Introduction

Competitive success in the insurance industry is predicated on the innovative efforts of today designed to favorably impact the operating models, processes, products and customer relationships tomorrow. An abundance of operational support alternatives permits executives to compare providers, analyze the insurance value chain and identify efficiency, enhancement and organiza-tional transformation opportunities. Outsourcing is one mechanism to achieve these gains. An outsourced claims management process can transform an insurance company, but requires thoughtful planning, partnering, transition and execution with great skill.

Competition and change

The insurance industry is competitive and change is constant. The competitive playing field is global and the competition is robust. Industry leaders deliver shareholder value by growing revenue, generating profit and producing above average returns on equity in a constantly changing environment. Predictions for the nature of change expected over the next ten to fifteen years are diverse, insightful and highlight the need for new ways of thinking about insurance operations. In a recent survey of insurance executives, 70% of respondents expect significant change while 30% of respondents expect incremental change during this period; not one respondent envisioned the future to be the same as the present nor expected the need for change to go unnoticed. The survey suggests that “mega trends will force the industry to innovate; old modes of thinking threaten the industry’s ability to innovate; interlopers will increasingly disrupt traditional insurance operations; industry leadership will require experimentation in operating models, processes, products and customer relationships; and strategic investment in innovation today is critical to success” in the future. Innovative change starts with the most senior executives. A recent survey of global CEOs reported that more than 40% of respondents indicated that, within their organi-zations, they lead business model innovation, while 38% lead operational innovation efforts and just over 30% lead product and service innovations. Executives must provide leadership within their organizations to prepare for the future. The role of the executive, need for innovative change and the need to experiment with operating models and processes to remain competitive in the long-term should drive insurance executives to evaluate the insurance value chain for opportunities to leverage innovative sourcing alternatives.

Sourcing alternatives

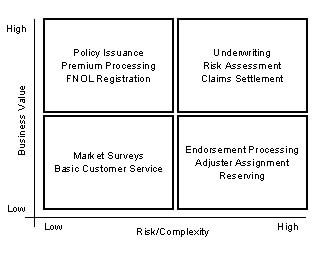

“The modern value chain is the collection of processes and services that are linked together to create, develop, sell, deliver, process and service an insurance policy over the life of the contract.” Organizations can leverage outsourcing relationships to complement internal processes to transform their businesses and produce operational and performance gains. Outsourced processes are typically made available through either “full service”, “prime vendor with subcontractors” or “selective” outsourcing arrangements. Organizations that outsource can gain process capabilities through joint ventures, consortia and other resource-pooling models. Further, an organization that offers an internally-built process to the marketplace in effect creates an independent profit center, responsible for delivering services internally and externally.

Sourcing alternatives are categorized based on the location of the process or service. The in-house domestic model describes when processes are internally built and maintained with personnel and resources in the same country as that of the service recipient. In the in-house non-domestic model, also known as captive offshore, an organization launches its own operation in a different country, including both near-shore and offshore outsourcing. When an external provider conducts the process with personnel and resources in the same country as the service recipient, the outsourced domestic model is being used. An outsourced non-domestic model refers to the performance of processes by an external provider that delivers the service with personnel and resources in a different country than the service consumer.

Due to licensing and oversight requirements, claims management service providers have traditionally been outsourced domestic service providers. The market for claims management service providers in the United States is fragmented with a small number of firms holding considerable market share. Claims management service providers have been providing outsourced claims man-agement solutions to insurance companies for more than forty years.

Claims management service providers as a sourcing alternative

The existence of a small number of large, well qualified commercial property and casualty claims management service providers in the United States may be attributed to the explosive growth of the alternative risk financing market during the latter part of the 20th century, and the subsequent broader adoption of these services by other bearers of underwriting risk. During this period, we saw large individual commercial insurance buyers self-funding increasingly larger amounts of underwriting risk in the form of self-insured retentions and large deductibles. As a result, they came to desire total control of the claims management process in order to gain process flexibility, fee and expense transparency, and reduced loss adjustment expenses. A few savvy insurers recognized a market opportunity and spun off their (superior) claims operations to create stand-alone profit centers that today are viable alternatives to the traditional insurance company claims operation.

