The Italian Insurance Industry: Analyzing the Current State of Operations

- Written By Scott Knight

Foreword

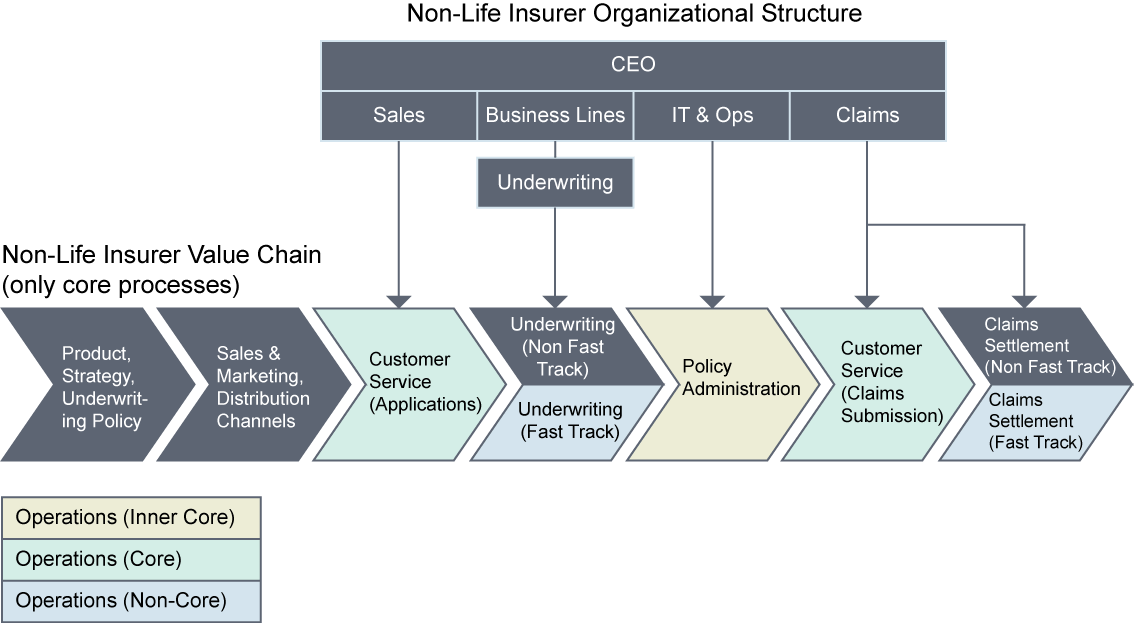

Issues related to Operations have surely become increasingly more crucial in recent years for every insurance company. Even though no insurance manager can presumably deny this statement, there is a worrying lack of analysis and research about the actual state of Operations in the Italian insurance industry. (It is astonishing to find no books about this topic when visiting a bookshop in Italy). This situation is further worsened by the uncertain boundaries of this function, since Operations related activities are delivered in several Departments, including Sales, Business Lines (Underwriting), Operations and Claims.

So, while in manufacturing the concept, and as such the scope, of Operations is quite clear cut, it is difficult to say the same in the insurance world. In fact, there are at least 3 different scopes assigned to this function in Italian insurance companies.

In a strict view, Operations is only in charge of policy administration, which includes activities related to the issuance of policy documentation and endorsements and the booking of premiums (both new and renewal premiums. Other tasks, theoretically under the roof of Operations, are subdivided between Sales (Customer Service), Underwriting and Claims. Unfortunately, this is still the most common organizational chart in Italian insurance companies.

In an ideal world, all of these tasks (previously pictured in any color except grey) should be led by Operations. In this wide approach, Operations should include customer service at the start (whenever the customer applies for an insurance coverage, or the broker asks for a quotation),at the end of the value chain (when the same customer/broker submits a claim), and a portion of underwriting and claims (so called “fast track-underwriting” and “fast-track-claims”).

Some intermediate choices are possible, of course, whereby for example Operations includes customer service but not fast track underwriting.

* * *

This survey was conducted in 2011-2012 by sending a detailed questionnaire to the Operations Directors of the main Italian insurance companies. It is an attempt to fix a lack of information and provide researchers, managers, consultants, and any other practitioners interested in Operations Management with critical elements of knowledge about Insurance Operations in Italy.

Objectives and Assumptions

The aim of this research is self-explanatory – that is, to identify the current state of Operations in Italian insurance companies. This search has, of course, been oriented by some specific assumptions, which have heavily impacted the objectivity of this work.

