California Rate Filings and COVID-19 – Latest Update on Filing Trends

- Written By Brett Horoff

With $86 billion in written premium, California is the largest market for property and casualty insurers in the United States. It is also a prior approval state[1] for rates, rules and forms, which are required to be filed and approved by the California Department of Insurance (CDI) prior to an insurer using them. Depending on the line of business and the filing type, the average time to obtain approval from the CDI for these filings can vary widely. It is important for insurers to understand the current environment for filings in the state. Poor planning by insurers could result in delays in implementing changes to rates, rules and forms and lost premium revenue. Nowadays, insurers must also factor in the impact that COVID-19 is having on filings and be aware that the CDI has put all rate increase filings for the COVID-19 impacted lines on hold.

The Rate Regulation Division at the CDI is responsible for reviewing and approving rate, rule and form filings submitted by insurers. As of the middle of September, the staff in the Rate Regulation Division is still telecommuting and has not returned to their offices. The Rate Regulation Division has offices in both Los Angeles and Oakland, and the filing review is split between these offices. Perr&Knight has submitted a few hundred filings in California since January of 2019 including over 100 filings this year. We are actively communicating with the CDI on a daily basis. Our recent experience is that the CDI has been very responsive to emails and to voicemails while their staff has been working remotely. We have also had several conference calls on filings with upper management at the CDI since the start of COVID-19, so the CDI has done well at adapting to their new work environment.

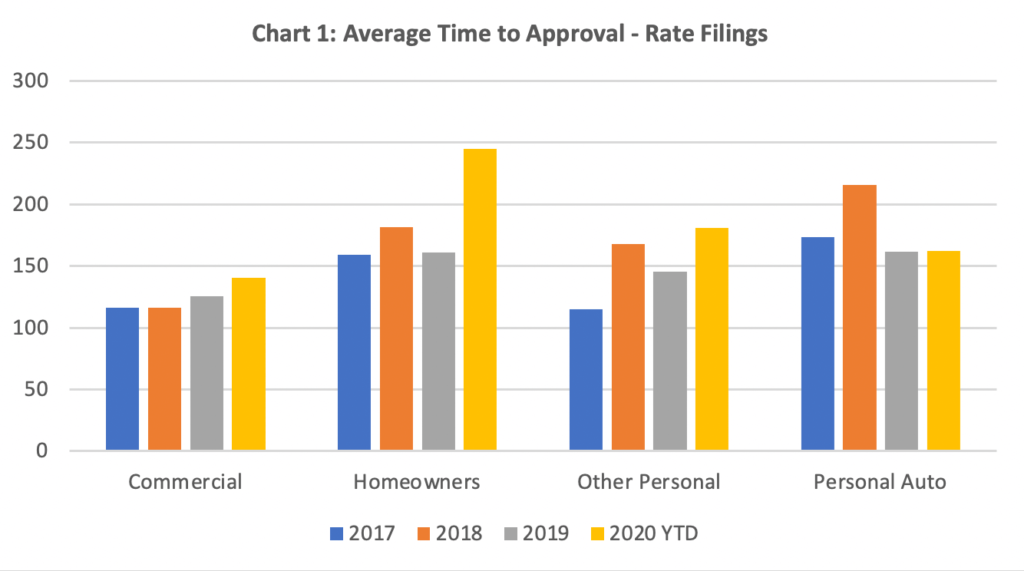

The CDI received over six thousand filings in 2019 and has received nearly 5,000 filings in 2020 through the middle of September, so the number of filings submissions is on pace to be higher than 2019, which has likely increased the workload for the CDI and may impact the time to approval[2]. In Chart 1 below, we have displayed the average approval time for rate filings in California by line of business for the last four years.

Source: Compiled from filings available through S&P Market Intelligence.

While the time to approval for personal auto rate filings has continued to take approximately 150 days in 2020, the time to approval for the other lines has seen an increase with the largest increase being in homeowners, which is taking on average nearly 250 days to receive approval from the CDI. There has been a steady increase in the homeowners rates in California with the wildfires losses under this line over the last several years. It is our understanding that these filings are receiving a higher level of scrutiny by the CDI in an effort to protect policyholders and must go to the Insurance Commissioner prior to approval. Companies should expect this to continue given the current state of the homeowners market in California.

