There is no doubt that 2020 was a rough year in many respects. While the Coronavirus pandemic was frequently the topic of conversation, there was considerably more to talk about for those in the insurance industry.

According to a recent report published by the National Oceanic and Atmospheric Administration (NOAA), there were an unprecedented 22 extreme weather events in the United States last year, causing 262 fatalities and totaling at least $95 billion in damages. The previous record of 16 events was set in 2011 and matched again in 2017. By comparison, 2019 saw 14 extreme weather events with $45 billion in damages. While much of the country was under quarantine and stay-home advisories, others were ordered to evacuate for their safety. Many lives were changed after the disasters of 2020.

In late August, Hurricane Laura devastated the Gulf Coast and was the costliest event of the year with numerous fatalities and $19 billion in losses. However, this was only one of the record-setting 30 named storms of the 2020 Atlantic hurricane season, 13 of which developed into hurricanes. According to NOAA, the average season will have 12 named storms, six of which will reach hurricane status. This was only the second time that the Greek alphabet was tapped since each of the 21 letters used in the standard naming convention was exhausted. The only other time this has occurred was during the historic 2005 hurricane season that brought Hurricanes Katrina, Rita, and Wilma.

In addition to hurricanes, wildfires and convective storms ravaged other parts of the country. With a severe drought impacting more than a dozen states, conditions were favorable for massive wildfires that consumed more than 10.2 million acres, mostly in California, Oregon, and Washington and caused $16.5 billion in damage. Severe convective storms also contributed to the number of catastrophes last year, including a massive derecho that swept across much of the country from South Dakota to Ohio, leaving $11 billion of damage in its wake.

With the multitude of perils that we are exposed to, being responsive to the market and nimble in the ever-changing insurance landscape is critical. Whether it be rate or coverage revisions or new insurance product introductions, we have the expertise and the resources to enable you to deliver that peace of mind to your customers.

Insurance News Update

California Rate Filings and COVID-19 – Latest Update on Filing Trends

With $86 billion in written premium, California is the largest market for property and casualty insurers in the United States. It is also a prior approval state[1] for rates, rules and forms, which are required to be filed and approved by the California Department of Insurance (CDI) prior to an insurer using them. Depending on the line of business and the filing type, the average time to obtain approval from the CDI for these filings can vary widely. It is important for insurers to understand the current environment for filings in the state. Poor planning by insurers could result in delays in implementing changes to rates, rules and forms and lost premium revenue. Nowadays, insurers must also factor in the impact that COVID-19 is having on filings and be aware that the CDI has put all rate increase filings for the COVID-19 impacted lines on hold.

The Rate Regulation Division at the CDI is responsible for reviewing and approving rate, rule and form filings submitted by insurers. As of the middle of September, the staff in the Rate Regulation Division is still telecommuting and has not returned to their offices. The Rate Regulation Division has offices in both Los Angeles and Oakland, and the filing review is split between these offices. Perr&Knight has submitted a few hundred filings in California since January of 2019 including over 100 filings this year. We are actively communicating with the CDI on a daily basis. Our recent experience is that the CDI has been very responsive to emails and to voicemails while their staff has been working remotely. We have also had several conference calls on filings with upper management at the CDI since the start of COVID-19, so the CDI has done well at adapting to their new work environment.

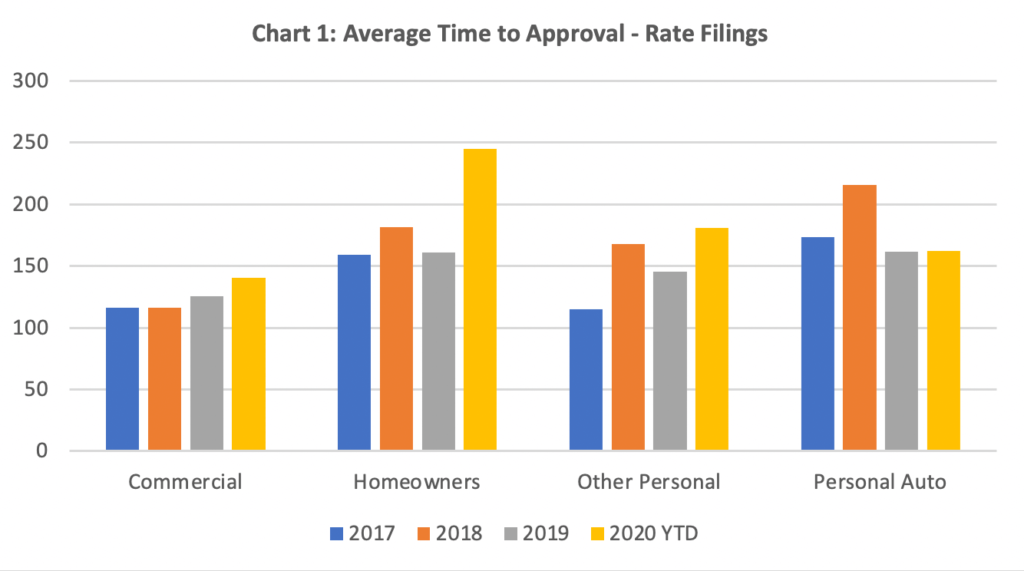

The CDI received over six thousand filings in 2019 and has received nearly 5,000 filings in 2020 through the middle of September, so the number of filings submissions is on pace to be higher than 2019, which has likely increased the workload for the CDI and may impact the time to approval[2]. In Chart 1 below, we have displayed the average approval time for rate filings in California by line of business for the last four years.