The first assumption affects the scope of the analysis, which regards every insurance company, regardless of size (large/small), geographical presence (multinational/local), business line (life/non life), or reach of business area (niche/general), due the early stage of the Operations research.

The second assumption considers Operations as a set of business processes which directly support and enable the effective implementation of the strategy of the insurance company. As such, any assessment of the Operations Department is strictly dependant on the company’s strategic landscape.

The third premise views the components of Operations as a business system subdivided into a structure (static component), a process (dynamic component) and some supporting tools (reporting).These three elements have to be synchronized to attain the best results.

Ultimately, this search takes into consideration the existence of some conditions which are external to the Operations Department but inside the insurance company which highly impact the overall level of operational performance.

On the basis of the above mentioned assumptions, the questionnaire used to gather data has been structured as follows:

- Strategic Landscape;

- Features of the Operations Department;

- Strategy, Planning and Control of the Operations;

- Operational Reporting;

- External Success Conditions;

- Operations Department Role (assumed and perceived).

Strategic Landscape

The wide-reaching strategic landscape where the Operations Department acts has been investigated by asking for:

- the performance influencing factors;

- the actually implemented strategies.

The answers to the first question have shown a correct awareness about the relevance of customer service (ranked first among the factors), followed by excellence in business processes. Immediately after these two factors, the respondents mention the traditional performance determinants of the insurance companies (underwriting quality and claims’ trend). Less decisive – but still ranked in the upper section – are product and process innovation. Operations Directors have not determined that (excessive) regulation (for example, Solvency II) or labor cost are as important for their company’s performance.

Specify the most important influencing factors of company performance in decreasing order of importance (1=the most important):

customer service1

process excellence2

underwriting risk management3

claims rate4

product innovation5

operational risk management6

financial management7

staff productivity8

process innovation8

premium rate9

labor cost10

competition11

regulation11

company size11

other12

Notwithstanding this proactive attitude about the performance influencing factors, the strategies actually followed so far don’t seem fully consistent with this view since the most popular strategy has been organizational change/restructuring, followed by investment in IT systems and cost reduction, while investment in distribution channels and sales/marketing ranked only 5th and 6th respectively. The investment in IT systems (ranked 2nd) is very significant, of course, however it is quite worrying that business processes improvement ranks lower since this enables the full exploitation of IT investments.

Specify the main strategies followed by your company performance in recent years in decreasing order of importance (1=the most important):

organizational change/restructuring1

investment in IT systems2

cost reduction3

process improvement4

investment in distribution channels5

investment in marketing/sales/commercial area6

management change7

risk management8

joint ventures/distribution partnerships9

acquisitions10

Features of the Operations Department

The Operations Department is a well consolidated function in insurance companies, since about 70% of companies confirm that the department is more than 5 years old and that this Department’s staff is composed of at least 10 employees. In this comfortable panorama there are still a small but not negligible number of companies (8%) where an Operations Department does not yet exist.

Indicate how long ago the Operations Department was established:

more than 5 years ago69%

less than 5 years ago and more than 2 years ago15%

less than 2 years ago8%

not applicable (Ops Dept does not exist)8%

Specify the number of staff in the Operations Department:

less than 5 employees18%

from 5 to 10 employees9%

more than 10 employees73%

Regarding organization, the Operations Department position is located immediately under the General Manager/Country Manager in two thirds of the companies.

Does the Operations Department report directly to the Managing Director/General Manager/Country Manager?:

yes67%

no33%

It is often united in the same department with IT, and less frequently with the Underwriting.

Does the Operations Department include the Underwriting Department?:

yes17%

no83%

Does the Operations Department include the IT Department?:

yes50%

no50%

It seems that Operations Departments are not well articulated internally, which could confirm the low specialization level of its resources.

Specify the internal structuring of the Operations Department:

the Ops Dept is not articulated internally46%

by product/business line15%

by geographical area8%

by front/middle/back office8%

by sales network8%

other15%

Strategy, Planning and Control of Operations

The strategies followed in the Operations Department seem consistent to the perceptions of the main factors influencing the performance of the insurance company, since response time, service affordability, customer assistance and quality have been mentioned by the Operations Directors as the key strategic priorities.

Quite surprisingly, cost has a medium relevance, while customization and agility in product/service offerings have not been reported among the most important objectives.

