Outsourcing: Considerations when transitioning business processes to third parties

- Written By Vivek Sethia

Overview

Today’s business world is characterized by organizations benefiting from efficiency breakthroughs enabled by the exciting technological advances of the past ten years or so. Associated with this change is the way in which businesses can now focus on core competencies, as inexpensive means of outsourcing what were traditionally internal functions, even to distant locales half a world away, have become prevalent.

Outsourcing and offshoring

Outsourcing refers to a transfer of certain internal processes that comprise business operations to a third party. Offshoring, on the other hand, is simply outsourcing business processes to a third party in a foreign country. India, China, Russia, Indonesia and Brazil have emerged as leading offshore outsourcing centers.

Outsourcing is suitable for virtually any business process, however, the most frequently outsourced processes are those that are considered “non-critical,” inasmuch as they do not represent a core competency. Increasingly, however, we’re seeing important, core processes, including product development and market research, being outsourced to third parties. Some commonly outsourced functions include:

- IT services, including data centers and programming;

- Transaction processing, such as credit cards; and

- Other business process outsourcing, including customer support functions, database maintenance and bookkeeping services.

Developments in technology and telecommunications have served to strengthen arguments in favor of outsourcing, hence an increasing number of organizations are making the decision to outsource. Businesses that outsource – especially offshore – enjoy the benefits of lower labor costs and favorable exchange rates. However, ill-informed companies often suffer from a poorly considered outsourcing strategy.

Like any other business decision, a decision to outsource should be based on numerous factors. A thorough inventory of existing, internal processes and an understanding of the benefits and pitfalls of outsourcing need to be taken into account.

Outsourcing insurance operations

Insurance operations and the processes that comprise them provide a major area of opportunity for insurers to enhance their competitive positions. As a driver of operational excellence, a well-defined and carefully executed outsourcing strategy can yield:

- Lower operating costs;

- Greater flexibility;

- Better responsiveness to customers; and

- Increased quality.

A word of caution is appropriate here. Few of these benefits may be realized without a thoroughly researched effort. A decision to transfer business processes is a major undertaking that should be analyzed and examined critically to derive an optimal result. A good place to start is by asking, What processes are good candidates for outsourcing? Insurance company operational processes that are most routinely outsourced include:

- Quote issuance;

- Policy issuance;

- Endorsement processing;

- Financial administration;

- Claims processing;

- Customer service; and

- Billing.

The motivation for outsourcing is more often than not a reduction in cost and acquisition of important skills, creating an apparent competitive boon to company operations.

However, is gaining competitive advantage this simple?

Before embarking on such an ambitious endeavor, it’s extremely important to understand the specific nature of one’s business and the impact of outsourcing on existing operations. Insurance operations are highly specialized, and their adequate conduct requires considerable experience and knowledge.

Further, cultural considerations must not be overlooked. Certain core activities are best performed with a tinge of local flavor and hence should not be outsourced. As such, differentiating core from non-core activities is critically important since such a distinction is often erroneously made on the basis of what might be considered “important” and “not-so-important.” To be sure, no activity is unimportant, and any decision to outsource should be based on an assessment of those activities that are readily transferable, versus those which are performed with a level of uniqueness that distinguishes them from competitors.

Outsourcing management

Outsourcing involves three major phases: pre-migration, migration andpost-migration.

Pre-migration includes the outsourcing decision, vendor selection and definition of the service levels that form the basis of an agreement. Once an agreement is executed, the engagement is officially kicked off and the transition to the migration phase begins.

Migration includes a thorough documentation of the activities that are to be undertaken by the outsourcing vendor, governance and compliance policy development, project planning and resource allocation, training, knowledge transfer, system integration (when applicable), data migration, security and user acceptance testing. A completed migration phase sets the stage for fully “operationalizing” the outsourcing relationship, which takes place during the post-migration phase.

Post-migration is the phase during which control of operational processes being outsourced are handed over to the vendor. Viable providers will offer transparency into daily operations and workflow, including activity reports, service level compliance, change control and audits.

Pre-Migration

The Decision to Outsource

The decision to outsource should center on seeking a professional relationship with a dedicated vendor who can provide fresh ideas on how to run and improve operations. Outsourcing is a strategic initiative, and as such has a goal of establishing a long-lasting and fruitful alliance formed for the mutual benefit of both parties.

One of the most common mistakes in the outsourcing decision is to focus solely on smaller or less critical processes as candidates with an eye toward cost cutting. While a reasonable decision criterion, cost savings should not be the sole motivator for outsourcing; there should be an acute awareness of the compromises to quality that might result from such decisions.