Source: Compiled from filings available through S&P Market Intelligence.

While the time to approval for personal auto rate filings has continued to take approximately 150 days in 2020, the time to approval for the other lines has seen an increase with the largest increase being in homeowners, which is taking on average nearly 250 days to receive approval from the CDI. There has been a steady increase in the homeowners rates in California with the wildfires losses under this line over the last several years. It is our understanding that these filings are receiving a higher level of scrutiny by the CDI in an effort to protect policyholders and must go to the Insurance Commissioner prior to approval. Companies should expect this to continue given the current state of the homeowners market in California.

For the lines that are impacted by COVID-19, insurers should also expect increases in the average time to approval. These filings are going to the Insurance Commissioner and/or Deputy Commissioner of Rate Regulation prior to approval for similar reasons as the homeowners filings mentioned above. On rate increase filings for the COVID-19 lines of business, the CDI has been sending out a letter encouraging insurers to reconsider any rate increase given the changes in the insured’s behavior and the environment during the pandemic. As mentioned above, at this point in time, the CDI has put all rate increase filings for the COVID-19 lines on hold until more data is available on the impact of COVID-19. As more information does become available, the CDI will eventually be requesting updated data for these pending rate filings. Currently, the CDI is willing to consider revenue-neutral filings for the COVID-19 lines of business, i.e. filings with an overall rate impact of 0.0%. However, approval will depend on how this rate impact is distributed by policyholder. The CDI is also not approving new exclusions of loss due to virus or bacteria or revisions clarifying the language without a corresponding rate offset. Even with the rate offset, which has been requested by the CDI in some form filings that have been withdrawn, it is possible that the CDI may still not approve any new or revised exclusions related to the pandemic at this point in time.

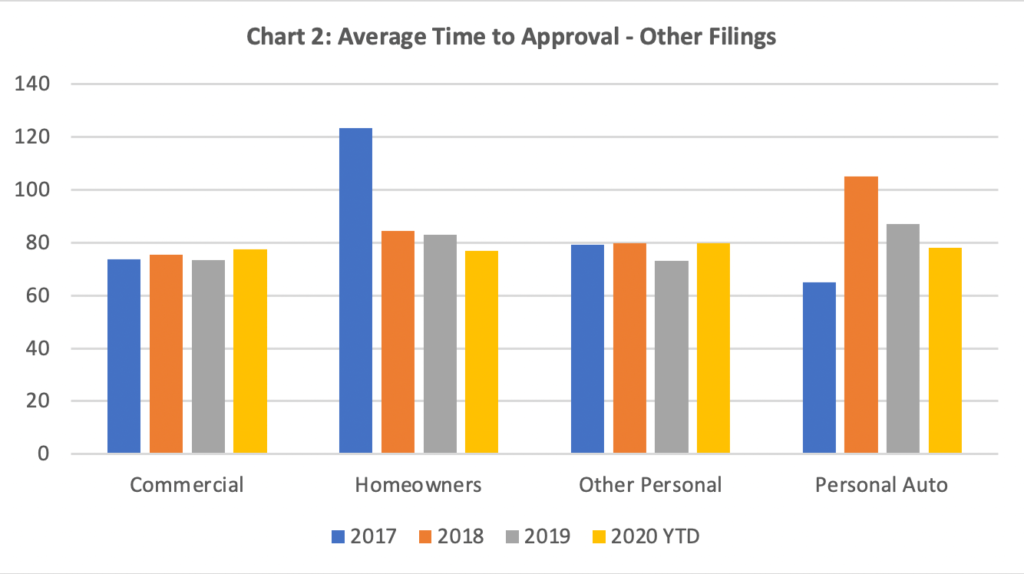

For rule and forms filings that do not include any rate impact, the approval time in California is much shorter than for rate filings. In Chart 2, we have displayed the time to approval for these filings. The average time to approval is generally around 75 to 80 days and has some variation by line of business and year. The earliest possible approval of most filings in California is approximately 60 days from the filing date due the mandatory waiting period of 47 days, which starts on the public notice date and allows time for a consumer to possibly intervene in a filing.

Source: Compiled from filings available through S&P Market Intelligence.

