Business process improvement: Seven steps to operational excellence

- Written By Rob Berg

Introduction

Total Quality Management. Six Sigma. Eight Omega. ISO 9000. CMMI. BPMM. SCOR. The number of process improvement frameworks out there is staggering. Where does one begin? What should we believe? Is there a right way and a wrong way? To be sure, we should make a distinction between a framework and a methodology. While a framework provides a foundation typically designed to promote a standard operational architecture, a competitive advantage may only be derived by applying an improvement methodology that aims to distinguish one company’s processes from another.

Why improve in the first place? There’s typically a contingent of folks who believe the old saw, “if it ain’t broke, don’t fix it.” But there are competitors out there, each a moving target, each determined to take customers away from you. Insurance companies face a particularly daunting problem: there is only so much room for price reduction. Unless you’re already a major player, growth strategies built entirely on price competition, especially in the personal lines markets, are largely opportunistic and ultimately difficult to sustain. Soft markets demand greater attention to the other side of the profit equation – cost cutting brought about by operational efficiencies is how the game must be played to ensure sustainable growth.

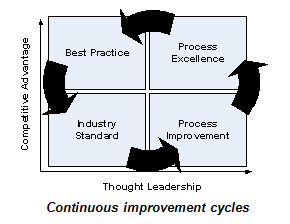

Take a look at the graphic above. The lower left quadrant is where you’ll find a myriad of insurance companies vying for the same business. Here we often see emphasis on new product development to meet the demands of their target markets. While product innovation is a critically important function to drive premium growth, a focus on new product development alone offers an invitation to competitors to imitate and, once again you’re caught competing on price. To sustain their competitive edge, savvy companies embrace the thought leadership that drives process improvement efforts (lower right quadrant). In so doing, they develop excellent operations which provide a distinct competitive advantage (upper right quadrant). However, over time, the processes that drive excellent operations become written about and spoken about as examples of great ways to do business, and, as such, become codified as part of a larger body of “best practices” to which everyone has access (upper left quadrant). As a result, the competitive advantage they once provided begins to erode as these “best practices” become relegated to the heap of industry standards – thus providing no advantage at all. To thwart this vicious cycle, it’s incumbent upon good competitors to continuously evaluate and improve their operations in order to preserve the competitive advantage that truly excellent operations provide.

Where do we begin?

So I’ll assume that you accept the notion that there’s a place for continuous improvement, that by itself, it’s not simply a buzzword or a faddish management mandate and that, sure, I’ve got your attention. But where to begin? Organizations can be terribly complex; a typical insurance company manages dozens of operational processes, all important, and all designed to influence the efficiency and effectiveness with which work gets done. There may be hundreds of staff members impacted by a single operational change, and technology – often millions of dollars worth of investment – to consider as well.

To be sure, I’m not advocating an all-at-once assault on the way things are done in an organization; those initiatives often fall flat, take too long and cost far more than anyone anticipates. At the end of the day, the benefit derived is simply not worth the effort (just ask those involved in business process reengineering initiatives in the mid-90s). What I am advocating, however, is the proliferation of a culture of continuous improvement – a workforce committed to monitoring and improving the way they perform their work.

So we’ve set up the thesis: (a) there are many approaches to process improvement; (b) there is a viable argument for undertaking a program of continuous improvement; and (c) given the complexity of most organizations, most folks don’t know where to start. Fair enough? Given this, there are four important “big picture” items that must be in place in advance of an effective business process improvement effort. They are:

- Providing the vision. Widely communicating what the world will look like in the event process improvement efforts are successful is critical. Good leadership skills are needed to promote and reinforce the notion that the hard work of changing the way things get done will yield phenomenal results.

- Providing the skills. Absent the simple means to set about improving their own work, staff members will wallow in their own incompetence as they struggle to make things better. This should not be so much an exercise in futility and frustration as one of the disciplined application of proven methods. Provide new skills and employees will be better equipped and far more enthusiastic about the program. This paper attempts to provide an overview of such skills.

- Providing the goals. Consistent with the vision, goals and milestones indicate that the program is working even before it has fully matured. Like the vision, goals, too, must be widely communicated and universally understood.