Selection of the best candidate processes for outsourcing begins with a review of all organizational processes. Those that represent core competency and demonstrate little room for improvement are best left alone; those to which a qualified outsourcing vendor can add value – by providing management frameworks, process visibility and guaranteeing service levels at reduced prices – are excellent candidates. Such an internal process review involves:

- Identification and documentation of organizational processes;

- Analysis of process challenges (multiple handoffs, bottlenecks, non-value adding activities);

- Feasibility studies and impact analysis; and

- Determination of decision criteria.

A typical insurance operation includes multiple opportunities for outsourcing, including underwriting, policy administration, customer support, claims management, renewals, and billing and collections.

A common misconception is that outsourcing should allow an organization to focus only on important operations that require direct control of quality. However, since no function is unimportant, this idea is a detriment to good outsourcing practices. In fact, outsourcing itself should be thought of as a process that requires careful attention to management, in order to derive the maximum value from the relationship.

Which processes?

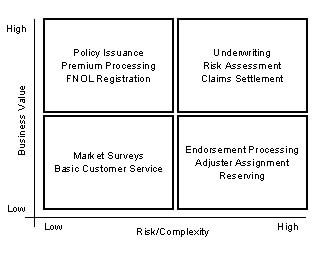

To support decisions to outsource specific business processes, operational processes should be evaluated with respect to the complexity and level of risk associated with the process, and the value that outsourcing that process can add to the business.

The matrix on the following page illustrates a good way to organize decision criteria to determine which processes represent the best candidates for outsourcing. Notably, in this example the business value derived from outsourcing is weighed against the complexity of business processes, the riskier ones less likely to be outsourced.

Outsourcing selection criteria

In examining their own processes, the organization depicted in our example has determined that:

- Policy issuance is a well-documented, mature process, and outsourcing could provide significant benefit – in particular for a company that issues fairly standard policies that require simple underwriting reviews.

- The claims settlement process is potentially complex and as such involves a fair amount of risk. In this case, extra attention should be paid to prospective vendors’ experience and expertise in dealing with the claims process. More tightly controlled service level monitoring is called for as well.

- Market surveys and basic customer service are processes that our subject company feels are best done internally. Though risks and complexities are low, maintaining a first line with customers is determined to be important enough to maintain in-house. Outsourcing these simple but important processes might also be compromised by the cultural differences of offshore providers, introducing unnecessary risk.

- Endorsement processing, adjuster assignment and reserving are processes that are viewed as highly complex, and our subject company is not comfortable outsourcing these processes to third parties.

Naturally, the position of the various processes that comprise an insurance operation in the matrix will vary from company to company.

Vendor selection

When choosing a vendor, selection criteria and the weight each is given will vary by company and are heavily influenced by market cycles and organizational objectives. Expertise, experience, reputation, efficiency and good customer service are among the factors to consider when choosing a vendor.

In addition, to better evaluate the fit of a prospective outsourcing partner, vendors should provide information regarding:

- Their vision, mission and values;

- Financial statements (two to three years preferred);

- Client lists and referrals;

- Capabilities and areas of specialization;

- Capacity;

- Office locations;

- Infrastructure; and

- Reporting and management capabilities (i.e. dashboards and portals).

These factors help narrow the field of prospective vendors considerably. [N.B.: While there’s some debate regarding exactly what value is derived by examining a vendor’s vision, mission and values, their overall cultural fit – something that should be a major consideration – becomes pronounced only by gaining an understanding of these “soft” factors. These are not mere niceties, rather important indicators of a vendor’s priorities.]

Having arrived at a shortlist of prospective vendors, final selection includes additional diligence, which should include:

- Capabilities demonstration. A live demonstration of the vendor’s capabilities is the best way to understand how the day-to-day relationship will be managed. During any such demo, representatives of all stakeholders should be present. It is advisable to score the vendor on a list of factors that the stakeholders feel are important, bringing objectivity to the process.

- Scrutiny, analysis and review. Scrutinize the presentations provided and compare notes with other users that attend the demonstration. This provides multiple perspectives from which the ultimate decision maker can determine the final selection. Site visits also provide valuable insights into the strength of a vendor’s claims regarding their servicing abilities.

- Negotiation and commitment. The closing step in the final selection process is negotiation. Vendor pricing, service levels and payment terms should be evaluated and compared.

Other important considerations include:

- Communications. Good communications are a hallmark of any well-managed enterprise. Frequent, comprehensive and candid communications help keep expectations aligned.