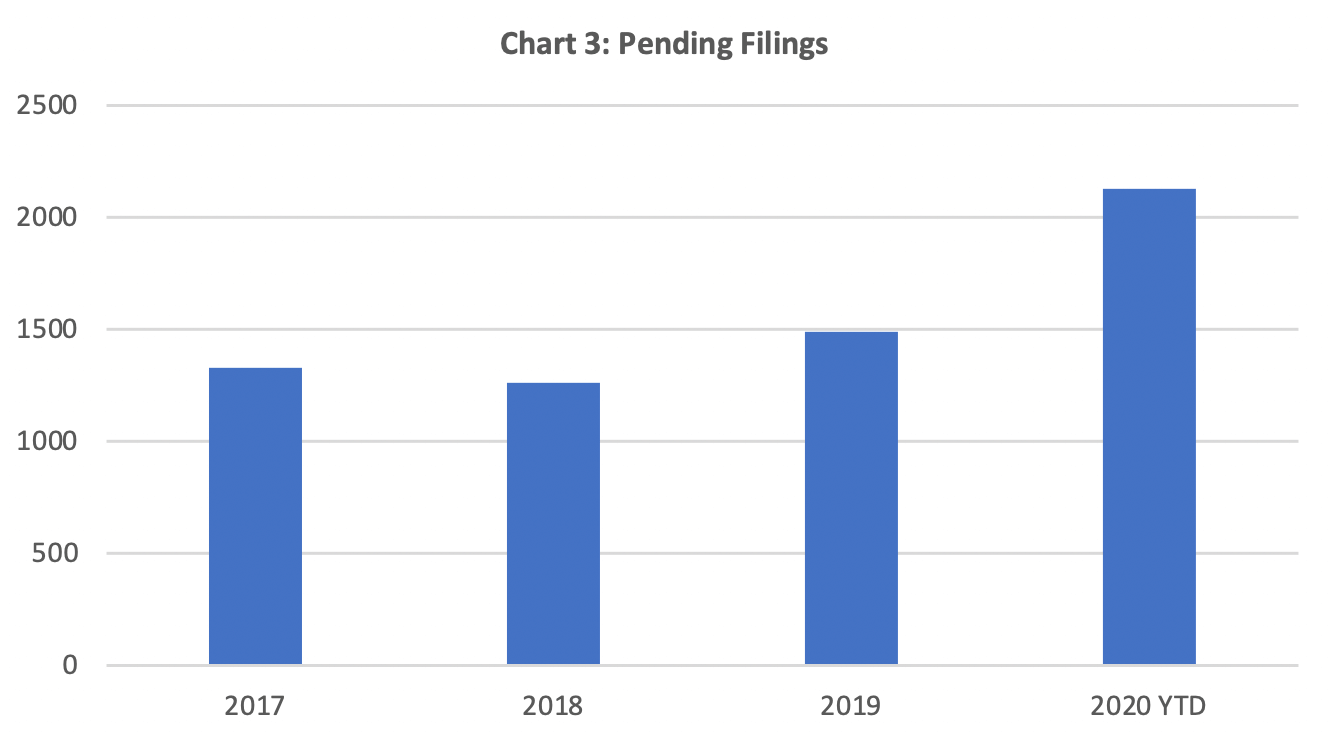

With the average time to approval increasing on rate filings, there has been an increase in the number of pending filings. Chart 3 displays the pending filings at year-end for 2017 to 2019 and year-to-date for 2020. The number of pending filings has decreased for personal auto compared to last year and the increases in the number of pending filings are related to filings for commercial lines and homeowners. Given the increase in the number of pending filings, we expect the average time to approval will continue to increase. Although the CDI has adapted well to working remotely, the telecommuting may be contributing some to the increase in the time to approval and the increases in the number of pending filings. The CDI is also short on staff and has a number of open positions in the Rate Regulation Division due to the normal turnover, including CDI employees retiring. This will likely contribute to an increase in the time to approval over the next year.

Source: Compiled from filings available through S&P Market Intelligence.

For insurers to achieve the shortest time to approval on their filings in California, they need to an understanding of the following:

- California’s filing requirements, which differ from other states;

- The CDI position on various issues;

- Actuarial support required for rate changes (trends, catastrophe loads, etc.); and

- Consumer intervention process and its impact.

When preparing and submitting filings in California, experience working with the CDI and responding to the CDI’s questions on filings is a must-have to reduce the time to approval. The above combined with actively following up with the CDI is the best approach to reduce the time to approval on filings in California.

Contact Perr&Knight

Perr&Knight is a leading provider of actuarial and state filing services to insurers in California. Our consultants actively follow the California market and are very familiar with all the filing requirements in the state. We prepare and submit more California filings than any other company. Our experience includes expert testimony on rating filings and providing guidance to industry associations.

Please contact us with any assistance that is needed with your California insurance products.

[1] Excluding workers compensation.

[2] Average number of days from submission to approval.

California Releases COVID-19 Company Reports – $1.2 Billion in Premium Refunds Reported

On April 13, 2020, the California Department of Insurance (“CDI”) issued a Bulletin ordering the refund of premium to drivers and businesses affected by the COVID-19 emergency. The Bulletin also required companies to provide a report outlining the details of the company’s response to COVID-19. These reports have been made publicly available by the CDI. Perr&Knight has aggregated detailed information from these reports from all the reporting companies and continues to assist companies with estimating the impact of COVID-19 on their insurance programs.