- Providing the rewards. When those goals and milestones are met, reward the team! Build compensation plans that reserve a portion of annual bonuses for meeting or exceeding the process goals established. Take a process improvement team out to dinner when a major milestone has been met. Reinforce the good work that’s being done and you’ll get the repeatable behavior that marks a culture of continuous improvement.

Why we don’t do it

If there is such obvious value to be derived from disciplined improvement efforts, why aren’t they more widespread? The challenge with many process improvement methodologies is that they portend to offer something uniquely valuable, something that, if embraced in their entirety, will provide a perfect response to the ills typical of poorly designed and executed processes: excessive handoffs, high rates of error, rework, delay, etc. However, we find management often stymied by choosing between methods, and getting staffs up to speed once one has been decided upon.

Is there a “correct” methodology? Which provides the best means to accomplish the goal of improving processes for sustainable competitive advantage? We all want to claim ownership over the best known way to approach something; we all want our names and companies associated with some proprietary method for achieving world-class status. But at the end of the day, there really is a simplified approach which is far easier to embrace; one that borrows from all but commits to none.

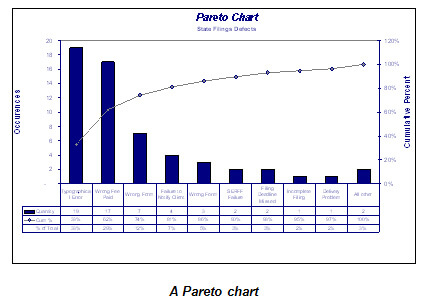

Understanding the principles of process improvement helps to remove the mystery and overwhelm that comes with attempting to approach many of the more comprehensive systems for improvement. A simple but often overlooked idea is based on Pareto’s Law – that 80% of the problems we find in a process come from 20% of the potential problem causes. Why is this helpful to realize? Because finding and isolating that critical 20% – those “vital few” causes – and separating them from the other 80% – the “trivial many” – helps focus improvement efforts such that they’re far more effective much earlier in the effort. Rather than attempting to fix everything at once, a committed, disciplined effort that first identifies the main causes of process problems and makes their remediation a priority means big gains and stellar results early on. And what does this accomplish? In addition to the obvious benefits brought about by better processes, the buy-in that’s needed to continuously improve is instilled in both the workforce who inevitably must change they way they approach their work, and among senior management, without whose support few initiatives would get done.

Getting to work

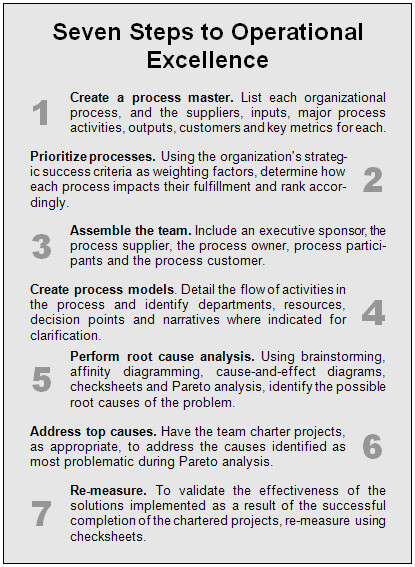

To this point, we’ve (hopefully) convinced our readers that there’s a solid argument for undertaking a process improvement initiative, and the foundations for doing so have been adequately conveyed. Next we define a simple but disciplined approach to such a program. Covering seven major steps, the following pages contain a simplified approach to process improvement that any company can embrace and implement immediately.