- Dedication. Naturally, most outsourcing vendors will vouch for their staff’s dedication to the job. Staff dedication is a result of training, incentives and job growth opportunities, which translate into employees’ willingness to study, engage thoroughly and adapt to the insurance company’s outsourced processes.

- Efficiency. It is always of interest to know whether workflows are optimized – where insurance company expectations are met or exceeded (as defined in service level agreements) at least cost. It’s important to understand how variations in volume impact turnaround times and how the company is equipped to handle the expansions and contractions that characterize any dynamic industry.

- Quality is a major consideration when choosing an outsourcing vendor. Compromising quality results in customer attrition and a consequent reduction in business volume. Obvious adoption of widely accepted best practices should provide comfort that the chosen outsourcing firm has in place a viable quality management system. Certifications such as ISO or CMMI provide reasonably reliable third-party quality endorsements.

- Customer service. Inasmuch as policy holders are extremely sensitive to their sense of relationship with their insurer, their needs must never be compromised. When outsourcing, it’s important to ensure that a chosen vendor will exercise the same level of care as the insurance company would if they employed their own internal staff. This requires frequent monitoring of customer satisfaction via surveys, complaint logs, and call monitoring.

- Reputation. Outsourcing companies that have an established name are the best bets to start with. While experience does not always relate directly to expertise, a company that has developed a solid reputation in a particular industry has a lot at stake, and will typically go to great lengths to ensure the success of the relationship.

- Size. Size is another important consideration in the vendor selection process. In any industry, there are players that target different segments based on their financial capacity, capabilities and value proposition. While the effect of size mismatch may not be felt initially, there are long term considerations that essentially indicate the importance of including size among the evaluation criteria.

- Pricing model. With the rapid growth and acceptance of outsourcing services, it’s natural to witness intense price competition. Since many companies outsource to obtain cost savings and operating efficiencies, a flexible pricing model that respects multiple service levels should be a feature of any outsourcing arrangement. In addition, pricing models should reflect the core business of the insurer. For example, an insurer that specializes in private passenger auto insurance exhibits certain operational characteristics that influence pricing, including:

- High volume (large number of policies);

- Low value (low premium values);

- High operational costs (resulting from large policy issuances);

- Requirement for faster turn around time; and

- Standardized processes.

As such, auto and similarly situated insurers should take note: these characteristics represent a collection of important evaluation criteria when selecting a vendor for outsourcing. However, an additional characteristic, flexibility, is driven by the notion that lower margin operations inhibit the ability to commit to fixed payment schedules, and as such the vendor should allow some form of unit pricing, where fluctuations in transaction volumes are mirrored with variable pricing agreements.

Agreement and kickoff

The final step in the pre-migration phase is marked by execution of an agreement with the outsourcing vendor and an all-hands kickoff meeting. Contract negotiation and finalization is a key step, the importance of which cannot be overemphasized. Offshoring in particular introduces risks that are only mitigated with the careful attention to contract terms that adequately define expectations. Risk factors inherent in an outsourcing arrangement that are amplified when dealing with offshore vendors include:

- Communication issues;

- Cultural differences;

- Political and economic climate;

- Legal environment; and

- Attitudinal differences.

A closer look at each of these factors highlights the importance of tight controls memorialized in clear contract language. Unfortunately, many outsourcing relationships begin with much fanfare and enthusiasm, only to irreparably degrade due to misunderstandings that might have been avoided entirely given a more diligent contracting process.

Having executed an agreement, the parties next assemble at a formal kickoff meeting that involves representatives of all stakeholders in the relationship to create the cohesiveness required for a well-integrated vendor-client partnership. Participants typically include the project sponsor, project manager(s), subject matter experts and core team members from the insurance company client, and a lead project manager, team leader(s) and key staff members from the outsourcing vendor. It’s important to understand the structure of the vendor’s project team organization prior to commencing the project, with the lead project manager’s reporting relationships and escalation protocols clearly defined.

The kickoff meeting provides an excellent venue to discuss these and other issues that influence the good communications that characterize any successful working relationship. In addition, the kickoff meeting is the principal forum used to align expectations between client and vendor. Some areas in need of reconciliation include:

- Performance and quality. Successful business operations are often defined by the quantity and timeliness of process outputs (i.e., performance) and the consistent ability to meet or exceed client specifications (i.e., quality). Quantitative measures that validate pre-defined performance expectations (in some cases, service levels) and quality should be routinely communicated.

