Billing modernization: Strengthening customer satisfaction to build a competitive advantage

- Written By Kim Morton

A Case for Change

Billing is a necessary function of the insurance transaction, and it is precisely that necessity that creates opportunity. A customer may go months or years without filing a claim, but every customer receives bills on a regular schedule. A customer may never read marketing materials insurers send—or even insurance policies themselves—but they will examine the bills they receive. Additionally, the majority of customer service calls a carrier receives are billing-related.

Therefore, billing represents a chance to build satisfaction and loyalty by delivering customers—and agents—flexibility, accuracy, and prompt resolution of discrepancies. In an Ernst & Young paper on billing transformation, authors David Connolly and Rick Raisinghani point out that, as an insurer’s first and most frequent touch point with its customers, billing presents an opportunity to create a positive experience and to build longstanding relationships.

Insurers do understand the direct link between billing and customer satisfaction. In 2008, Guidewire Software surveyed a wide range of Property and Casualty insurers in North America about the current state of their billing operations, how well current systems support their needs, and how they see their billing operations evolving in the future. In that survey, most carriers reported that billing is “important” or “very important” to customer satisfaction.

However, there is often a disconnect between carriers’ understanding of the importance of the billing function and their investment in technology to support the billing department. Carriers continue to run their billing operations on aging, legacy systems that simply cannot support emerging customer needs and expectations, let alone go beyond those expectations to provide competitive differentiation.

Guidewire’s survey found that few carriers believe that their current billing systems offer the flexibility required to support customer service excellence. Few systems can support multiple payment channels or payments by credit or debit card. Carriers may wish to correct these and other system shortcomings, but report that legacy billing platforms are simply so inflexible that functional enhancements are not feasible. Perhaps this is why so few of the carriers surveyed are confident that their systems will continue to support them when new demands inevitably arise in the future.

Understanding that billing is a customer service opportunity is an important first step. However, this step must be followed with a strategic investment in modern billing technologies that deliver process improvement, enhanced customer and agent service, and better control of and visibility into the billing operation. In fact, research firm Gartner says that for insurers, replacing legacy billing applications is a “strategic imperative.”[1]

A Legacy of Challenges

In the Guidewire survey, the overwhelming majority of companies use mainframe-based billing systems, including 84% of large companies (defined as over $1 billion in written premium). One-quarter of all respondents—and half of large companies—have billing systems that are more than 20 years old.

Part of the reason for the longevity of these systems is that carriers have worked to maintain, enhance, and modify them over the years to continue to meet business needs. However, legacy platforms tend to have several key architectural shortcomings:

- They are typically hard-coded, often in archaic programming languages that are increasingly difficult to support.

- They may not be a consolidated system but, instead, a collection of different applications purchased over time to perform different billing sub-processes and cobbled together with inflexible, point-to-point integration.

- Business logic and workflow is embedded in years of coding, making it difficult to change and leading to manual workarounds to overcome system limitations.

More troubling than these architectural limitations, however, are the business challenges created by legacy billing systems. In fact, in Guidewire’s survey, only 23% of respondents said that current billing platforms met their needs “very well.” Dealing with inefficient legacy platforms creates a host of problems.

Poor Customer Service. Regardless of the type of insurance they provide or the distribution channel they use, every carrier has a common opportunity for contact with customers: the bill. In fact, the bill may well be to be the only piece of carrier correspondence an insured actually takes time to read and the only one they call to discuss. Therefore, billing is a vital opportunity to build customer relationships.

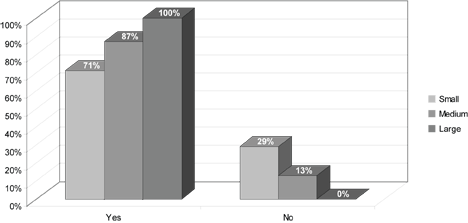

Carriers understand this, with 54% of all carriers reporting that billing is “very important” to customer satisfaction, and another 26% considering it “important.” They also understand that customer satisfaction is directly related to customer retention: a full 100% of large carriers surveyed believed that billing impacts retention (see graph below). However, over half of survey participants (56%) believe that their current billing systems and processes inhibit their ability to provide superior customer service.

Do you think billing affects customer satisfaction?