Good claims management service providers offer competitive advantage through the maximization of efficiency, enhancement and transformation gains produced by their own sourcing strategies. Inasmuch as the claims management process is comprised of several sub-processes, including claims investigation, loss reserving, financial management, litigation management (litigation planning), medical cost containment (managed care strategies), recovery management (subrogation, salvage, second injury fund), settlement, regulatory compliance and information management, each represents an opportunity to provide a superior service that positively influences loss and expense ratios. In addition, other sub-processes involving call center functions, independent adjusting, loss fund administration (loss payment issuance), defense work, medical bill review, nurse case management, PPO network management, structured settlements, and others may offer additional gain if managed effectively. The most successful outsourcers focus on planning for business outcomes, partnering for performance, strong governance for smooth transition and execution with innovation.

Planning and the claims management service provider

The outsourcing planning process considers the desired level of impact the outsourcing engagement will have on the organization. Outcomes are commonly classified into three broad categories: efficiency, enhancement and transformation. Planning centers on creating efficiencies by identifying opportunities for cost reduc-tions while maintaining high quality and high process availability. This approach leverages the service provider’s scale of operations, technical capabilities and management proficiency. The overarching objective is to optimize a process in a way that gives an organization a tangible advantage or a new degree of functionality not previously available. Transformation is the most ambitious objective and directly affects the fulfillment of business strategy by altering the organization through significant changes to the business model. Outsourcing may produce all three outcomes, however, transformation is the ultimate objective of the most successful outsourcing engagements – experienced outsourcers recognize that “value lies in turning costs into capabilities” – a product of successful transformation. Transformation requires an alignment of the service recipient’s and service provider’s business strategies. A successful transformation results in the ability to “innovate and dramatically improve the very competitiveness of the organization by creating new revenues, outmaneuvering the competition, and even changing the very basis on which a corporation operates.” Transformation involves a much higher level of risk and is generally approached as a partnership of equals; the planning, implementation and realization of benefits requires high level interaction, investment and trust.

Claims management service providers can deliver transformational change to commercial property and casualty insurance companies at all stages of the insurance company’s life. Well-planned and executed arrangements favorably impact income, profit and return on equity during the launch, growth, maturity and decline of an insurer. For example, during launch, an executive team outsourcing the claims management process can focus on strategy and tactics that increase value rather then developing a claims management organization; the expertise, scale and scope of the claims management service provider are available for immediate implementation. The fixed expenses of developing a claims operation are avoided as fixed expenses are converted into variable expenses, thus freeing the organization to invest capital in activities producing the highest return on investment. This approach is most successful when speed to market is imperative. One real-life example involves an insurance company that had committed to the “virtual insurance company” model to launch and underwrite property and general liability insurance on a single-state basis. The executive team understood the benefits of the model, and by contracting with a claims management service provider was able to immediately access the deep expertise, scalability and a broad scope of claims-related services that the provider offered. Additionally, the company’s capital was not tied up in office leases for claims staff, their salaries and benefits, advanced claims management information technology, errors and omissions insurance and other related expenses. Service fees paid to the claims management service provider were variable based on a percentage of gross written premium with a very manageable fixed expense component.

During the growth phase, an executive team may choose to outsource the claims management process as it expands product lines, geographic range or total premium writings. To use another real-world example, let’s examine an insurance company that has committed to an all-lines (workers’ compensation, general liability, automobile liability and property) national expansion strategy after years of regional operation as a workers’ compensation insurer. The challenges of expanding the existing regional monoline claim operation to manage claims arising from new product lines on a national basis are many. By using a third-party claims management service provider, the existing claims organi-zation’s regional capabilities simply augment the outsourcing arrangement without disruption to the existing operation.

For a mature insurance company confronted with the constraints of legacy information systems, outdated claims processes, underperforming managed care arrangements and other inefficiencies the outsourcing of the claims management process offers a viable alternative. A third example is an insurance company that had a claims organization yet empowered policyholders with the option of selecting an approved claims management service provider instead. This is common to the individual risk management account market. The mature insurance company continues to underwrite profitable policyholders with the loss of nominal incremental revenue on claims management services.

Insurance companies with discontinued operations are confronted with the same challenges as the start-up. As claims volume declines, the allocation of capital to claims office leases, professional compensation, management information systems, errors and omissions insurance and other related expenditures must be scaled back. Consider an insurance company in runoff. A claims management service provider is capable of assuming claims handling responsibility for all open and closed claims. The runoff insurance company shifts much of the fixed expenses to variable expenses while gaining all of the advantages of the world-class claims management process offered by the claims management service provider. It is possible for the claims management service provider to carve out the existing claims organization, assume staff and facilities, and manage the runoff claims activity as a standalone unit.