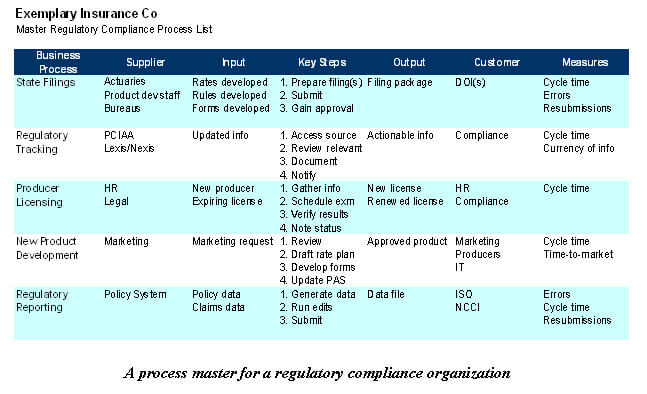

Step 1: Create a process master

The first step of any process improvement initiative is to take stock of as many organizational processes as possible. Why? Because everything is connected to everything else in the value chain – from concept to customer. Considering all organizational processes will force the team to think about the interdependencies between individuals, departments, vendors and customers, all of whom may influence the process. The tool we use to accomplish this is the process master (see following page) – a table that lists each process in a particular operational value chain. For our purposes, we’ll focus on a subset of processes that comprise the regulatory compliance function of an insurer, which taken together represent the core of the compliance value chain:

- State filings

- Regulatory tracking

- Producer licensing

- New product development

- Regulatory reporting[1]

Once the processes have been identified, for each, further identify and note on the process master:

- The supplier of inputs to the process;

- Each input upon which the process depends;

- The major activities performed by the process participants that, when performed in sequence, lead to the output;

- The output(s) which result from performance of the activities;

- The customer who receives the output of the process; and

- The key metrics that indicate the effectiveness and efficiency of the process (cycle time, error rates, delay, etc.).

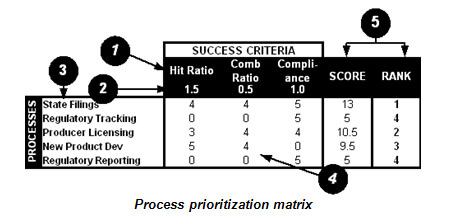

Step 2: Prioritize processes

We next determine which process(es), if improved, would have the greatest positive impact on the organization (i.e., would most likely contribute to the fulfillment of the organization’s goals). To do this, we’ll develop a process prioritization matrix that ranks processes accordingly. There are five steps involved in building the matrix, depicted on the following page:[2]

- List success criteria. Success criteria are those measures, ranging from most tangible (e.g., financial measures) to least tangible (e.g., strategic measures), that indicate the larger organization is on the right strategic path. In this case, the organization has determined that hit ratio, combined ratio and compliance are the three criteria that demonstrate it is performing according to its strategic plan.

- Weight success criteria. Success criteria are then weighted relative to each other, using an index from 0.5 to 1.5, where 0.5 indicates the criterion has the least weight, and 1.5 indicates the criterion has the most weight. In our example, the organization has deemed new business to be a critical success factor. As such, hit ratio (1.5) is the most important strategic measure relative to compliance (1.0) and combined ratio (0.5). They are all important, however; this is simply a relative weighting.

- List processes. List the names of the processes from the process master on the left-hand side of the matrix.

- Assign anchors. A number from 1 to 5 (each, an “anchor”), is inserted in each cell indicating the strength of correlation between each process and each success criterion.

- Determine score and rank. The resulting scores, which are the products of the relative weights times the anchors summed across each process, provide a ranking, based on the success criteria, that indicate which processes should be given improvement priority. In our example, it has been determined that the state filings process (with a score of 13) most contributes to the fulfillment of the organization’s strategic objectives.

It should be noted that prioritizing processes in this manner is purely for decision support. Obvious needs should be addressed first and must trump the outcome of this type of prioritization analysis.

Step 3: Assemble a process improvement team

Since the single greatest impediment to change is a lack of buy-in on the part of those who we hope will embrace it, it’s important to involve representatives from every part of the organization that might influence or be influenced in any way by the modified (i.e., improved) process. As such, input from the following individuals should be solicited throughout any process improvement initiative:

- The executive sponsor is typically a member of senior management who endorses the process improvement initiative.

- The process supplier is the source of input to the process being evaluated.

- The process owner is the person responsible for the quantity, quality and timeliness of the ultimate output from the process.

- Process participants are those whose daily work impacts the process. At least one representative from each major process activity should participate on the process team.

- The process consumer is the recipient of the process output.

Without assembling a team comprised of each of these members – even if some only have peripheral involvement – you are almost certain to face resistance in the improvement effort.

