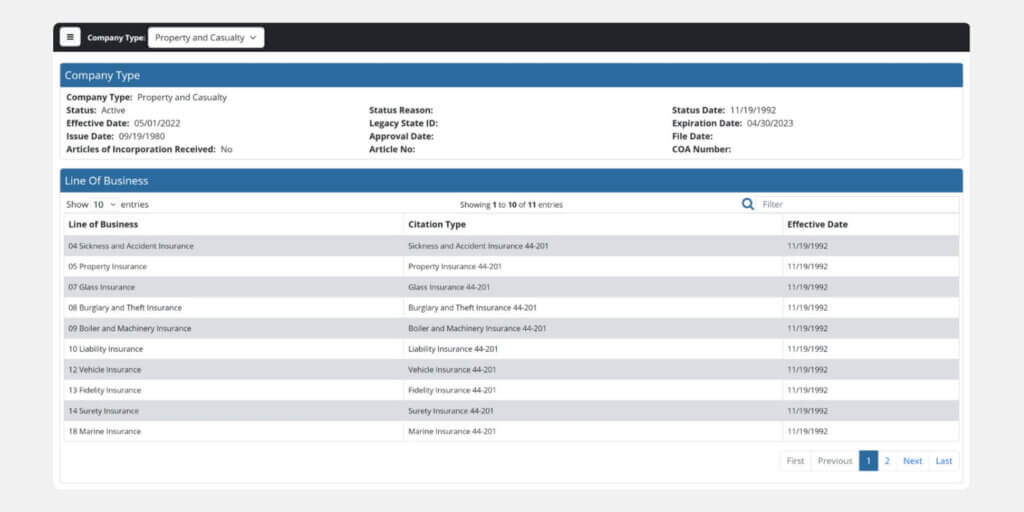

- Baseline library Maintain a centralized location that retains all filed forms, rates and rules, with version control, for comparison.

- Scenario-based testing Run end-to-end transactions (quote → bind → issue → bill → renew → cancel) on a sample of risks to capture all system outputs.

- Premium calculation check Recalculate premiums for a cross-section of risks using filed rate manuals, and reconcile them to what was charged, reconciling to the penny.

- Form generation and content validation Confirm the system attaches the correct forms, applies approved variability, and inserts all required disclosures.

- Regular cadence Perform regular testing, prioritized based on risk factors that may include: high-volume products, active DOIs, known previous issues, product updates (e.g., recent filing activity).

Benefits of Proactive Testing

The benefits of proactive testing far outweigh the time and expense. In addition to preventing costly exam findings, proactive testing provides the following additional benefits:

- Demonstrates disciplined compliance control and a strong governance framework that regulators respect

- Improves speed-to-market by reducing last-minute compliance fixes and re-filing delays

- Strengthens collaboration between compliance, actuarial, and IT teams, ensuring aligned implementation

- Provides executive leadership with confidence that compliance risk is proactively managed

- Builds trust with regulators and policyholders by showing transparency and consistency

- Protects brand reputation through accurate, compliant policy issuance at every stage of the product lifecycle

How Testing Supports Statistical Data Reporting

Accurate PAS workflows and outputs do more than just ensure filed-to-issued compliance. They are also the foundation of statistical data reporting compliance with regulators and statistical agents. Regular testing helps:

Premium & exposure accuracy

Confirm that premiums generated align with risk classifications, coverages and filed rates for each policy transaction to prevent misreporting of earned/written premium and exposures.

Form and rating component reporting

Ensure the data within policy forms and rating component details are accurately captured and flow downstream to the statistical reporting sources and reports.

Policy and claims linking

Validate that claim and policy data are linked at the policy, risk classification and coverage level and can be traced back to filed policy statistical data, supporting actuarial reviews of statistical submissions.

Regulator trust

Reduce the risk of DOI inquiries, costly resubmissions and data quality penalties, or corrective action associated with inaccurate data capture.

By integrating output testing with data reporting, insurers create a closed loop: filed forms and rates drive system output, which in turn drives compliant statistical submissions.

Insurance Consulting Experts Can Help

Partnering with credentialed, experienced insurance compliance consulting professionals like Perr&Knight can help you get ahead of any market conduct exams your company might face. Our product design experts have experience with regulatory requirements in all jurisdictions and can provide guidance and support to help design or evaluate your testing program.

Contact the team at Perr&Knight today to discuss your policy administration testing.