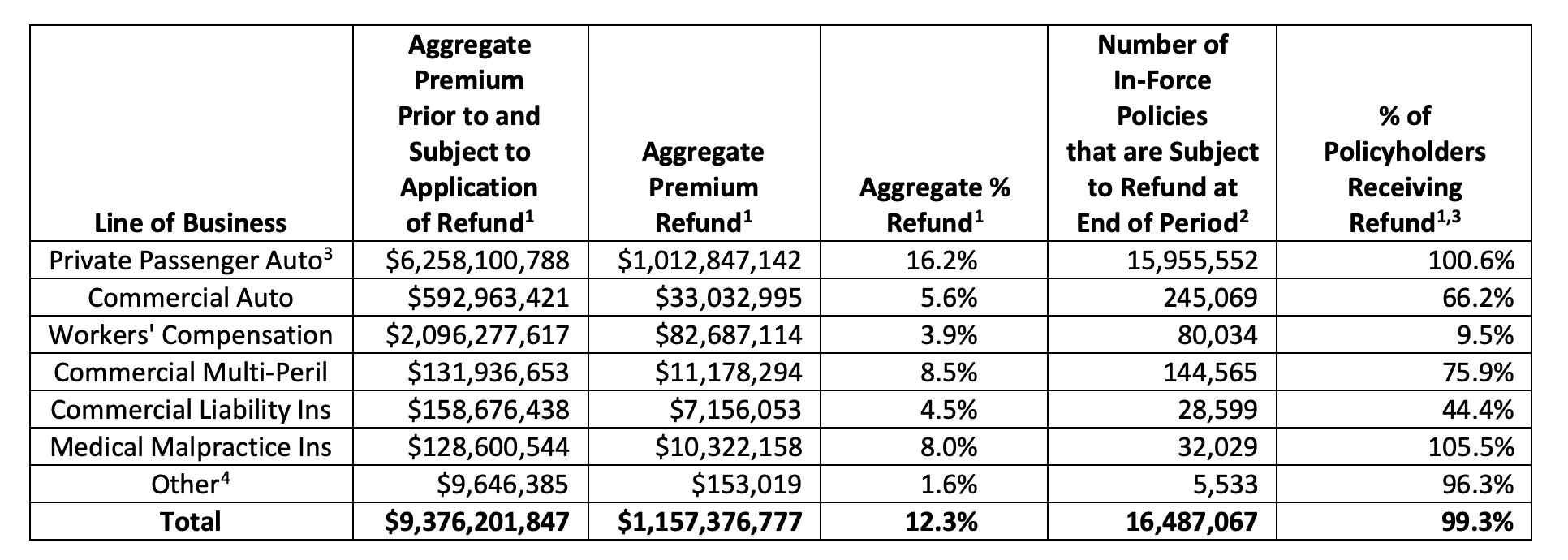

The following chart summarizes the reports available as of June 26, 2020 by line of business:

Table 1: Summary of Premium Refunds, Credits and Reduction

-

-

- Premium refunds include refunds, credits, reductions and policyholder dividends.

- For companies that provided policy counts by month, the same policies in effect during multiple months will be counted more than once.

- The percentage of policyholders receiving a refund is greater than 100% when refunds are issued to policyholders that were not in force at the end of the data period (e.g., canceled or nonrenewed).

- Private Passenger Auto is personal auto, although some companies reported motorcycle, motorhome and collector car program data as Other.

- Any other line of insurance that is impacted by COVID-19 pandemic

-

As indicated in Table 1, $1.0 billion in premium refunds have been reported to the CDI for personal auto policyholders. This line represents 88% of the total refund dollars reported. Companies representing 99% of the 2019 statewide written premium for the private passenger auto line of business have submitted reports. For the top 20 carriers in terms of market share, the smallest premium refund for personal auto is 15%, which was done by multiple carriers, and the largest premium refund was 27.5% by State Farm. State Farm also amended their pending rate filing and increased the proposed rate decrease from -2.1% to -6.5%. Assuming other companies do not offer additional premium refunds for future months, the GEICO companies are offering the largest portion of return premium to policyholders as they are offering a 15% discount on premium for the full policy term at renewal as opposed to offering the refund or credit for a few months of the prior term.

Additionally, in response to the CDI’s request, several carriers withdrew pending rate increase filings for their personal auto programs including withdrawals from the following companies below:

- 21st Century Insurance Company: +6.0%

- California Automobile Insurance Company: +5.0%

- Esurance Property and Casualty Insurance Company: +6.9%

- Mercury Insurance Company: +4.0%

- The Wawanesa General Insurance Company: +6.8%

Companies representing 1% of the California 2019 written premium for private passenger auto lines indicated that no refunds were being provided. The reasoning for not applying refunds was generally due to the inadequacy of the current rates, the lack of credible data for programs with very few insureds or the nature of the risk (such as for collector car programs).