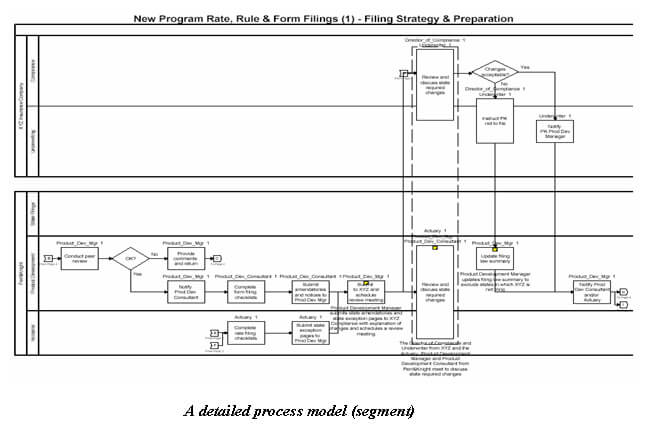

Step 4: Create process models

There are many business reasons for which an insurance company should model its processes. A well-developed process model renders the departments, resources, activities, third parties, handoffs and decision points graphically; a process deconstructed in this manner expedites analysis and problem identification. They are also increasingly important for compliance purposes, including Sarbanes-Oxley, ISO 9001 and the forthcoming adoption of the NAIC’s Model Audit Rule by many states.

A best practice for modeling a process involves a “swimlane” diagram (see figure on page 36), where each lane represents a department within an organization. Lanes that “float” outside of the main body of the map (i.e., the three lanes at the bottom of the diagram) represent third parties who provide services in the conduct of the process. Rendering the process in this manner also gives a sense of timing with respect to the flow of the process, as activities flow downstream to the right as time passes and the process is completed.

I like to keep these diagrams simple, and use only a few mapping symbols: a rectangle to represent an activity, a diamond to represent a decision point and a rounded rectangle to represent an endpoint. Note that activities in the figure can span multiple departments or organizations, indicating that responsibility for completing the activity is shared.

In addition, the functional title of the resource(s) charged with performing each activity is included above each activity rectangle, and, where needed for clarification, brief narratives are provided below both activities and decision points to describe the step in greater detail.

In reviewing the process model, our intention is to identify as many non-value-adding (NVA) activities – those activities that add nothing of value to the ultimate consumer of the process output – as possible. The list of “usual suspects” includes:

- Excessive handoffs. Workflow that navigates between multiple staff members in multiple departments requiring multiple approvals is a major impediment to efficiency. Review the process model to see whether some of those handoffs can be eliminated. A concept known as rolled throughput yield (RTY) exemplifies this best: if there are two activities in a certain process, and each activity is performed with 98% effectiveness, the output, or RTY is 98% X 98% = 96%. However, if the same process involves five activities each performed with same level of effectiveness (98%), the RTY is much lower (98% X 98% X 98% X 98% X 98% = 90.4%).

- Bottlenecks. This where someone or something in the process can’t keep up with the rate of input. Bottlenecks represent the best opportunity for improvement, as they’re easy to identify; the slowest activity and resources with highest utilization rates often indicate bottlenecks.

- Rework. When something has to be sent back into the process because of defect or error, it contributes to bottlenecking and decreases RTY. Look for “hidden” incidences of rework at activity steps (does the activity get the job done or is it redone somewhere down the line?) and decision nodes (once the decision is made, is it made again?). Bear in mind that the further downstream in a process rework occurs, the more costly it is, as each preceding activity step has a cost associated with it, and the more activities that have to be repeated, the more the overall cost of the process increases.

- Waiting/idle time. Often a by-product of bottlenecks and rework, waiting and idle time are akin to throwing money out the window. Waiting saps the process of productive capacity and even contributes to higher rates of error, as process participants who start and stop multiple times during the day lose their focus and the consequent ability to get into flow.

- Transport. If process participants are physically moving documents for signature or shipping off files to another office for completion or approval, the process is undoubtedly suffering from an inefficiency due to transport. In addition to the direct cost of transport, it, too contributes to idle time and bottlenecks. Pay attention to where the process requires the physical movement of work product for completion, and eliminate as much as possible.