For the lines that are impacted by COVID-19, insurers should also expect increases in the average time to approval. These filings are going to the Insurance Commissioner and/or Deputy Commissioner of Rate Regulation prior to approval for similar reasons as the homeowners filings mentioned above. On rate increase filings for the COVID-19 lines of business, the CDI has been sending out a letter encouraging insurers to reconsider any rate increase given the changes in the insured’s behavior and the environment during the pandemic. As mentioned above, at this point in time, the CDI has put all rate increase filings for the COVID-19 lines on hold until more data is available on the impact of COVID-19. As more information does become available, the CDI will eventually be requesting updated data for these pending rate filings. Currently, the CDI is willing to consider revenue-neutral filings for the COVID-19 lines of business, i.e. filings with an overall rate impact of 0.0%. However, approval will depend on how this rate impact is distributed by policyholder. The CDI is also not approving new exclusions of loss due to virus or bacteria or revisions clarifying the language without a corresponding rate offset. Even with the rate offset, which has been requested by the CDI in some form filings that have been withdrawn, it is possible that the CDI may still not approve any new or revised exclusions related to the pandemic at this point in time.

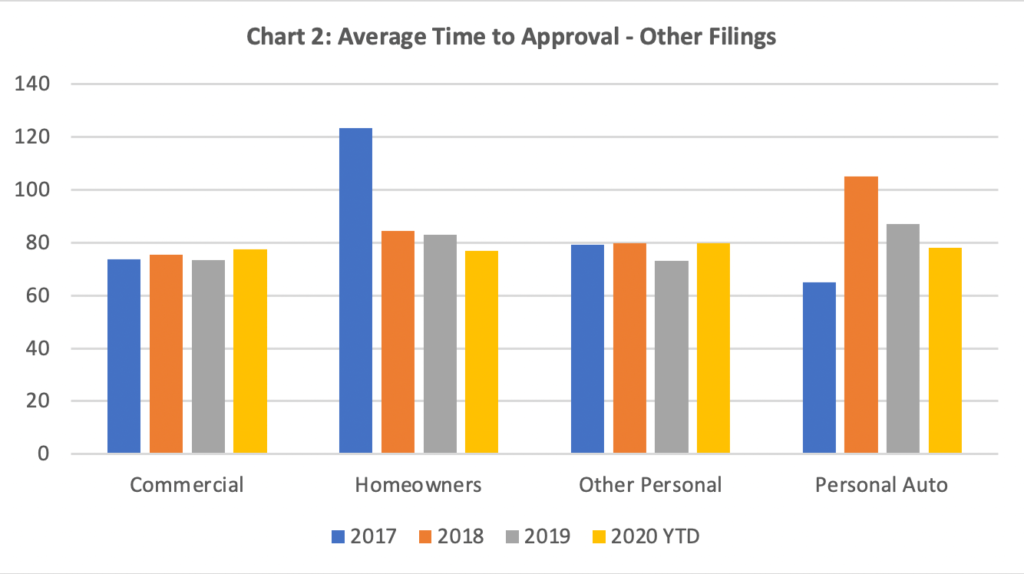

For rule and forms filings that do not include any rate impact, the approval time in California is much shorter than for rate filings. In Chart 2, we have displayed the time to approval for these filings. The average time to approval is generally around 75 to 80 days and has some variation by line of business and year. The earliest possible approval of most filings in California is approximately 60 days from the filing date due the mandatory waiting period of 47 days, which starts on the public notice date and allows time for a consumer to possibly intervene in a filing.

Source: Compiled from filings available through S&P Market Intelligence.