As for the methods used to compute the premium refund for personal auto, over 70% of the companies used an average percentage based on estimated change in risk and/or reduction in exposure. Another 18.5% of the companies adjusted the miles driven for the rated exposure while the other companies used other methods. Of the companies who indicated an average percentage based on the estimated change in risk or reduction in exposure was used to determine the refund, 91% stated that a 15% average percentage was being applied for one or more months.

For commercial auto, the aggregate percentage refunds are less than personal auto and vary depending on type of business written by the company. The companies who have reported refunds represent 57% of the 2019 written premium in California. State Farm issued premium refunds of 27.5% for commercial auto, which equals their premium refunds for personal auto. Progressive, the largest commercial auto writer in California, had overall premium refunds amounting to 24.4% of subject premium. Great West Casualty had a premium refund 7% on their truck program and stated the following in their response to the CDI: “refunds, or premium accommodations, to insureds are made on a case-by-case basis depending on the insured’s operations, exposure, and premium calculation program.” California Automobile Insurance Company (“Mercury”), which is another top 10 commercial auto writer in California, provided a refund of 10.0%. Travelers, also a top 10 commercial auto writer in the state, reported a premium refund of 7.9%. However, Travelers mentioned it is “providing premium relief…on a case-by-case basis.” They further mentioned that they are expanding their “seasonal lay-up credit” and are waiving the 60-day minimum requirement for the credit. This will allow policyholders to suspend coverage on some or all of their operations for liability and collision coverage, which Travelers stated “will provide insureds a credit of at least 15% of the vehicle’s premium on an annualized basis.” For Travelers transportation book, they are applying “a “limited use” classification which reclassifies vehicle(s) and applies an approximate 60% credit on vehicles moved from “full use” to “limited use” during the period that the risk is impacted.”

The second largest amount of premium refunds reported to the CDI was for workers compensation policyholders. The reported information for workers compensation had 71% of companies indicating that refunds are determined based on “reassessment of the classification and exposure bases of affected risks on a case by case basis”, which is one of the checklist options on the CDI questionnaire. Of responding workers compensation writers, 59% indicated that a reduction of the rated exposures to reflect actual or indicated exposures based on payroll was used to compute the premium refund.

For the other lines of business required in the reports (Commercial Multiple Peril Insurance, Commercial Liability Insurance, Medical Malpractice Insurance and any other line of insurance that is impacted by COVID-19 pandemic), responses from the companies were more varied depending on the nature of the underlying policy. These lines represent less than 2% of the premium refunds reported to the CDI.

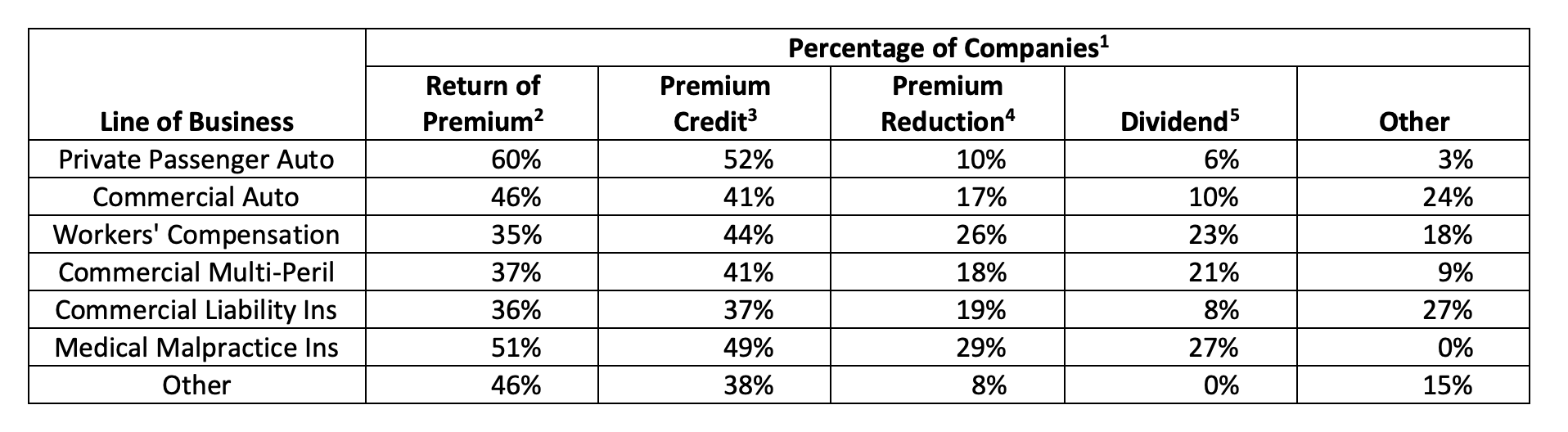

For the companies issuing premium refunds, the table below displays the methods by which the company is accomplishing this for the line of business.

Table 2: Summary of Premium Refund Methods

-

-

- Many companies (33% of respondents for private passenger auto) indicated that the refund is being achieved both through a return of premium and a premium credit. The method used for a specific policyholder could depend on things such as whether or not the policy is still active, the payment plan, etc.

- Sending payment (checks, credit back to credit card, etc.) to policyholders for the amount of the premium adjustment.

