Complemented Core Capabilities: How small insurers can adapt and thrive

- Written By Thomas Trezise

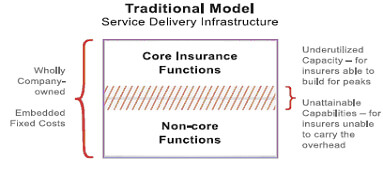

Our products are services

Insurers are service businesses. Although insurers use the same vernacular as manufacturers and refer to their “products,” they do not create a tangible product. Instead, insurers agree to provide services to their clients when certain events occur. The original insurance service, in its simplest terms, was fulfilling a promise to pay. This simple promise has expanded over the years into a broad array of services. To deliver these services, many insurers developed internal personnel and technology infrastructures that were substantial and complex. Whether large or small, successful or struggling, established or start-up, almost every insurer operates within this proprietary service business model: to provide services they build, own, and control the infrastructure and resources that provide the services.

This proprietary business model has been a competitive advantage for organizations large enough to create the needed service delivery infrastructure, and a barrier to entry for start-ups and for insurers seeking to open new lines of business, develop product variations, or expand geographically. But this past advantage has now been turned on its head. Technology and market forces have converged in recent years to offer small insurers an affordable opportunity to control their service infrastructure – without having to build and own the resources. Small insurance businesses can now effectively deploy a different business model: they can staff their core functions internally and use technology and insurance service providers as a key strategic factor, at a variable cost, to complement and extend their core capabilities.

Technology and insurance services can be dedicated to the insurer as though they are part of its internal infrastructure, but matched just to the extent of the insurer’s needs rather than drawing resources as embedded overhead. This Complemented Core Capabilities approach enables smaller insurers not only to manage infrastructure costs effectively but also to compete, grow, and thrive in ways that were previously beyond their grasp. This business model would have significant strategic and structural cost advantages even in the older, quieter insurance business of decades past. In the current competitive business environment, which includes market forces such as rapidly changing technology, increasing difficulties in recruiting and retaining insurance talent, and tightening regulatory restrictions, the model becomes even more compelling.

The competitive environment

The property and casualty insurance industry faces a deepening and potentially long term soft market. The soft market appears to be firmly entrenched across all lines of business.[i] Some analysts characterize the current market cycle as “painful and destructive.”[ii] Moreover, the market may stay this way until 2015 or 2016 and inevitably produce impairments in insurers that are less able to compete.

In addition to this soft market, costs are increasing on several fronts. This includes, for example, the effect of regulatory changes such as the Gramm-Leach-Bliley Financial Services Modernization Act and Sarbanes-Oxley requirements, disaster planning regulations after Hurricane Katrina, changes in accounting standards, and more that have added layers of regulatory and market-conduct burdens. The possibility also looms of a federal regulatory role increasing the industry’s already expensive and cumbersome regulatory environment.[iii] These changes and others present challenges for insurer staff and their technology. Unfortunately, both the ability to add expert staff and the readiness of legacy technology are problematic.

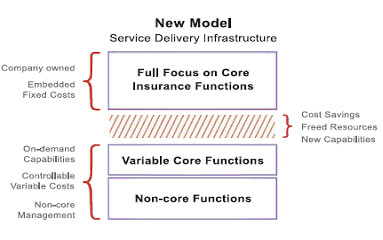

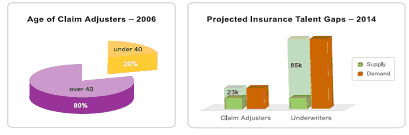

The insurance industry faces a rapidly and significantly shrinking employee base, and the competition for talent has become acute.[iv] The numbers are sobering. Deloitte Consulting notes the following:

[T]here is an impending shortage of “critical talent” in the insurance industry – the talent that drives a disproportionate share in a company’s business performance. Depending on an insurer’s business strategy and model, these can be the underwriters, claims adjusters, sales professionals, actuaries, and others who can make the difference between 10 percent and 20 percent annual growth – or between underwriting profit and loss. The looming talent crisis is about to become much worse due to two emerging trends: the retirement of Baby Boomers, who begin turning 62 in 2008, and a growing skills gap.[v]

In 2006, 80% of the chartered property and casualty underwriters and 70% of property and casualty claim adjusters were over 40. And replacements aren’t arriving in large enough numbers. By 2014, Deloitte predicts the industry will face a talent gap of 23,000 underwriters and 85,000 claim adjusters. This would be a crisis in any business environment, but the current soft market means that an insurer’s ability to compete will depend on finding flexible sources of talent and expertise. The shortage of talent is occurring at all levels, including executive and middle management. This crisis affects all insurers, but smaller businesses with fewer resources to compete on salaries and other incentives will have an acute disadvantage.