Specify the strategic priorities of the Operations Department in decreasing order of importance (1=the most important):

response time1

service reliability1

customer assistance2

quality2

cost3

capability to adequate supply to demand4

customization5

flexibility in product/service offering5

The Operations Department is fully involved in the planning process and the company’s budget includes a section devoted to Operations.

Is there a structured process whereby the Operations Department participates in budget preparation?:

yes77%

no33%

Does the Company Budget include a section devoted to Operations?:

yes69%

no31%

In case of positive answer, please specify the type of assigned operational target (multiple responses are admitted):

production capability50%

support infrastructure63%

human resources and workload75%

technology63%

IT systems75%

Unfortunately, the targets assigned to Operations seem generic, since the operational metrics are not included in the budget in more than 60% of the companies.

Does the Company Budget include operational metrics?:

yes38%

no31%

partially31%

Regarding control, the most sophisticated type (steering control) is cited as the most spread (more than three fourths of the companies have it), but 15% of the respondents declare not to have an Operations Plan.

Is steering control applied to the Operations Plan?:

yes77%

no8%

not applicable (Operations Plan does not exist)15%

In general, the culture of Operations (in terms of value) has a very limited impact on the other responsibility units of the insurance companies, since the performance evaluation process of these units simply doesn’t take into consideration their operational performance.

Are Responsibility Centers assessed according to their operational performance, as specified in the Company Budget?:

yes38%

no8%

not applicable (operational performance indicators by

Responsibility Units are not included into the Budget)54%

Operational Reporting

In spite of the absence of operational metrics in the budgeting plan, the introduction of operational metrics on a periodic basis is quite common in Italian insurance companies.

Are Operational Indicators measured on a periodic basis?:

yes77%

no23%

The key business processes are measured in almost half of the companies and (quite unbelievably) 15% of the insurers yet don’t measure their processes.

The periodic performance measurement affects:

each business process8%

the key business processes46%

the business processes are measured only if and when needed23%

the business processes are not measured15%

The most popular measurement objects affect backlog and cost. Less widespread are the indicators regarding cycle time and productivity. This potentially disproportionate focus on backlog could be attributed to an excessive fragmentation of business processes and IT systems.

The periodic business processes performance measure affects (multiple responses are admitted):

cycle time67%

cost75%

backlog83%

productivity67%

The strong interest in operational measurement just mentioned does not imply for the time being the adoption of reliable and sophisticated tools, since the Excel spreadsheet is still the most popularly used software.

Performance measurements by activity/process are calculated using (multiple responses are admitted):

the Company Information System54%

stand alone software tools8%

Excel spreadsheet62%

Needless to say, activity based costing is not used by 85% of the respondents, which makes impossible any determinate link between traditional financial and operational metrics according to a balance scorecard’s approach.

Does your Company use an Activity Based Costing system to measure cost by activity/process?:

yes15%

no85%

External Success Conditions

The actual success of the Operations Department is strongly influenced by the existence of some conditions outside of the Operations Department, but inside the insurance company, related to:

- medium term perspective;

- operational performance assessment in staff evaluation;

- business process management;

- relationships between financial control and operational indicators.

Regarding the first condition, the survey states that the short term horizon is absolutely dominant (62% of the companies don’t have a multi-year Operations planning) and even a significant portion (15% of the total) of the insurers which, apparently, have a medium/long range planning for the Operations, since they state to have a formalized plan, actually do not have a formalized planning, which means that their long range planning is not significant and their behavior is strictly tactical, being influenced by the top management’s needs in a precise time.

Does your Company have a multi-year planning range for Operations ?:

no62%

yes, there is a formalized plan stating objectives and strategy15%

yes, there are a formalized plan and a structured process23%

The importance of Operations is, of course, determined by the use of the operational indicators in the Human Resource Management: it seems that staff assessments are weakly related to the staffs’ operational performance.

Human Resource Management in your company is:

weakly linked to the operational performance of the employee38%

on average linked to the operational performance of the employee46%

strongly linked to the operational performance of the employee15%

The third influencing factor – the existence of effective business process management – is certainly the most crucial. The answers to the survey evidence that BPM is still in an early stage in the Italian insurance companies: while the process mapping is adopted in every company, it does not mean that a BPM is actually in place, since in about 80% of the insurers the business processes are not reviewed by each business owner in a systematic way, but only in case some particular events occur (for example, top management change or crisis).