Large, competent claims management service providers deliver transformational change to insurance companies. Designated adjuster, dedicated adjuster and dedicated unit staffing models based on traditional scale and scope of control caseload models provide great flexibility to executive teams. Claims management service providers are capable of generating mutually beneficial partnerships.

Partnering and the claims management service provider

The focus now shifts to the selection of a service provider through a formal vendor selection process and contract negotiation. Successful outsourcers no longer view external service providers as cynically as perhaps they once did, as “the enemy – dishonest, untrustworthy characters, totally focused on sucking as much money as possible” from the service recipient. Instead, these organizations “create mutually beneficial relationships with trusted providers who understand their industry, respect their corporate cultures, and put mutual interest before self interest.” They frequently consider these factors above price. Proper evaluation of service providers requires the creation of a detailed statement of work and contract as part of a provider evaluation packet. Ideally, the packet is offered to fewer than four relevant service providers. Responses should define a detailed approach to the work and a price for doing so. Proposals should be scored based on predetermined criteria and negotiations can thereafter begin with finalists. This differs from the traditional request for proposal (RFP) process that offers a list of open-ended questions that invite widely disparate answers that are often difficult to evaluate objectively. The service provider and service recipient learn little about each other this way, and vendor selection becomes a highly subjective process. Experienced outsourcers, however, approach service providers with proven capabilities and structure the evaluation process to actually test the most important selection criteria. Notably, experts “ranked the contract as the most important management tool in the first year of a[n outsourcing] relationship.” Arrangements aimed at organiza-tional transformation involve the most risk and as such should focus on the successful alignment of organizations to achieve a well-defined, mutually understood vision. Relationship management, service delivery, service level expectations and price must also be considered. The most successful relationships are conducted as quasi-partnerships with mutual benefits acknowledged by each party.

To generalize, and perhaps oversimplify, in our experience the less successful outsourcing relationships are approached as typical vendor/buyer arrangements. Although a best practice involves some form of the evaluation process described above, most continue to be undertaken through a rigid but less effective RFP process or worse, some form of informal decision making based on who has the best sales pitch.

In their responses, prospective claims management service provid-ers should clearly define how they would align their operational capabilities with the insurer’s strategic vision and describe how they would complement the existing claims organization, leverage existing service provider and service recipient relationships and adapt the claims process to better serve the insurer’s needs. A plan describing options for the integration of claim reporting processes and call center services, data exchange processes for policy verification and coverage determination and data interface processes should also be presented to the insurer. The claims management service provider should then determine to what extent independent adjusting firms, managed care services organizations, defense counsel and others should be brought to bear to produce a truly integrated solution. Any changes to the claims process must be evaluated by the insurer with their accep-tance explicitly confirmed. Throughout the selection process, both parties should involve a team of stakeholders including executive management, claims operation leadership, information technology experts and others. Claims handling expectations should be memorialized in a formal set of claims handling guidelines. Contract terms should stress the strategic alignment of both organizations through service level requirements. Once the claims management service provider is selected, the focus shifts to transition.

Transition and the claims management service provider

The most successful outsourcers recognize transition as a critical part of the outsourcing lifecycle. Identifying an executive sponsor, managing change, defining governance measures and developing an exit strategy are critical to the success of the engagement. Experienced outsourcers realize the importance of identifying executive and general managers with the requisite skills to manage all phases of the outsourcing lifecycle. The most successful understand that “it is best if sponsorship includes the most senior leadership possible – one or more individuals at the c-suite level with a deep passion for the long-term goals of the arrangement.” Some organizations deploy organizational structures dedicated to sourcing projects. These units are typically staffed with relationship managers, performance managers and contract managers. A relationship manager is responsible for developing and prioritizing requirements, managing issue escalation, monitoring performance, acting as account-level liaison for the multiple service providers (to the extent they’re engaged) and as a liaison for business unit relationship managers. The performance manager is responsible for operations oversight, service integration, incident management, and performance management. The contracts manager is responsible for the management of contract terms and conditions, the management of projects and bids and the enforcement of contracts and schedules. Transition-ing to a service provider involves a great deal of change. The fundamentals of change management suggest that the change agent clarify the need for change, outline a vision for the future and provide a logical first step to achieve the desired outcome. Committing to a comprehensive change management plan that, through sound communication, reinforces the vision and quantifies the strategic objectives sought is a key success factor. Governance measures are applicable to all phases of the outsourcing engagement and include the “formal and informal structures a company and its service provider use to monitor, manage and mediate their collaborative effort.” Some service recipients establish formal sourcing units responsible for relationship, performance and contract management. Others rely on operational review committees, capability review committees, joint review boards and compliance committees. These formal committees meet monthly or quarterly. The informal daily contact and interaction create an environment of open and honest exchange and are not to be underestimated. As needs change, service recipients may move work from one service provider to another. Experts contend that it is “important to consider how the next transition will occur if and when the outsourcing relationship ends.” Such planning protects the organization in case a contract is terminated and provides a plan for the next transition.