In addition to the increasing shortage of insurance expertise, insurers face a technology bind between new and legacy technologies. The average policy administration, claim, and billing system is 24 years old.[vi] Like investors increasing holdings in a stock that has dropped in value, companies have continued to add enhancements and modifications to their legacy platforms rather than making a stop-loss move to Web services systems with a clearly brighter upside. Insurance executives do see the problem. KPMG’s 2007 survey indicated that improving technology is second only to strategic acquisitions as a target for capital deployment and a major factor affecting their capabilities for future growth.[vii]

Small mutual insurers have great difficulty allocating the threshold amount of capital to join the “club” that benefits from rapid changes in technology. The National Association of Mutual Insurance Companies identified this capital deficit as a developing crisis for small insurers a few years ago,[viii]and if anything the situation has worsened. Adding insult to injury, customers expect more. IBM recently surveyed more than three thousand property and casualty policyholders and noted that insurers must change their traditional business models and technology to reach increasingly Internet-savvy customers who have increasing expectations for instantaneous transactions and information.[ix] Web-based product distribution presents both a significant competitive challenge to insurers who lack access to this customer channel and a significant cost, deployment, and maintenance challenge to insurer technology infrastructures and staff.[x] The event horizon of the new market created by these forces is rapidly moving closer. According to the Gartner Group, just five years from now only insurers that overcome the challenges of increasing regulation, an aging talent base, and inflexible systems will remain competitive.[xi] Without a solution to enable them to remain competitive, small insurers will simply slip further behind their larger competitors. The solution path for small insurer survivors and “thrivers” lies in a Complemented Core Capabilities approach that leverages technological opportunities, internal core insurance strengths, and external availability of variable-cost insurance expertise.

Complemented Core Capabilities

A Complemented Core Capability approach builds on shifting business process outsourcing or BPO (retaining another company to perform distinct business activities for you) from a tactical to a strategic component of your business model. BPO has proven to be a successful strategy in financial service industries other than insurance.[xii] In deploying a Complemented Core Capabilities strategy, an insurer focuses its limited resources and talents on its core competencies while complementing those capabilities with leading technology and insurance services from outside the company. This is a strategic response to the market forces specified in the first part of this article. Insurers have looked outside their internal resources for help on individual service issues for decades. The claim process has particularly been an area where insurers have utilized outsourced services. Independent adjusters and appraisers have long been a staple of the property and casualty industry. Although the insurance industry has outsourced some services on a tactical basis, it nonetheless has lagged far behind other industries in deploying BPO to develop a strategic advantage. Smaller insurers facing today’s fierce competitive pressures now have an opportunity to leverage a Complemented Core Capabilities strategy to transform their capabilities to compete and succeed.

Technology capabilities

Transformational opportunities have emerged for insurers over the past five years due to two key fundamental changes to property and casualty insurance technology: (1) maturation of Web services architecture and (2) business process management tools.[xiii] Indeed, 80% of 2008’s technology development projects may be focused on these technologies.[xiv] With so many businesses now investing in these technologies, the changes they bring are inevitable. They are particularly suited to enable insurers facing resource challenges to extend their core capabilities and maintain and grow their market position. Small insurers, however, are traditionally cautious and change-averse. We’ve all heard decade after decade of hype about the great changes the newest new technology will bring. But a cynical approach is strongly contradicted by the facts on the ground – the performance of the technology in real work settings – and is especially counterproductive in this environment, for inaction actually produces the real risk of an insurer’s obsolescence and inability to compete as more and more competitors adapt.[xv] These technologies have demonstrated capabilities, robust performance, and cost savings in crucial areas such as implementing and changing business rules. The question is no longer whether these technologies will dominate the market but rather which insurers will embrace the opportunity.