Business process in your company:

are not formally mapped38%

only the main business processes are mapped46%

all the business processes are mapped46%

Business process in your company are:

managed/reviewed by the owner only in case of particular events31%

managed/reviewed when business needs50%

systematically reviewed according to their operational performance19%

Ultimately, Operational Reporting is highly integrated into the wider Company Reporting in only less than a fourth of the interviewed sample.

Specify the integration level between operational reporting and financial reporting:

the operational reporting is highly integrated into the financial reporting23%

only some Departments have an operational reporting46%

the operation reporting is available only in case of particular events31%

Role of the Operations Department

The last questions of the questionnaire deal with the role of Operations as perceived by other Insurance Managers.

The analysis of the answers seems to indicate that Operations Directors may not be fully aware of his significance for the success of his company (Question 26), while the other members of the top management team are more prone (at least apparently) to assign an expanded role to Operations (Question 27).

Define the role assumed by the Operations Department (multiple responses are admitted):

support the business strategy54%

source of the competitive advantage15%

support the commercial area54%

other8%

Define how the Operations Department is perceived inside your Company (multiple responses are admitted):

a core Department, enabler of the Company’s success15%

an important Department, whose importance is growing46%

a support center for the business, whose costs need to be strictly monitored39%

Findings & Conclusions

The Operations Department currently acts in a problematic environment, between the absolute need to improve customer service and to strongly monitor and reduce costs. In such a situation it could happen that the choices and decisions of the Operations Director are loose or inconsistent, even though some research about the most successful insurers demonstrate that improved customer service and cost reduction are not necessarily conflicting objectives, provided that the insurance company is able to do more (customer service) with less (human and IT resources), which absolutely requires not only the avoidance of fragmentation in processes and IT systems, but also to centralize some functions, like back office and IT.

Operations represent a fully recognized portion of the Insurance Company budget, however significant improvements are needed in specifying their objectives, in order to influence effectively their behaviors, and in measuring them; a long way is still to come about this point.

Fortunately, a spontaneous use of operational metrics is spreading in the insurance companies, even though the tools adopted so far are not sophisticated enough to ensure a reliable measurement, which negatively impacts the acceptance of these indicators in the company’s other departments.

Business process management is certainly the most powerful enabler of Operations management, since it promotes the operational mindset, that is a correct orientation towards tangible results. As such, it is not surprising that the typical values and culture of Operations are not widespread in the company, and that the same CEO is in any case not involved enough in Operations Strategy Development.

Despite all these weaknesses, it is reasonable to believe that the pressures from the environment and the strong awareness about the cruciality of Operations will make this function one of the key success factors of the most profitable and growing insurance companies in Italy.

* * *

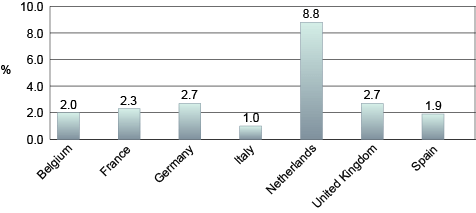

Everybody is fully aware that the Italian insurance business is not adequately developed, as reported by the low level of Premium to GDP ratio (around 7% is the value of total insurance premium on GDP ratio, compared to about 10% in France and 9% in EU15), particularly in non life non auto segment (auto insurance is compulsory, of course, as such its size in Italy – around 1,3% – is quite comparable to other European countries,), while the life insurance in Italy has some but less room for development (its premium on GDP ratio amounts to 4,7%, as opposed to 3,2% in Germany, 6,2% in France and 9% in UK).

Non-Life & Non-Auto Premiums/GDP Ratio (2011)

Source: Insurance Europe

The deep reasons for this underdevelopment are not easy to deal with, since they stem from: a) the low level of insurance culture among Italians, b) the high weight of welfare state, destined for a profound slash in the medium term and c) the peculiar structure of the manufacturing industry, where small and medium enterprises predominate. However, some of the most important constraints to the growth of the insurance business that include:

- the very low level of customer satisfaction;

- the complexity of the insurance products (usually, very expensive insurance coverage, quite difficult to assess and appreciable by the client, particularly in case of SME);

- the high level of administrative costs incurred by the insurance agencies (about 82% of premiums is channeled by agencies in non life insurance), which reduces the time devoted to sales

can be successfully overcome by improving the effectiveness and scope of Operations ,by spreading its culture, and by achieving business process excellence through the use of BPM and other process-related techniques, such as Six Sigma or Lean Production.

Angelo Minafra is the Head of Operations at AIG United Guaranty Italy. He can be reached for comment at angelo.minafra@yahoo.com.