- Giving a credit at the next installment or renewal equal to the amount of the premium adjustment.

- Reducing the premium amount payable at the next renewal.

- Refunding an amount as a policyholder dividend.

-

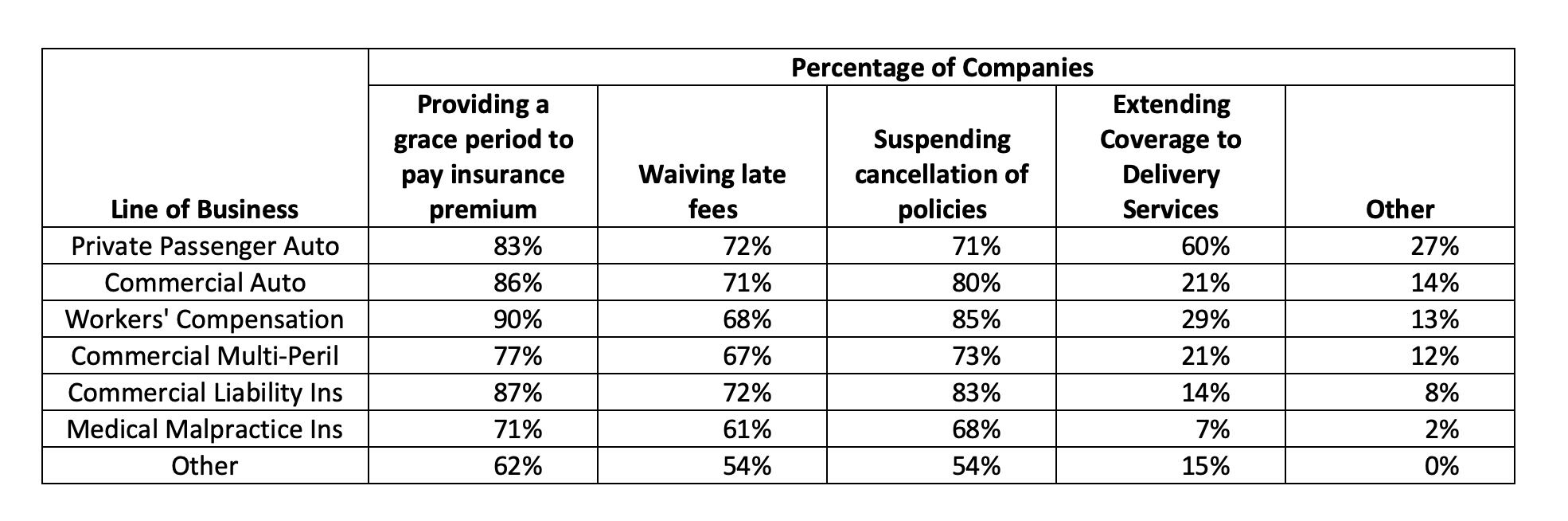

In addition to offering premium refunds, most companies are taking other measures to help policyholders during the COVID-19 quarantine period. The table below summarizes the methods indicated by the companies responding for each line of business:

Table 3: Summary of Other Measures

As mentioned, the information compiled above is from reports available on the CDI website as of June 26, 2020. The CDI continues to add reports to the site. As of June 30, 2020, an additional 40 reports had been added. Six of these were resubmissions that have no significant impact on the refunds summarized in Table 1. The remaining additional reports include an additional $53 million of premium refunds, with the majority (77%) for workers compensation policyholders and most of the remainder (19%) for commercial auto policyholders.

The CDI has issued a Bulletin that extends the directives of the prior bulletins (Bulletins 2020-3 and 2020-4) through June and to any subsequent months where COVID-19 continues to result in “projected loss exposures remaining overstated or misclassified.” The new Bulletin includes the following reporting dates for insurers:

- October 1, 2020: Premium relief provided to policyholders for the months of June, July and August (as conditions warrant); and

- January 1, 2021: Premium relief provided to policyholders for the months of September, October or November (as conditions warrant).

The Bulletin further states the following: “Insurers shall continue to provide premium relief information to the Department on a quarterly basis for any future months in which a premium adjustment is Provided.”

Perr&Knight prepares more rate filings in California than any other company and our actuaries are available to assist companies in estimating the impact of COVID-19 on their insurance programs. Contact us today.

California Commissioner Orders Premium Refunds in Response to COVID-19

On April 13, 2020, the California Department of Insurance (“CDI”) issued a Bulletin ordering the refund of premium to drivers and businesses affected by the COVID-19 emergency. The implications of the Bulletin are complex and require consideration of various aspects of an insurer’s business model. Perr&Knight is having discussions with the staff at the CDI regarding their expectations for compliance with the Bulletin. We have extensive experience with rate, rule and form filings in California as we submit more filings to the CDI than any other consulting firm and will be assisting insurers with complying with the CDI requirements to ensure that the appropriate adjustments are made for the change in risk and/or reduction in exposure.