Web services technology takes what used to be complex business operations represented by millions of lines of code and breaks them down into reusable building blocks. Previously, to change the business process, add a product, enter a state, or implement any significant change, the insurer had to invest substantial time and resources changing those lines of code and testing those changes. Web services architecture allows insurers to capitalize on the fact that the business of insurance consists of patterns that repeat throughout business requirements across the various departments and functions of the insurer. This architecture provides very generic, reusable building components that produce a simple, easily configured environment that focuses on the business operations and facilitates rapid and flexible product development. Where business processes previously were forced to match system capabilities, now systems are easily configured and changed to match the business process. Business process management technology automatically tracks and coordinates transactions and processes, allows and triggers manual intervention as required, extracts data and transfers it to appropriate users, executes transactions across multiple systems, and facilitates straight-through processing of transactions without human intervention under defined criteria. The heart of business process management solutions are process and workflow automation in accordance with rules, maintained in a rules engine, that define the sequences of tasks, responsibilities, conditions controlling the processes, and process outputs, among other aspects of the processes.

Business process rules engines have even transformed the cumbersome process of configuring and maintaining rating engines.[xvi] Systems streamline processes by limiting human involvement to just those aspects of transactions that require exception decisions and actions by automatically handling transfer and execution of process tasks in accordance with defined conditions. By reducing the time and resources required to complete processes, the system reduces cost. Moreover, reducing manual touches reduces transaction time, improves service, and reduces errors.[xvii]

Straight-through processing (STP) is just one of many areas where the combination of Web services architecture and business process management solutions is making an impact on the property and casualty insurance industry. STP means the end-to-end execution of a business process, such as policy rating, quoting, and issuance, with little or no human interaction.

According to John Del Santo of Accenture:

[T]op performing carriers are now turning STP into reality and profiting handsomely along the way. These carriers are implementing rules-driven platforms that enable STP across the entire insurance policy life-cycle – from sales illustration to policy administration. The scalable technology with which these platforms are built is enabling these carriers to drive major transformational initiatives – a feat that their competitors are racing to repeat.[xviii]

Access to business process management technology is the obvious essential first step in winning that race.

Core capabilities

Increasing the focus on core competencies to increase business value is not a new concept to anyone who has ridden in an elevator with a newly minted MBA. The Complemented Core Capabilities approach builds on the basic core competency argument that capabilities reflected in skills and knowledge sets define the unique elements of a business and its competitive position in the marketplace. Non-core competencies when performed to expectations, on the other hand, do not offer an opportunity for significant differentiation from your toughest competitors.

Non-core does not, however, mean unimportant or unnecessary. Poor execution of non-core functions can, of course, impair competitive position, but there is no business advantage in your doing it well, if someone else can do it well or better for you as their own core competency. This risk of a non-core business done poorly has led a naturally risk-averse insurance industry to sequester non-core capabilities in house. That, in this market, is a strategic mistake and is based on a fallacy that only ownership delivers control. A model that delivers control without ownership, such as the Complemented Core Competencies approach, can increase focus on core competencies with controllable risk. The risk, indeed, lies elsewhere. In an environment where talent in both core and non-core functions is becoming harder to find and more expensive to acquire and retain, insurers become particularly vulnerable; one commentator articulated this as follows:

Given the limited corporate resources and executive attention, if you focus on core competencies, who focuses on the other non-core but necessary elements of the value chain?[xix]

Stated differently, if an insurer’s success depends upon its core capabilities, should it divert its resources and energy from those core competencies to maintain capabilities in non-core functions? Complemented Core Capabilities as strategy is more than tactically shifting staff time from non-insurance tasks. For example, automation of tasks and transfer of knowledge through the creation of system rules in business process management systems may alleviate some pressure on an insurer’s staff.[xx] Nevertheless, increasing competition, rapid technology changes, an evolving regulatory environment, and demand for ever more innovative insurance products will still challenge the capabilities of the insurers’ employees.[xxi] Insurers who are willing to realistically assess their inadequacies and needs, and turn to experts outside their organization to complement their core capabilities, will be in a better position to survive and prosper than those that continue to stretch their executives and staff to cover broader and broader areas of responsibilities and execute processes and tasks beyond their core skills.[xxii] In addition, by looking outside the company for resources to enhance expertise and capabilities, insurers can access talent on an as-needed, variable-cost basis rather than adding to overhead or, alternatively, proceeding without the expertise because a full-time resource cannot be justified financially or acquired competitively.