- Roles and responsibilities. Team skills assessments should precede the assignment of specific roles, and the client should be made aware of the backgrounds of vendor staff members designated to perform work on their behalf. The roles and responsibilities of people working within each organization should be well-defined and communicated to all team members to avoid confusion, duplication of effort and to instill accountability.

- Control. In any outsourcing relationship, control of operations is a major cause of anxiety. Operations once exclusively the domain of internal resources may now be distributed worldwide. As such, technology and telecommunications occupy a pivotal role to the success of the relationship. The benefits of outsourcing tend to evaporate if the client company exercises too much control. As such, good visibility and frequent, if not real-time reporting help allay the fears that often accompany a loss of control.

- Security. Data security is of paramount importance for insurance companies. In an industry built on trust, security, confidentiality and the protection of sensitive customer information is critical; breaches of trust can spell disaster for the outsourcing vendor and the insurance company client. A review of documented security measures and a thorough examination of data facilities should precede any outsourcing relationship.

Migration

The migration phase involves the actual implementation of the outsourcing process. It starts with documentation of all outsourced processes and ends with user acceptance testing.

Activities involved in each step of the migration phase are detailed below:

- Documentation. A review of process and other manuals that assist the vendor in providing their services is the first step of the migration phase. It’s good form for an insurance company to develop and maintain manuals that highlight procedures and indicate roles, responsibilities and process owners for each operational function. These documents provide valuable input to an outsourcing vendor, and help preserve business continuity in the event of staff changes. Process manuals are dynamic, with process efficiencies built upon past experiences and evolving market conditions that are recorded as lessons learned within its pages. Accordingly, the vendor should demonstrate the ability to adapt to these changes.

- Compliance checks. Both parties need to ensure that there are no legal or compliance issues encumbering the outsourcing or offshoring arrangement. For example, many jurisdictions regulate the sharing of personal information and leverage severe penalties for infringement. Reviewing such limitations is an important part of the migration process.

- Governance and infrastructure. Process governance, including vendor policies and procedures, and the infrastructure upon which outsourced staff rely to perform their jobs should be examined thoroughly and well understood by the insurance company client. System availability should meet or exceed “five nines” of uptime (99.999% availability).

- Disaster recovery. The outsourcing vendor’s disaster recovery plans should be reviewed and understood, and the procedures for dealing with failures due to unforeseen natural and unnatural catastrophes widely communicated and even rehearsed from time to time.

A related issue during this phase includes the installation of software applications required in the conduct of the insurance company client’s business at the vendor’s locale. Software End User License Agreements (EULAs) should be reviewed, and additional licenses purchased if necessary to ensure compliance. In addition, insurance companies should collaborate with their chosen vendor on the following:

- Project/resource planning. Detailed project plans, including resource allocations and task scheduling are drawn up during the migration phase. Project timelines should be determined based on actual level of effort required while considering business objectives, rather than arbitrary due dates and guesstimates. Business process outsourcing represents a major change in the means by which business is conducted. As such, the impact on the client’s existing business should be acknowledged while project planning, and the appropriate buffers and lags associated with any such impact accounted for.

- Training. Training and knowledge transfer is another critical part of the migration phase. Resources employed on the various process teams should be well-versed with the rules and regulations, statutory issues, data structures and data protection laws, internal policies and procedures impacting any outsourced process with which they’re involved. Training should include a level of interactivity that tests the knowledge and the grasp of specific processes, enabling the vendor to assign responsibilities to the appropriate staff members.

- Data transfer. The actual transfer of data is a preparatory step in advance of user acceptance testing, and provides the vendor with the requisite raw material to make the outsourced process operational.

- Process integration/migration. As seamless a transition as possible from outsourcing location to insurance company client operation is the objective of this stage of migration. Procedural challenges may best be served with the adoption of certain technologies, such as extract, transform and load (ETL) tools for efficient data migration and Business Process Management Suites (BPMS) to link disparate systems and promote efficient workflow.

- Compliance again. At this stage of migration, it’s wise to ensure that all necessary contracts and agreements are in place, with an explicit understanding of the timing and frequency of audits to ensure compliance with service levels, policies, and regulations.

- User acceptance testing (UAT). The UAT process allows the insurance company client to validate the chosen set of procedures for effecting the outsourced process within the service levels defined in the outsourcing agreement. Sample transactions and associated reporting provide the best means for such validation.

A properly managed migration phase will provide for the insurance company client an excellent understanding of the vendor’s ability to meet expected performance levels. UAT results and any corrective action should be taken by the vendor as a pre-condition to going live.