In practice, claims management transitions are complex and time consuming exercises. Participation expands beyond the claims function to include operations, finance, regulatory compliance, legal, underwriting, actuarial and information technology functions. As a function critical to customer perception and satisfaction, executive level sponsorship by the chief executive officer, chief operating officer and/or chief claims officer (or equivalent) is crucial. The claims officer is perhaps best positioned to assume the executive sponsor role, articulate business objectives and internally champion the transition. The claims officer is best suited to communicate the message that the insurance company expects to experience more rapid and profitable growth and plans to be able to develop and service new product lines by outsourcing the claims management function, without discontinuance of the existing operation. The claims officer would need to address the existing claims operation’s concerns of obsolescence by emphasizing the strategic importance of the operation in the long-term. The claims officer should assemble and work to closely align an internal team with the claims management service provider’s implementation team. A well-considered collaborative implementation plan will specify key objectives and mutually acceptable deadlines. To execute the plan, the claims management service provider should appoint an implementation manager responsible for leading the overall transition and any related function-specific projects. Related projects may include integration of call center services, adaptation of the claims process to address oversight requirements, coordination of independent adjusting, legal and salvage services, integration of medical cost containment processes, establishment of loss funding mechanisms, development of policy and claims data interfaces and others. The implementation team should include members with experience in each of these areas. During transition, team members generally interact with their counterparts at the claims management service provider while the implementation manager steers the project. Periodic status meetings and other communications should be used to gauge progress, address open concerns and define next steps. The claims management service provider’s relationship manager supports the implementation manager during transition and takes the lead once the transition is complete.

Although the claims management service provider and the service recipient operate closely, process alignment is achievable without complete process integration and the alignment can be undone without catastrophic impact on either firm when the relationship no longer makes sense. Such dissolution of the relationship should be spelled out as an exit strategy in the services agreement between the parties.

Execution and the claims management service provider

Throughout the operational phase of an outsourcing engagement, service recipients often begin to realize significant performance improvements, cost reductions and capability gains. The primary focus of the engagement thereafter shifts to optimizing outsourced processes. According to Accenture, the most successful outsourcers “seek to build on their immediate gains by setting new standards and by seeking out new opportunities to capture value and raise performance.” These outsourcers produce real value by stressing continuous improvement by seeking broader use of process automation and performance improvement strategies. Tremendous value is created when the environment shifts from one in which the service recipient dictates requirements to the service provider to an environment in which the service recipient taps the service provider’s knowledge of best practices. Continuous improvement may be included as a contract feature by adding terms that require defined performance gains – based on key performance measures that are continuously monitored – on an annual basis.

An insurance company in growth mode could derive substantial benefits by engaging a claims management service provider, as support for independent adjusting, medical cost containment, defense, salvage and other critical process would be immediately available and the claims function would be eminently scalable. Such scale and scope of a claims solution is rarely available on a “build-only” basis. The variable expense structure afforded by outsourcing arrangements frees capital for other purposes. Additionally, continuous performance gains often result from the claims service provider’s own pursuit of operational excellence.

Conclusion

Insurance executives can transform their organizations by successfully outsourcing processes within the insurance value chain. Planning for transformational change by closely aligning with a claims management service provider – and leveraging their unique qualities and capabilities to benefit your own organization – sets the stage for meeting or exceeding expectations.

Derek D’Onofrio is an Account Executive in the National Sales Division of Gallagher-Bassett.