An opportunity: Reduced-risk transformational change

The maturation of Web service and business process management technologies, the increasing availability of outsourced insurance talent and services, and the convergence of those capabilities into variable cost options for insurers present small insurers the opportunity to transform themselves into formidable competitive platforms. Michael Sutcliffe of Accenture characterizes the challenge and opportunity as follows:

High-performance businesses revisit and adapt their operating models as required to sustain competitive advantages over time. Outsourcing can allow companies to build new business capabilities rapidly, expand into new geographic markets and change internal systems and processes to support new business models. It reduces the risk associated with implementing transformational change.[xxiii]

Market forces will inevitably transform small insurers over the next five years. The crucial question for each company is whether it executes that transformation purposefully and strategically, or shifts reactively to wherever the market forces drive it. Each insurer has an opportunity to rethink the way it does business and find ways to extend its current capabilities and develop new ones. Some are embracing that opportunity.

Case study: Unity Life[xxiv]

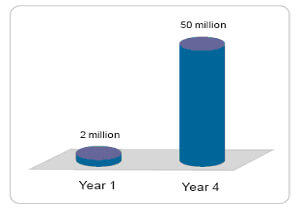

Unity Life of Canada has embraced a business model that enabled the Toronto-based mutual life insurer to grow from $2 million to $50 million in settled premium in only four years. The company

has been transformed from a struggling life insurance company into an innovative provider of unique insurance products through unique distribution channels. It accomplished its transformation by focusing its staff exclusively on core competencies while enhancing its capabilities in all processing and non-core functions by establishing strategic relationships with outside experts.

“About five years ago, we decided if we were going to survive and prosper in an environment where the larger mutuals had de-mutualized and there were mergers and acquisitions going on, we had to do something significantly different,” says Tony Poole, senior vice president of sales and marketing at Unity Life. So Unity Life management decided to create a virtual insurance company, spinning off its back-office operations into a separate company, now called Genisys.

“We recognized this was a completely different business model,” Poole says. “It would free us up to really do what we do best – our core competency – which is the manufacturing and distribution of products.” The idea was to transform Unity Life’s back office from an expense-driven operating division of a life insurance company into a revenue generator, Poole says. With Unity Life as its original customer, Genisys – an end-to-end business processing outsourcer (BPO) to the life insurance industry – has since attracted several more customers, including CIBC, BMO Life, Gerber Life Insurance Co., and Manulife Financial. Unity recently finished its transformation by divesting itself of Genisys to better execute its new business model. Freed from day-to-day back-office operations, Unity Life also outsourced human resources and legal, valuation, and actuarial services. “We said, ‘What is our core expertise? It’s manufacturing, marketing and distribution of products,’” Poole says. By outsourcing the valuation and actuarial functions, Poole noted that Unity Life obtained best-of-breed talent that it otherwise couldn’t afford as a small insurer. Indeed, Unity Life now functions very successfully with a core group of executives and employees who focus on developing profitable new business and retaining profitable current accounts, while complementing those core capabilities with technology and insurance services from expert providers. Unity Life has successfully executed a Complemented Core Capabilities strategy to transform itself from a small, struggling insurer to a thriving competitor. The strategy seems particularly suited to markets characterized by commodity products, tight margins, and industry consolidation, according to Mike McGuin, senior marketing specialist at Toronto-based Genisys. He notes, “When you look at the landscape, insurance companies need to redefine their core competencies to continue to be viable down the road. That’s why outsourcing is an option they should look at – to reduce expenses, redefine their processes, and leverage best-of-breed technology that they would not be able to afford otherwise.”

Case study: SureProducts Insurance

SureProducts Insurance Agency, a Monterey, California, property and casualty program manager, has employed an aggressive Complemented Core Capabilities strategy to profitably underwrite and service approximately $10 million of California-based property and casualty insurance. Utilizing a rule-based platform provided by its sister company, ISCS, Inc., SureProducts manages and services the business with just four employees: a senior executive with deep underwriting expertise, a senior executive with substantial claim expertise, a field underwriter, and an office manager. All other functions are performed on an outsourced basis.