The Bulletin requires action of all companies who write the following lines of business in California:

- Private passenger automobile insurance

- Commercial automobile insurance

- Workers’ compensation insurance

- Commercial multiple peril insurance

- Commercial liability insurance

- Medical malpractice insurance

- Any other line of coverage where the measures of risk have become substantially overstated as a result of the pandemic.

The following is required of each California insurer writing the lines above:

- By June 12, 2020, report the following information to the CDI:

a. An explanation and justification for the amount and duration of any premium refund, and how those measures reflect the actual or expected reduction of exposure to loss.

b. Monthly and overall California-specific totals for the following:

i. Percentage of refund applied,

ii. Aggregate premium prior to, and subject to, application of refund,

iii. Aggregate premium refund,

iv. Average premium before and after refund,

v. Average percentage of refund, applied to each policyholder,

vi. Number of in-force policies, and

vii. Number of policyholders receiving refund.

- By August 11, 2020:

a. Provide each affected policyholder, if applicable, with a notification of the amount of the refund, a check, premium credit, reduction, return of premium, or other appropriate premium adjustment.

b. Provide an explanation of the basis for the adjustment, including a description of the policy period that was the basis of the premium refund and any changes to the classification or exposure basis of the affected policyholder.

c. Offer each insured the opportunity to provide their individual actual or estimated experience. For automobile policies, this includes an invitation to provide updated mileage estimates as appropriate.

Perr&Knight is available to discuss any questions or unique situations with the CDI on your behalf. We can also provide information on what other companies have done, to the extent this information is publicly available in California or other states. Finally, we can prepare and submit your required report to the California DOI.

We expect that other states may issue similar bulletins. If there is anything that Perr&Knight can do to assist your company in California or any other state, please complete our contact form.

Auto Accidents Drop Dramatically with COVID-19 Stay-At-Home Order

Authors: Brett Horoff, ACAS, ASA, MAAA, Director, Consulting Services, Dee Dee Mays, FCAS, MAAA Principal and Chief Actuary, and Denise Farnan, ACAS, MAAA Principal and Consulting Actuary.

To control the spread of COVID-19, many states have issued Stay-At-Home[1] orders for non-essential workers, resulting in a large portion of the workforce working from home and many businesses temporarily closing. Schools have also been forced to close or have moved to online solutions for classes. These changes have brought a significant drop in the number of miles driven by each household and the volume of the traffic on the roads. With fewer miles being driven and a decrease in traffic density, the number of auto accidents has decreased.

According to the Public Policy Institute of California, essential workers are one-third to one-half of the California labor force. The definition of essential workers varies across the state. It includes sectors such as healthcare and public health, emergency services, food and agriculture, energy, water and wastewater treatment, transportation and logistics, communication and technology, government operations, critical manufacturing, hazard materials, financial services, chemicals and defense industries. Outside of these sectors, households are no longer commuting to work. There has also been a significant reduction of personal auto use as this is pretty much limited to driving to the grocery store, pharmacy or to pick up takeout food from restaurants.

The average annual miles driven in the U.S. is 13,476[2] or approximately 260 miles per week. For non-essential workers, this could be down to less than 30 miles per week assuming five trips a week that are six miles round trip. This represents an 88.5% reduction in the weekly miles driven for households with nonessential workers from 260 miles per week to 30 miles per week. For households with essential workers, they will also have a reduction in the miles driven per week; however, the essential worker will still be driving to work. Assuming half the average annual miles driven is commuting to work, then an essential worker is driving 130 miles per week to commute to work plus another 30 miles per week for personal use. With these assumptions, they would be seeing a 38.5% reduction in the miles driven per week from 260 miles per week to 160 miles per week. If half the households have essential workers, the reduction in miles driven is 63.5%, which is just an average of the figures for non-essential and essential workers. This is a very rough estimate with simplified assumptions, but it gives you an idea of the impact that the Stay-At-Home orders are having on miles driven.

The number of auto accidents will be directly related to the number of miles driven, so insurance companies should be seeing a significant drop in the number of auto accidents. With fewer vehicles on the road and a decrease in traffic density, there should be fewer auto accidents. The number of reported auto accidents in Los Angeles is down approximately 25% in March 2020 compared to March 2019 based on adjusted data[3] from the City of Los Angeles. The Safer at Home Order was issued by the City of Los Angeles on March 19, 2020, so the full impact on auto accidents is likely to be more than double.

It is still very early to assess the impact that COVID-19 and the impact that Stay-At-Home orders will have on the number of auto accidents. The definitions of essential workers have been changing over time and the orders could be extended. When the orders are lifted, we may also see a slow return back to the prior driving habits. There are several insurance companies that have already taken action to get the savings from the decrease in auto accidents back to their customers. Allstate has submitted filings this week to state Departments of Insurance for a Shelter-in-Place Payback endorsement that authorizes and facilitates discretionary payments to policyholders. They also had a press release on April 6, 2020 that states their customers will receive more than $600 million as part of this payback. Another insurance company, American Family, announced on the same day that they will return $200 million in premium to their auto customers related to the COVID-19 impact on auto accidents. There also insurance companies with pay-per-mile programs where any savings is automatically passed on to the customer, since the customer pays for each mile driven.