- Untapped creativity. The people charged with working daily within the process being examined are a terrific source of ideas. What are you doing to solicit their input? Not only do the front-line staff often have the best ideas, but the implementation of their ideas gives them ownership of the process and improves morale. Be sure to actively solicit the ideas and opinions of staff.

The next stage of the improvement initiative, root cause analysis, seeks to identify the underlying causes of these and other process problems.

Step 5: Perform root cause analysis

While the first four steps represent discovery and team identification, this step represents the first major diagnostic part of the improvement effort. The root cause analysis technique that is most easily taught involves using several tools from the Six Sigma toolkit, including brainstorming, cause-and-effect diagramming, affinity diagramming, discrete data collection and Pareto analysis. As such, this stage of our process improvement initiative involves five sub-stages, described in turn below.

-

Brainstorm possible causes of the problem being investigated. Brainstorming sessions should involve the entire process team and others who may have an interest in the outcome of the effort. For example, if the team includes a member who represents a particular activity performed by, say, five staff, all five staff should be invited as well. Brainstorming should be somewhat of a free-for-all, with few rules other than these:

- Name a facilitator who calls on participants and jots down ideas on a whiteboard that all can see;

- Anything goes – no judgments should be made and all ideas, no matter how far-fetched, are valid; and

- Limit the session to no more than 45 minutes.

At the start of the session, the facilitator provides the ground rules and addresses the group with a problem statement:

“We have a problem. It takes far too long to complete a new rate or form filing and submit it to a DOI. As a result, new product introductions have been delayed. We need to determine why it’s taking so long to get these filings out the door. Any ideas?”

Meeting participants then raise their hands to offer ideas, which the facilitator writes down in rapid succession. The goal is to gather as many ideas as possible in the 45 minute session. The facilitator uses the list of generic issues identified during the process modeling step to prompt the group. All possible issues should be considered in their “organizational context” – how they are impacted by workflow, systems, key performance metrics, governance (policies and regulations), personnel (reporting structure, hiring, training and compensation practices) and the physical environment in which the work is performed. The group should continue to drill down until it can go no further, having reached a possible root cause.

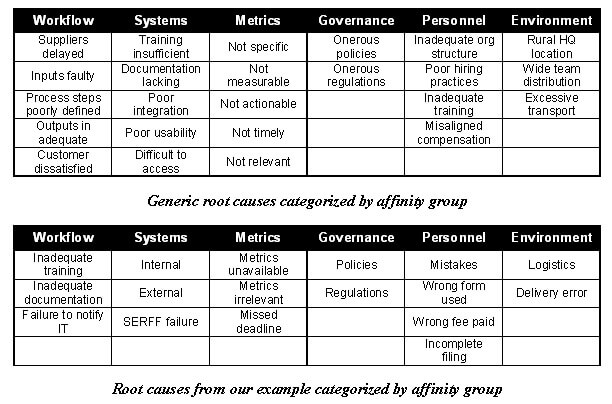

- Assign ideas to affinity groups. A good brainstorming session will yield 50, 100 or more ideas in 45 minutes, which becomes somewhat unwieldy. To make the process more manageable, the group next endeavors to place the ideas into broader categories, called affinity groups. While there is no “correct” set of affinity groups, the major areas impacting most processes are those described above as comprising the “organizational context” in which the process is conducted. As such, our affinity groups are labeled workflow, systems, metrics, governance, personnel and environment.

An affinity chart of some of the possible root causes typically discovered during brainstorming sessions, as well as a chart showing the possible root causes from our example, are depicted on the following page.

