Are Your Personal Auto Rates Keeping Up with Soaring Claim Costs?

- Written By Andrew Douglas

In the personal auto insurance industry, the cost of repairing or replacing cars involved in accidents has spiked and continues to rise. These increases appear in insurer claim severity data as double-digit percentage increases in the cost of covering property damage and collision claims. Propelled by persistent supply chain shortages, general inflation, and shifting composition of vehicles under coverage, some of these higher costs may be here to stay.

Insurers should be responsive to these changes or risk inadequate rates to cover future costs. As actuarial consulting partners to some of the nation’s top insurance companies, we have helped many insurers accurately predict future premiums needed to keep up with these rising costs.

Here are some factors influencing higher costs and what to expect in the coming year.

Claim costs have risen dramatically

Property damage coverage and collision coverage costs are tied to the price of vehicles and vehicle parts. The cost of vehicle repairs and replacements has sharply increased, coinciding with pressures on the global supply chain caused by COVID-19, changing consumer demand, and inflationary impacts.

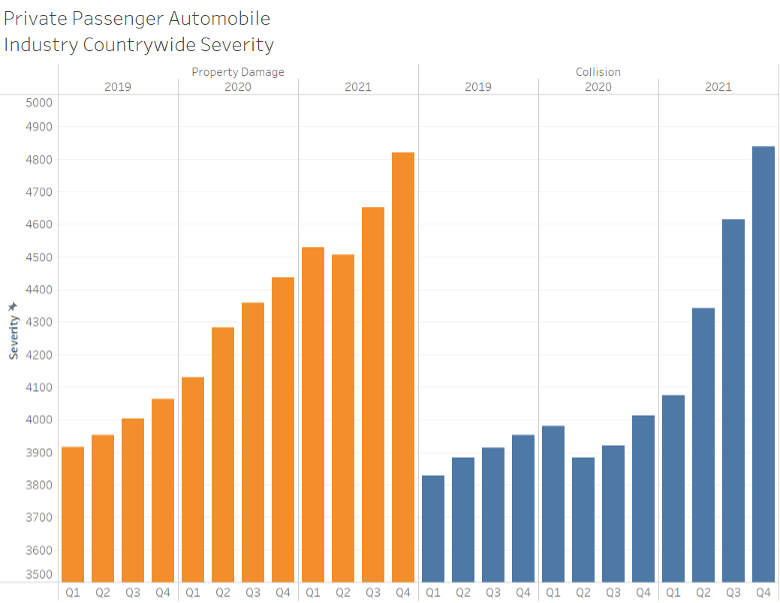

Countrywide data shown in the table below reveals the average cost of a claim for property damage and collision coverages has increased by over 30%. Many areas of the country have experienced more significant spikes. For example, Florida, Georgia, Maryland, and New York all have experienced claim cost increases closer to 40%.

Source: Chart created using data from the Insurance Services Office, Inc. Fourth Quarter 2021 Private Passenger Automobile Fast Track Data Circular AS-PA-2022-013 published on May 12, 2022. Includes copyrighted material of Insurance Services Office, Inc., with its permission.

Safety features drive up costs

New safety-related vehicle features are also raising the price tag for repairs as late-model vehicles feature more crash avoidance technology than ever. True, some of these technologies reduce accident frequency. However, expensive new technologies also elevate repair costs as many of the parts used in these systems are located on the vehicle’s exterior.

For example, the Insurance Institute for Highway Safety (IIHS) April 2019 report showed the average payment per claim for damage to the insured vehicle goes up by $109 for vehicles equipped with the forward collision warning without autobrake.

As the auto industry promotes tech-powered safety features as a selling point, increased associated repair costs are a trend we don’t expect to reverse. According to the IIHS, the percentage of registered vehicles estimated to utilize these systems will increase by over 20 percentage points by 2024.

Shift toward electric vehicles also has an impact

Car buyers’ affinity toward electric vehicles (EVs) will also push severity up. Overall, the number of electric cars on the road in the United States is small, but in some areas like California, EVs make up a significant proportion of new vehicles. In the near term, severity will rise with the expansion of EVs on the road because it takes time to build a robust parts network and shops will need to invest in training to service these new vehicle types.

Additionally, global semiconductor shortages continue to squeeze the supply of microchips in cars, which means low supply and high prices. The dynamics causing parts shortages are likely to persist into 2024 (S&P Global, 2022).

As gas prices rise and the popularity of electric vehicles continues to climb, claims costs may trend upward as well.

Insurers nationwide are scrambling to increase rates

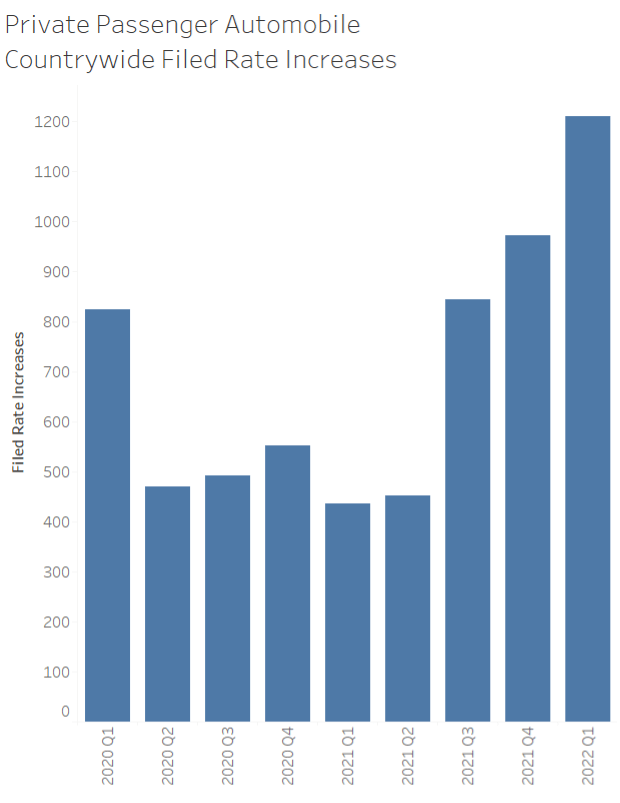

Though most insurers reduced rates and/or returned premiums during the height of the pandemic, insurance companies today are feeling the pressure of rising claim costs, resulting in a mass push to increase rates. Due to this realization, rate increase requests are pouring into Departments of Insurance across the country as shown in the graph below. States like California are experiencing long wait times for rate increases to be approved.

Source: Chart created using data from S&P Global Market Intelligence

The type of support required for personal auto rate filings varies by state. With staffing shortages slowing down the filing review process at Departments of Insurance and inflation putting pressure on the rates charged by insurance companies, it is more important that the submitted filing meets all the state-specific requirements. Improving the time to approval could save a company millions of dollars. Partnering with actuarial consulting experts like Perr&Knight for support can reduce the risk of inaccuracies that can slow the approvals process.

Higher costs are here to stay

Supply chain shortages and inflation, new safety technologies, and EV popularity are driving claims costs up and show no sign of abating any time soon. To keep pace with higher expected loss costs, insurers should proactively keep pace with rate increases. Actuarial consulting partners like the team at Perr&Knight can evaluate rates and rating structures to ensure rate adequacy and determine what actions are needed to promote both short and long-term success.