Inflexibility. Survey respondents were asked if the ability to offer flexible billing options and a variety of billing programs to customers would be a source of competitive advantage. In aggregate, 85% “agreed” or “strongly agreed.”

However, carriers reported that their current billing systems did not allow them the flexibility they needed to offer these options. Over a quarter of survey respondents (26%) reported that enhancements to their primary billing system are so difficult that they are no longer made. In addition:

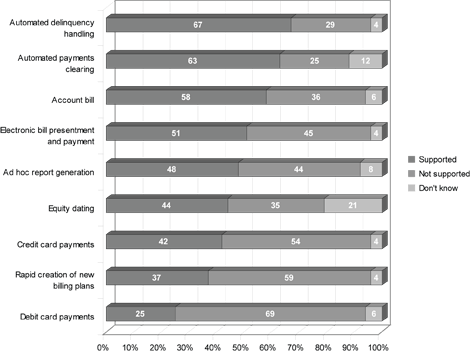

- 54% reported that their systems lacked support for credit card payments,

- 69% reported that their systems could not handle debit card payments, and

- 59% reported that they had difficulty administering new billing plans.

Functionality of primary billing system

In today’s business climate, these limitations put carriers at risk of customer attrition. Customers expect options and flexibility, including electronic bill presentment and payment (EBPP) and the ability to choose payment schedules that best meet their needs. They are accustomed to using a variety of payment methods. Insureds who hold multiple policies with a single carrier expect to pay one consolidated invoice each billing cycle. Legacy systems instead force customers to select from a limited set of options—or choose another carrier that can be more flexible.

Billing Leakage. Insurers commonly think of leakage in the context of claims. However, leakage also occurs in billing when profit is lost as result of inefficiency or when a carrier fails to collect all that is owed in the form of premium payments.

Billing leakage includes “free” coverage provided because of faulty cancellation procedures, the inability to apply cash received quickly and automatically to the right accounts, high bad-debt reserves and write-offs, and inaccurate revenue reporting on earned premiums due to irreconcilable differences between different systems. The Ernst & Young paper also points out that billing errors, such as mistaken cancellations, lead to higher call volume and can have a direct negative impact on an insurer’s financial performance.[2]

The cause of all this leakage can be directly traced to legacy billing systems that rely on manual processes, contain only parts of the needed end-to-end billing functionality, and are difficult and costly to modify.

Inefficiency. Some carriers contend with a variety of billing systems, acquired to meet different needs over time. In fact, in Guidewire’s survey a third of large carriers reported using four or more billing systems throughout their organization. These systems are often nonintegrated, lacking a common user interface. Dealing with different systems makes it difficult for billing representatives to locate customer information quickly.

Legacy, “green screen” billing systems also lack the intuitive, web-based design with which today’s generation of users is most familiar. They also don’t support direct navigation, instead requiring users to page through many screens to retrieve the right information, which further diminishes efficiency. Legacy systems lack flexible workflows, leading to manual workarounds and “desk processes” created by billing center staff to solve common customer problems. Physical “sticky notes” to track tasks are an all-too-common sight at billing centers that contend with these platforms.

Increased System Maintenance Costs. Hard-coded, legacy billing systems require more IT resources than modern platforms in order to maintain the application and to modify it to accommodate new products. When those systems are written in arcane programming languages, with little or no documentation, this problem is intensified. In Guidewire’s survey, 75% of large carriers reported having more than five full time resources to maintain their billing systems.

Poor Agent Service. Agents are a valuable business partner for insurers, and carriers have deployed agent portals for rating and policy underwriting. Insurers have also worked to integrate the systems supporting those portals to agency management platforms to make it easier for agents to do business with them. Today, in addition to these sales-focused capabilities, agents are also demanding additional and more flexible billing management options, including details on commission and incentive plans and information on scheduled commission payments.

However, this information is often locked in mainframe systems and is difficult to expose to external agents. Legacy billing systems offer little or no native integration capabilities with agent portals or agency management systems, preventing agents from maximizing on online business functionality. In order to access billing and commission information, agents must instead contact the carrier and request it. They must then work to resolve any discrepancies in a series of subsequent calls. Additionally, the calculation and payment of commissions to agents is seldom automated in legacy billing systems, leading to payment delays and calculation errors.