SureProducts has integrated its business rules into the ISCS system rules engine to facilitate a modified straight-through processing approach. “Our system enables us to function almost completely on an exception basis, “says Ernie Weilenmann, vice president, Underwriting. “We spend our time making decisions to assure that we write good business, not processing policies or managing a backend infrastructure.” Steve Broom, vice president, Claims, manages the claim function in a similar fashion. He notes, “We rely heavily on outside adjusters to perform claim tasks, but I can make the key decisions on our claims and be confident that our service requirements will be met.”

Managing a $10 million book of business with just four employees may seem like a fantasy when companies of similar size require 20+ employees, but SureProduct’s track record proves the model works. It has consistently written to a combined ratio of less than 65% over the last five years. Moreover, in the critical area of operating expenses, its total cost for the company infrastructure and outsourced services is 10%.

Getting there

Conceptual barriers can keep an insurer from “getting there.” Although the reasons vary from company to company, major factors are fear of losing control and internal cultural resistance to outsourcing.[xxv]These barriers can seem insurmountable until forcibly shattered by market forces and it is too late to adapt. But research shows that fears of outsourcing are most often not realized: contrary to placing their businesses at risk by seeking expertise from outside sources, a large majority of companies report that their processes and capabilities improved, according to research by Accenture.[xxvi] The researchers also observed that “Outsourcing provides the opportunity to reach beyond a company’s typical boundaries with internal staff and leverage new thinking and alternative ways of effective change.” Moreover, outsourcing unquestionably introduces a rapid infusion of advanced technology and ongoing access to enhancements. These are positive views of specific changes and increased competitive positioning. Still it is change, and addressing cultural resistance to change can be solved only by effective insurer executives who are committed to assuring that their carriers can compete in the future and leading their companies through that change.[xxvii] Anxiety over loss of control should diminish considerably once the insurer understands the capabilities provided by business process rules engines. As Andy Scurto, President of ISCS, Inc. relates,

Insurers are just beginning to grasp the potential of Web services and rules-based technology. Many executives think that because they now have a Web-enabled front end to their system that they have all the functionality they need. But if they deploy a Web services and rules-based platform, they can have every person who services their business, whether an employee, agent, outsourced service provider, or vendor, work on the insurer’s platform through a Web portal and then assure through business rules in the rules engine not only that those individuals meet service standards but also that exceptions to those standards are immediately escalated to company management. That is a more reliable and controlled environment than they have now.

It may seem counterintuitive to those still wedded to the owning-is-control model, but the reality is that the small insurers that are laboring to compete with client-server technology, that even have deployed a Web front end, and are asking staff to stretch themselves across diverse functional areas have less control over their businesses than those moving to a Complemented Core Capabilities strategy utilizing advanced Web services and business process management technology. We must remember that while we call what we create “products,” we are more accurately executing business processes that deliver services according to designed rules. With the latter framework, we can better adapt to the changing market. The small insurers that thrive in the immediate future will be those that get beyond their cultural barriers, adapt to new business models, and embrace the transformational opportunities now available to them. The reward is a competitive business delivering value to its customers, gainful employment for staff, and significant return on investment for its owners. That’s worth striving for.

References

[xiii] See, “Tipping Points in Insurance Automation,” ISCS, Inc., 2006.

[xviii] “Welcome to STP,” Best Review, October 2007, p. 121.

[xxii]See, “Outsourcing to Play Larger Role Among Insurance Companies,” Outsourcing Center, January, 2003.

Tom Trezise is president of Convergent Insurance Services. Tom possesses an extraordinary depth of experience in the property casualty business, including operational areas, technology, financial concerns, and contractual issues facing insurers, reinsurers, third party administrators, and intermediaries. From start-up insurers to large international insurers, Tom has served the insurance industry for over 28 years as an insurance executive, general counsel, and trial attorney. He has led organizations with more than 1,000 employees and managed multimillion dollar budgets. His roles have included VP Liability Claims with USF&G and VP Commercial Claims St. Paul Companies/USF&G. With XL Vianet, Tom was a member of the senior management team that launched an Internet-based commercial insurance business start-up, from business plan development through business process design, technology platform decisions, Web-tool design, and business operations.