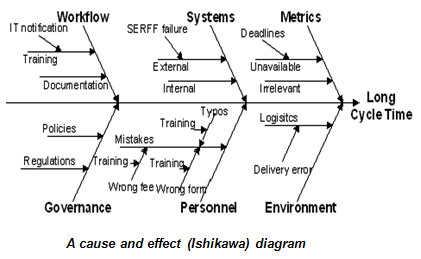

- Map affinity groups to a cause and effect diagram. Each of the possible root causes identified are next mapped to a cause and effect diagram (also called anIshikawa diagram, after its creator, or a fishbone diagram, for obvious reasons) in order to examine the relationships between possible causes. At the far right we indicate the process problem we wish to address, and on each of the major “fishbones” we indicate the major affinity categories. We then place possible causes on branches of the major fishbones, and drill down as necessary until we get to the possible root cause. In our example, you can see that personnel (staff) involved in the process run the risk of using the wrong form, paying the wrong fee or making typographical errors, which the group attributes to poor training. We’ve illustrated just a few of the possible root causes for each of these process errors.

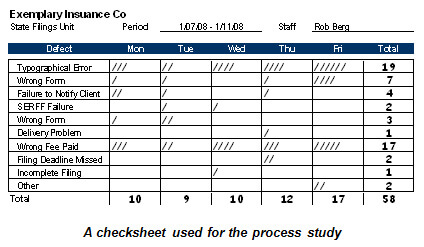

- Collect data. At this point, we’ve already begun to discover many possible causes of process delays that result in increased cycle time. However, it’s important to make fact-based decisions about improvement efforts and further refine our analysis by recording each incidence of each possible root cause to measure the frequency with which each occurs. Such measurement is performed using another simple tool, the checksheet (pictured below). The checksheet simply provides a list of possible causes (of increased cycle time, in our example) in a grid in which process participants record the number of times a particular type of defect is discovered.

- Perform a Pareto analysis.After a reasonable study period (which, depending upon the process, will typically last anywhere from one to twelve weeks), the results are translated to a Pareto chart (see following page) – a histogram depicting the frequency with which each possible cause occurs – to help separate the “vital few” causes from the “trivial many.” Our objective here is to eliminate the sense of overwhelm that accompanies process improvement approaches that fail to zone in on the most pressing problem causes, and instead attempt to fix everything at once. In our example, of the nine causes of increased cycle time identified by the team, three stand out as most problematic – typographical errors, wrong fee paid and wrong form used account for 74% of the causes of the undesirably long cycle time required to submit a complete filing to a department of insurance. The job of the team is to determine how best to address these issues.

Step 6: Address top 2 – 3 causes

While there are far more comprehensive approaches to process improvement using advanced techniques like statistical process control or experimental design, our simple analysis, supported by real data and not just guesswork, has revealed some important information and we’re in a strong position to develop our first hypothesis. In conducting root cause analysis, the process team determined that each of the three potential causes we’ve chosen to address are most likely caused by poor training. As such, we hypothesize that by improving our training program we would realize a profoundly positive impact on our process – to the tune of a 74% decrease in errors and a corresponding decrease in cycle time based on our data. At this point, the team should charter a project aimed at creating or revising training materials and delivering the improved training program.

Step 7: Re-measure

Once the selected improvement project has been completed and the revised practices have been implemented, it’s time once again to take a tally of the possible root causes identified in the earlier stages of the improvement initiative. Each subsequent measurement serves to validate the effectiveness of the improvement program, which reinforces team and management buy-in and sets up the organization for the next set of initiatives.

Summary

If you’ve made it this far, well, you’ve got yourself a bona fide process improvement framework – certainly enough to give you a feel for a simple – and perhaps best – way to approach troublesome process problems. The process doesn’t end here, however; only through successive iterations of the improvement program can you sustain operational excellence, and so it becomes important to ingrain the tools and methods presented here among the staff, who are daily charged with performing the good work of the organization. The seven major steps are summarized on the following page.

Conclusion

“Perpetual optimism is a force multiplier.”

– Colin Powell

The adoption of a disciplined approach to solving process problems will provide substantial rewards to organizations and separate those that do so from their competitors. A workforce genuinely focused on continuous improvement – on making things better – is enviable. The dividends from improved morale alone rival the direct financial benefits, by demonstrating to customers and the world at large a dedication to excellence and a commitment to quality. A framework that facilitates the continuous establishment and achievement of goals that are appropriately rewarded breeds enthusiasm – and the optimism infused in the visions that motivate great competitors.

References

Rob Berg is the Director of Management Consulting at Perr&Knight. He can be reached at rberg@perrknight.com.