Manual processes related to agency billing management waste time that agents would rather spend on sales and service. Carriers that cannot meet agents’ expectations around billing management will ultimately find themselves at a competitive disadvantage as agents remarket their existing book to other companies and steer new business to carriers who can ensure that they are paid on a timely and accurate basis for all of the business they produce.

Lack of Visibility into Billing. Survey respondents were asked how difficult their billing systems are to balance, and more than half of small carriers (under $100 million in written premium) reported that this is a key shortcoming in current billing systems. In other words, legacy billing systems are failing at their most basic function: managing the receivables process and recording details of these financial transactions.

Legacy billing systems are also not designed to provide reporting capabilities to management about the billing process itself and its impact on overall business performance. In a compliance-focused environment, this limitation is becoming increasingly troublesome. The Ernst & Young paper notes that billing is an area where the impact of regulatory compliance is becoming a concern and that “some degree of transformation may be more a requirement than an optional pursuit.”1 Insurance companies need to address regulatory compliance matters in their billing areas to avoid non-compliance penalties.

Benefits of Billing Modernization

Insurers are coming to realize that the billing function must be modernized to mirror operational improvements made in other areas of the enterprise, such as underwriting, rating, and claims. Modernized billing departments will be characterized by flexibility, efficiency, and visibility, and will be supported by a modern billing administration platform. Compared to legacy billing systems, modern billing platforms feature:

- An open, standards-based architecture rather than proprietary systems hard-coded in languages that are increasingly difficult to support,

- Web-based, yet enterprise-grade, designs that minimize the “footprint” on user desktops and feature intuitive navigation,

- Automation and workflow modifiable via a configurable rules engine rather than locked in application logic, and

- Web-service APIs that enable integration into a service-oriented architecture (SOA), seamless connection to other core systems such as policy and claims administration, and support for agency and customer portals.

In contrast to legacy platforms, modern billing systems are designed to make it easier for insurers to provide faster resolution of customer questions, better management of agent commissions, automation of the billing lifecycle, flexible designs of billing, payment and delinquency plans, and painless integration with external systems.

Modern, web-based, enterprise-scale billing systems have proven to deliver insurers quantifiable business benefits in several key categories.

Enhanced Customer Service and Higher Retention. According to the Ernst & Young paper, when billing is properly managed, it can be a significant factor in preventing customers from switching insurance carriers. In contrast, when billing is poorly managed, an insurer could be placing its customer relationships at risk.

Customers understandably expect accurate statements and timely resolution of billing discrepancies. To resolve discrepancies faster, a modern, consolidated billing system serves as the “single source of the truth” for customer service representatives fielding billing-related calls. Once the customer record is located, customer service representatives can enter search parameters to jump to the precise information they seek, or they can navigate to that information using tabs or menu bars. Representatives can quickly and easily find the information they need to resolve a customer issue, reducing customer wait time and enhancing customer satisfaction with each interaction.

Modern billing systems also provide control surrounding customer interaction. Rather than handle exceptions outside the system with manual processes and sticky notes, modern systems support exception processing and provide automated dispute resolution to ensure that tasks are followed up on and completed. Visibility into the billing process enabled by modern systems also provides billing supervisors the information they need to intervene if necessary and resolve problems to customers’ satisfaction.

Increased Flexibility. Beyond accuracy and fast resolution of problems, customers expect flexibility in billing. They want many payment options designed to meet their individual needs and the ability to make payments using both their payment method and payment channel of choice.

Modern billing systems offer the ability to provide customers multiple bill plans and payment plans. These plans can be custom-tailored to meet the needs of individual customer segments, policy types, or regions. Plans can be configured to determine invoice timing, level of invoice detail, and assessment of fees. Invoices can be suppressed for amounts that fall below a configured threshold. Customers’ payment plans can be changed to accommodate a change in demand, and new billing and payment plans can be rapidly created and deployed at any time through system configuration, rather than requiring custom coding by IT. Modern systems are also designed to provide customers with self-service online bill review and payment.

This flexibility benefits not just customers, but an insurer’s marketing efforts as well. For instance, insurers that have already made an investment in modernizing policy administration have seen the benefits of being able to bring new products to market quickly. However, it is not uncommon for those same carriers to discover that their multi-million dollar investment in a new policy administration system may enable them to get products to market faster, they quickly discover that same level of flexibility and support of new product features does not extend to the billing system. When migrating to modern policy administration systems, insurers should also consider the new payment, invoice and statement options required to support these new and innovative products.