There are a number of filings being made by insurance companies to the state Departments of Insurance to address the impact of COVID-19 on auto accidents. Go Maps has filed to offer personal auto discounts to essential workers and recently unemployed workers in multiple states. Next Insurance has filed to reduce the commercial auto premium for their customers for the month of April in several states. Safe Auto Insurance Company and Elephant Insurance Company have also filed rate reductions related to COVID-19. There are several insurance companies that have filed endorsements lifting the delivery exclusion in personal auto policies during the COVID-19 pandemic in order to provide insurance coverage to the increasing number of people delivering medicine and food.

While several insurance companies are moving fast to pass the savings from a decrease in auto accidents on to their customers, there are consumer groups saying it is not enough. There is much uncertainty right now and the full impact of COVID-19 on auto accident frequency will not be known until the pandemic is over. It is likely that insurance regulators in each state will take a look at the impact of COVID-19 on auto accident frequency and may require the premium savings to be passed on to the consumer.

About Perr&Knight

Perr&Knight is one of the largest providers of State Filing Consulting Services to the insurance industry and is available to help insurance companies with preparing and submitting filings addressing COVID-19’s impact on auto insurance or other lines of business. Our actuaries can help companies estimate the impact of COVID-19 and have assisted companies with preparing and submitting filings related to COVID-19.

Contact us to schedule a consultation.

[1] Also referred to “Shelter in Place” or “Safer at Home” in some municipalities.

[2] Figure is for 2018 and is from the U.S. Department of Transportation Federal Highway Administration.

[3] Data was through March 28, 2020 and was extrapolated to month-end. It was also adjusted for a reporting lag.

Rate, Rule and Form Filing Activity in Response to COVID-19 Crisis

We have all seen the various headlines regarding what companies are doing in response to the COVID-19 Crisis. Many Departments of Insurance (“DOI”s) are encouraging companies to act quickly to provide relief to policyholders during these difficult times. Perr&Knight is closely monitoring the rate, rule and form filings submitted by insurance companies to the DOI in each jurisdiction, to the extent these filings are publicly available.

If you are interested in obtaining additional information on filings related to the COVID-19 crisis, please complete our contact form.

Here are samples of changes included in company filings:

- Allstate has made two changes:

- Revising their rules and forms to include an exception to commercial activity exclusions to cover the delivery of food, medicine or other goods while a statewide Emergency Order is in effect related to the COVID-19 virus.

- Adding a Shelter-in-Place Payback Endorsement to Allstate, Esurance and Encompass personal auto policies. Per the Allstate press release, “…customers will receive a Shelter-in-Place Payback. Most customers will receive 15% of their monthly premium in April and May, totaling more than $600 million.”

- American Family has announced that they are refunding $50 per insured vehicle to their personal auto policyholders for a total return of approximately $200 million. We have not seen any filings publicly available as of yet.

- Clear Blue Insurance Company temporarily removed late fee and reinstatement fee surcharges to provide relief to the insureds in their CB Rideshare Commercial Auto program that covers transportation network company drivers.

- Erie has filed a new Additional Payment, Gift Card and Gift Certificate Reimbursement Coverage. This provides reimbursement for the remaining balance of an unexpired local business gift card or gift certificate when the local business has permanently gone out of business. The coverage will be added to all ErieSecure Home, ErieSecure Condo and ErieSecure Tenant policies covering a primary residence, at no additional charge.

- Germantown Insurance Company is notifying homeowners policyholders with payment issues to arrange for delayed billing or switch to an installment payment plan. They have filed changes to their underwriting scorecard to avoid penalizing policyholders who make these changes.

- Silicon Valley-based insurance company Go announced that it is offering a 50% discount on auto insurance to all Essential Workers in Texas who are on the front lines of the COVID-19 crisis. See the press release at https://www.goclub.com/get.

- National American Insurance Company has added new Contractor and Subcontract Epidemic Bond Riders in response to the impact of COVID-19. These riders amend a surety bond to allow for equitable adjustments of contractual obligations if work is delayed, disrupted, suspended, or otherwise impacted as a direct or indirect result of any virus, disease, contagion, including but not limited to COVID-19.

- Next Insurance has submitted filings to implement a temporary relief measure regarding COVID-19 for insureds in their Commercial Auto and Liability (Errors and Omissions, Premises and Operations, etc.) programs. The Company’s intent is to reduce 25% of April’s 2020 premium for all insureds who purchased a policy prior to March 1, 2020.

- Utica National group has expanded the eligibility for Commercial Auto lay-up credits to all risks/vehicle types. The expanded eligibility is intended for businesses that plan to take vehicles out of service due to loss or reduction in business due to the COVID-19 pandemic.

- Several companies are filing COVID-19 related leave of absence endorsements for their medical malpractice policies to help their insureds whose employment may be affected due to COVID-19 related lay-offs, office closures, and illness, among other things.

If there is anything that Perr&Knight can do to assist your company with any filings, please complete our contact form at https://www.perrknight.comcontact/.