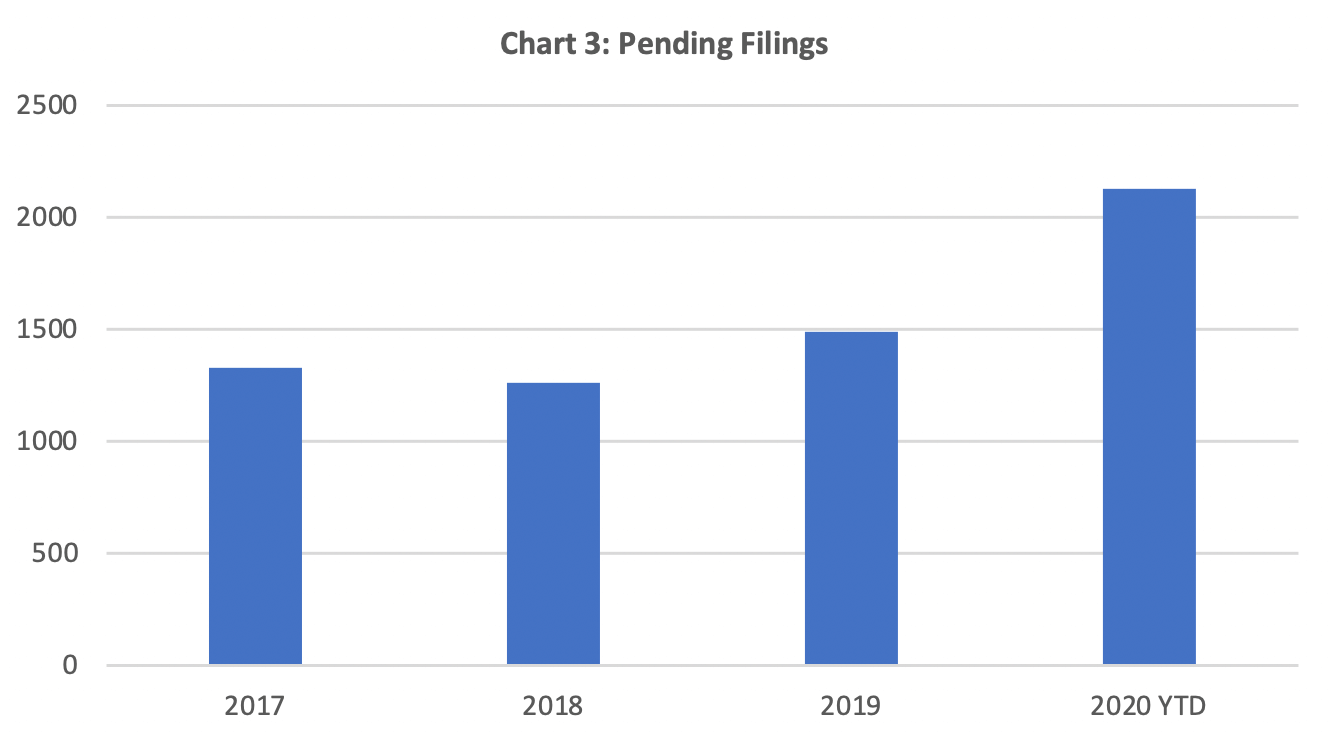

With the average time to approval increasing on rate filings, there has been an increase in the number of pending filings. Chart 3 displays the pending filings at year-end for 2017 to 2019 and year-to-date for 2020. The number of pending filings has decreased for personal auto compared to last year and the increases in the number of pending filings are related to filings for commercial lines and homeowners. Given the increase in the number of pending filings, we expect the average time to approval will continue to increase. Although the CDI has adapted well to working remotely, the telecommuting may be contributing some to the increase in the time to approval and the increases in the number of pending filings. The CDI is also short on staff and has a number of open positions in the Rate Regulation Division due to the normal turnover, including CDI employees retiring. This will likely contribute to an increase in the time to approval over the next year.

Source: Compiled from filings available through S&P Market Intelligence.

For insurers to achieve the shortest time to approval on their filings in California, they need to an understanding of the following:

- California’s filing requirements, which differ from other states;

- The CDI position on various issues;

- Actuarial support required for rate changes (trends, catastrophe loads, etc.); and

- Consumer intervention process and its impact.

When preparing and submitting filings in California, experience working with the CDI and responding to the CDI’s questions on filings is a must-have to reduce the time to approval. The above combined with actively following up with the CDI is the best approach to reduce the time to approval on filings in California.

Contact Perr&Knight

Perr&Knight is a leading provider of actuarial and state filing services to insurers in California. Our consultants actively follow the California market and are very familiar with all the filing requirements in the state. We prepare and submit more California filings than any other company. Our experience includes expert testimony on rating filings and providing guidance to industry associations.

Please contact us with any assistance that is needed with your California insurance products.

[1] Excluding workers compensation.

[2] Average number of days from submission to approval.