Improved Efficiency. Carriers need a billing system that is not just easy to use and understand, but a modern billing platform designed to put the most important and current information at the fingertips of customer service staff and enable billing representatives to retrieve information quickly, unlike systems that lack search and “jump-to” navigation capabilities. Particularly for companies that replace multiple legacy platforms with a single billing system, having a “single source of the truth” for customer information doesn’t just enable billing representatives to provide better customer service, it also increases their speed and efficiency.

Business process management capabilities that are native to modern billing systems also increase staff efficiency. Systems include task-oriented features such as inboxes, to-do lists, and trouble tickets to ensure that service tasks don’t fall through the cracks. Additionally, rather than locking business process logic into hard-coded routines, modern systems extract this logic and provide rules-based workflow that can be modeled and modified easily to reflect changing business practices.

And, when a billing system is intuitive and easy to use, internal staff proficiency is a much more achievable goal, with some carriers noting that training on their modern billing system required only four weeks compared to a six month training effort requirement in the legacy environment.

Improved Agent Service. Providing superior service to agents is as important to a carrier’s long-term success as providing service to insureds. Whether carriers use captive or independent agents, modern billing systems enable them to significantly improve agent service levels. Unlike legacy platforms, modern systems are natively designed to present information about agent commission structures and payments through a web interface. They are built to perform within an SOA and incorporate web services integration technology to connect to agency portals and agency management systems and bridges.

Combined with automatic commission calculation and configurable business rules around these calculations, modern billing systems expedite payments to agents, thereby increasing agent satisfaction. The agency bill process can be further automated by the electronic transfer of statements between agent and carrier.

Easier Maintenance and Modification. The Ernst & Young paper points out that implementing a modern billing application offers insurers an opportunity to simplify their IT application architectures, and that architectures based on SOA principles provide an adaptable and scalable model for integrating the billing system into the existing environment.

Billing applications integrate with many other core systems, including the general ledger, policy administration system, and claims management system. A modernized billing application will allow a carrier to eliminate multiple, hard-coded interfaces with these systems.

Furthermore, when a carrier chooses a billing system built on the same platform as other administration systems, that carrier can then leverage a common set of skills and knowledge across its entire core systems portfolio. Business and IT analysts who are able to configure one core application can easily work with any other. Additionally, systems built on the same platform, being seamlessly integrated, reduce both overall implementation time and the ongoing cost of system maintenance and management.

Visibility into the Billing Process. Legacy billing platforms obscure the billing process by locking process logic into application code, by lacking system documentation around design, and by lacking sufficiently understood security and control mechanisms. These problems are exacerbated when there are multiple applications within a billing systems environment. Modern systems provide improved visibility that, in turn, leads to better service, reporting, and compliance.

- Service. Customer service representatives no longer waste time searching for customer information that is difficult to locate or housed in different systems. Instead, they have clear insight into customer data from a single user interface. This information is also presented in natural-language format, rather than being abbreviated and codified because of legacy system data-field display constraints. As a result of this visibility, not only is customer service improved, but representatives’ job satisfaction is increased.

- Reporting. Legacy systems make it difficult for companies to extract data and generate reports, particularly ad hoc reports. Modern billing systems provide prebuilt reporting capabilities and provide easier access to data, enabling insurers to mine customer information for business intelligence purposes that range from targeted marketing to overall operational improvement.

- Compliance. The visibility afforded by modern billing systems into billing processes greatly simplifies insurers’ compliance efforts and, in today’s environment, is quickly becoming a business necessity. By providing clear insight into processes and controls around processes, modern billing systems help reduce an insurance carrier’s cost and time related to testing of internal controls. They improve a company’s ability to reconcile billing data with the policy administration system, financial ledger, and other systems, and provide flexibility to adapt to accounting standards changes.

Reduced Billing Leakage. Manual processes and workarounds required in a legacy environment introduce more opportunity for human error into the end-to-end billing process. These errors cost carriers in terms of free coverage provided to non-paying customers during the cancellation process, write-offs of amounts that do not reconcile, and premium calculation mistakes. When carriers need to rely upon manual reconciliations typical of a legacy environment, the result is often found in excessive billing leakage.