A common mistake made in outsourcing relationships is moving on to the post-migration phase immediately after completing the UAT. However, it is highly advisable that a thorough comparison of client objectives against test results is undertaken in a manner that validates the outsourcing decision for the client’s management.

Validating the decision

According to the 8th Annual Outsourcing Index released by The Outsourcing Institute, the single most common reason companies outsource is to reduce and control operating costs. As such, ensuring this objective is actually realized should be given much weight when evaluating the viability of continuing to outsource any process. There are many ways to go about this:

- Compare service level agreements. SLAs provide quantitative benchmarks for evaluating the speed, cost and quality of various processes. For every transaction processed during UAT, the insurance company client should evaluate compliance with stated service levels. There’s no reason to expect failed service levels to improve in a production environment, so remedial attention is imperative prior to going live.

- Current vs. future. A comparison of current process performance to UAT results provides a good indication of the cost, speed and quality benefits of outsourcing.

The most important takeaway from the migration phase is a validated understanding of the benefits of outsourcing that aligns vendor and client expectations.

Post-Migration

During the post-migration phase, emphasis shifts to relationship management and the ability to rapidly address issues that arise in the live production environment.

To preserve business continuity and enhance the quality of outsourced processes, the following steps should be followed:

- Handover and control. Naturally, some insurance company personnel are reluctant to give up control over certain organizational processes. The lines of responsibility, however, must be clearly drawn for the relationship to work. Control anxiety is best alleviated by providing frequent, if not real time, visibility into process performance.

- Transparent operations. As earlier intimated, for the outsourcing relationship to be viable, the vendor’s operations must be transparent to the client. This means the personnel engaged on behalf of the client are known and accessible to the client, and the results of operations are reported as frequently as mandated by the SLAs that govern the relationship. Absent adequate transparency, the client and vendor expectations will, over time, become misaligned.

- Reporting. Consistent with the need to provide transparency into the daily workings of the outsourcing vendor is a clear definition of the type and frequency of reporting that will take place. Reports that indicate weakening service levels should be thoroughly discussed and the lessons learned institutionalized to avoid further slippage.

- Process updates and change control. Changes to business processes and the associated service levels must be documented and incorporated into existing agreements as mutually understood modifications to the current arrangement. Failure to support change in writing often results in misunderstandings, especially with offshore partners whose language interpretations may be somewhat nuanced. Changes should be authorized by a client representative who fully understands the impact of any such change. The adoption of the change is facilitated with documentation and training in any revised procedures mandated by the change.

- Audits. Occasionally, it may become necessary for the client to undertake a detailed review of the vendor’s operations in order to verify that reported information is, in fact, consistent with reality. Further, periodic reviews are not only prudent, but represent a good business practice to which no outsourcing vendor should object.

Conclusion

In the strictest sense, outsourcing should be viewed as a strategic initiative designed to help an insurer in the advancement of its organizational objectives. As with any major operational undertaking, outsourced processes require diligent monitoring, careful analysis and well-documented contingency plans to maximize the benefits of the engagement.

Offshoring operations introduces additional risks, though it’s an increasingly accessible strategy for even small and mid-sized insurers to realize significant cost advantages. Cost considerations, however, must be weighed against the quality, cultural differences, time zone changes and language barriers that might inhibit a relationship with an offshore provider.

Insurers have many choices when selecting a third party with whom to engage for outsourcing business processes. Aligning a prospective vendor’s operational strategy with the insurer’s is a fundamental endeavor in advance of entering such a relationship. Insurers should be aware of prospective vendors’ own market positioning, to see whether they are focused on:

- Lower costs services for transactional processes;

- A wider breadth of services offered;

- Deeper vertical (i.e., insurance) knowledge; or

- Better methods of execution.

Matching business objectives helps considerably in aligning the client-vendor relationship from the start.

According to Gartner, the offshoring component of outsourcing alone is expected to exceed $235 billion by 2008. This represents a compound annual growth rate of 7.8% since 2002, and speaks loudly about the success of offshoring as an important operational strategy that affords those who carefully consider it, and apply best practices to the engagement of a qualified provider, a distinct competitive advantage.

Vivek Sethia is Vice President, Insurance Practice – North America at 3i-Infotech Inc. In this capacity, he manages and charters the growth path for the Insurance IT Solutions practice and oversees the IT Solutions and Consulting businesses for both the property & casualty and health insurance sectors, managing a team of over 200 people. Having spent more than 12 years in providing IT solutions and consulting services, he has experience with requirements analysis, design, development and implementation. Vivek is a management graduate from India with experience spanning some twenty-five countries across four continents.