Improved efficiency, reduced errors, and optimized collection activities minimize billing leakage. Modern billing systems automate many common tasks, increasing accuracy and allowing billing staff to focus on exception processing. These systems allow carriers to incorporate best practices into their billing systems and instill process consistency. Additionally, integration with both portals and other core administration platforms eliminates reentry of data, further reducing the chance of errors.

In modern billing systems, collections are also improved. First, providing a wide array of flexible billing options makes it more likely that customers will be able to find a plan that best matches their financial situation, thereby minimizing the chance of delinquency. Better visibility into the collection and payment processes also allows carriers to project cash flow more accurately based on current invoice data, rather than historical data, which is particularly important as economic conditions fluctuate. Receipts are predictable and manageable, and carriers are better able to manage collection activities.

Increased Sales Opportunity. Finally, because the billing statement is a piece of correspondence that customers are likely to read, it is to an insurer’s advantage to maximize the value of this correspondence. However, legacy billing systems offer little support for customized invoice messaging, and customers will ignore marketing messages that are not targeted specifically to them.

Modern billing systems connect to document production systems through flexible, standards-based interfaces. This integration enables carriers to drill down into customers’ accounts and create customized marketing messages based on what they know about individual policyholders, the types of policies customers already have, and whether or not a customer is a desirable target for up sell or cross-sell.

Case in Point

A $2.5 billion specialty lines carrier contended with a decades-old billing system that constrained its ability to increase efficiency and improve customer service.

Problematic for the insurer’s customers, the system supported only two payment plan options and lacked the ability to process credit card or recurring ACH payments. For its billing staff, complex screens made it difficult to navigate the system, locate information, and answer questions in a timely manner. For company management, the system had limited reporting capabilities, lacked robust security provisioning, and required manual reconciliation with the general ledger. And finally, the aging platform was experiencing internal balancing issues and unexplainable system failures.

Replacing its legacy platform with a web-based, enterprise billing system delivered a host of business benefits:

- Payment plan options were increased from two to twenty.

- Customers can now pay with credit card or recurring ACH.

- Billing representatives can provide rapid response to customer inquiries and faster dispute resolution.

- The company’s agents can view commission information online and in real time.

- Call volume from agents and internal business units has been reduced.

- System training time for billing staff was trimmed from six months to four weeks.

- The system provides automated journal entries, drillable reconciliation reports, ad hoc report generation, and a detailed audit trail for control and compliance.

Bringing Billing to Light

Most carriers understand that the impacts of billing processes are not limited to the back office. Billing affects customer satisfaction and customer retention, and a customer-focused billing strategy can create real competitive differentiation.

However, legacy billing systems are not compatible with delivering customer-oriented billing service. These systems lack the ability to put vital information at the fingertips of billing center staff. They cannot support flexible billing options and channels that customers expect. They cannot connect to agent portals or agent management systems. And the inflexible, often proprietary architecture of these systems makes them difficult to change in order to extend new capabilities to staff, customers, and agents.

Few carriers Guidewire surveyed believe that their legacy billing systems are a suitable platform for meeting emerging needs. This realization, combined with the proven benefits delivered by modern billing systems, is prompting more and more carriers to investigate and invest in new solutions.

The Ernst & Young paper points out that “custom-built billing solutions are a thing of the past.” When looking to modernize their billing systems, carriers have an array of solutions in the marketplace from which to choose, and it can be difficult to evaluate and select a billing platform that best meets their needs. Guidewire provides a free Billing Starter Kit, including a detailed Request for Information document, which carriers can use to guide their selection process. The kit is available at http://www.guidewire.com/our_solutions/billing_starter_kit.

In a competitive environment, carriers look for any edge that can make their service stand out from the competition. A modern, customer-focused billing solution provides that edge.

References

Kimberly Morton brings over a decade of insurance expertise in her role as Global Product Marketing Director at Guidewire. She was successful in bringing PitneyBowes Insight (formerly MapInfo Corporation) into the Property & Casualty market and then spent a few years with the financial services analyst firm, TowerGroup before joining Guidewire. She has been published in top insurance magazines and enjoys working closely with carriers and industry analysts to discuss industry trends and thought leadership topics.