Citizens of Nevada may be seeing a refund come their way this year after the Division of Insurance (DOI) approved regulation R087-20 on December 28, 2020. This measure prohibits personal lines property and casualty insurers from taking adverse action when re-scoring policyholders at renewal and requires that a refund be made for any increase in premium as a result.

Retroactively effective March 1, 2020, an insurer may not increase premium based on information contained in a consumer file, including information that determines an insurance score. The prohibition continues until a date two years after the termination date of the Declaration of Emergency for COVID-19 issued by the Governor on March 12, 2020. The regulation does, however, allow for favorable re-scoring if the information results in a lower premium.

These measures are similar to bulletins issued in other states directing insurers to exempt extraordinary life events related to the COVID-19 pandemic from credit-based insurance scoring. However, all companies writing personal lines property and casualty business in Nevada are required to notify the DOI via email, by February 1, 2021, as to how consumer information is used. If a company does regularly re-score their book of business, the insurer must commit to identifying all policyholders whose premiums were increased on or after March 1, 2020, and issue a refund for the increase. A rule filing is required to be submitted to the DOI by March 3, 2021 to supersede any previous rules that allowed adverse action. Insurers are encouraged to start issuing refunds as soon as the affected policyholders are identified.

To ensure your compliance, we at Perr & Knight are here to assist you in submitting your rule filing to the Nevada Division of Insurance. Please contact us today.

Reference:

Copy of approved regulation – Nevada Regulation No. R087-20

Guidance and FAQs – FAQ on Regulation R087-20

News

2019 TRIA Reauthorization – Are You Compliant?

On December 20, 2019 President Donald J. Trump signed into law the Terrorism Risk Insurance Program Reauthorization Act of 2019. The NAIC Terrorism Insurance Implementation Working Group recently issued bulletins related to this matter. his Reauthorization Act of 2019 changes the Terrorism risk Insurance Program as follows:

- Extends the Federal Terrorism Risk Insurance Program through December 31, 2027.

- Adjusts the mandatory recoupment timing.

- Fixes the United States Government reimbursement level of covered terrorism losses above the deductible at 80%.

Will Your Rules, Forms and Policyholder Notices be Compliant?

Affected Commercial lines of business may require updates that must be in place prior to the end of 2020 including the following:

- TRIA endorsements and disclosure notices must be revised to properly reflect the federal share percentage of 80% and may need to be filed in some states.

- Various rates and rules need to be reviewed to ensure they are compatible with the revised program terms. If revisions are needed, they may need to be filed.

Whether you need help drafting updated endorsements and notices, revising your rules or submitting required filings, the experts at Perr&Knight can help you prepare to be compliant with required changes. Contact Us Today.

California Rate Filings and COVID-19 – Latest Update on Filing Trends

With $86 billion in written premium, California is the largest market for property and casualty insurers in the United States. It is also a prior approval state[1] for rates, rules and forms, which are required to be filed and approved by the California Department of Insurance (CDI) prior to an insurer using them. Depending on the line of business and the filing type, the average time to obtain approval from the CDI for these filings can vary widely. It is important for insurers to understand the current environment for filings in the state. Poor planning by insurers could result in delays in implementing changes to rates, rules and forms and lost premium revenue. Nowadays, insurers must also factor in the impact that COVID-19 is having on filings and be aware that the CDI has put all rate increase filings for the COVID-19 impacted lines on hold.

The Rate Regulation Division at the CDI is responsible for reviewing and approving rate, rule and form filings submitted by insurers. As of the middle of September, the staff in the Rate Regulation Division is still telecommuting and has not returned to their offices. The Rate Regulation Division has offices in both Los Angeles and Oakland, and the filing review is split between these offices. Perr&Knight has submitted a few hundred filings in California since January of 2019 including over 100 filings this year. We are actively communicating with the CDI on a daily basis. Our recent experience is that the CDI has been very responsive to emails and to voicemails while their staff has been working remotely. We have also had several conference calls on filings with upper management at the CDI since the start of COVID-19, so the CDI has done well at adapting to their new work environment.

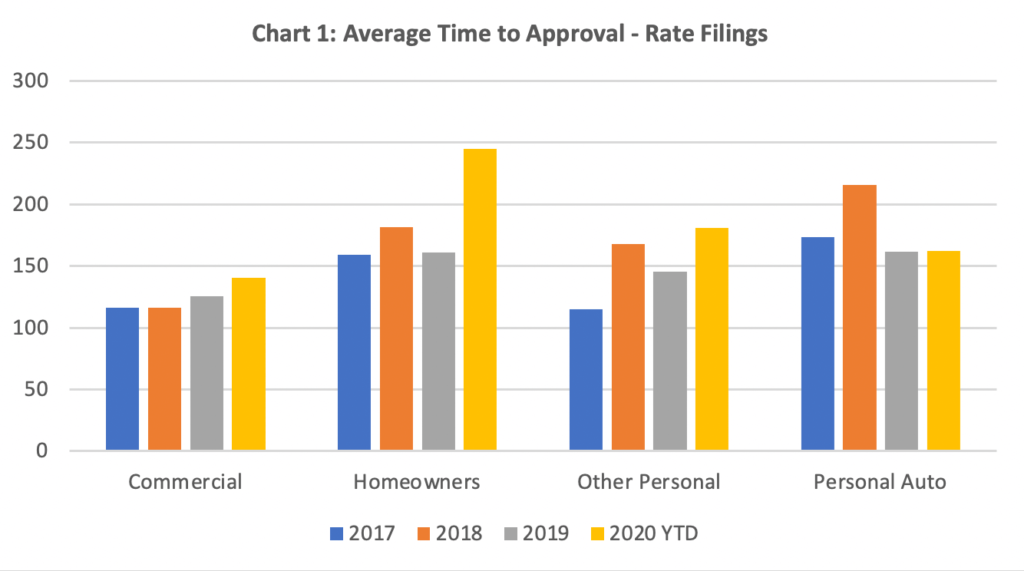

The CDI received over six thousand filings in 2019 and has received nearly 5,000 filings in 2020 through the middle of September, so the number of filings submissions is on pace to be higher than 2019, which has likely increased the workload for the CDI and may impact the time to approval[2]. In Chart 1 below, we have displayed the average approval time for rate filings in California by line of business for the last four years.

Source: Compiled from filings available through S&P Market Intelligence.

While the time to approval for personal auto rate filings has continued to take approximately 150 days in 2020, the time to approval for the other lines has seen an increase with the largest increase being in homeowners, which is taking on average nearly 250 days to receive approval from the CDI. There has been a steady increase in the homeowners rates in California with the wildfires losses under this line over the last several years. It is our understanding that these filings are receiving a higher level of scrutiny by the CDI in an effort to protect policyholders and must go to the Insurance Commissioner prior to approval. Companies should expect this to continue given the current state of the homeowners market in California.

For the lines that are impacted by COVID-19, insurers should also expect increases in the average time to approval. These filings are going to the Insurance Commissioner and/or Deputy Commissioner of Rate Regulation prior to approval for similar reasons as the homeowners filings mentioned above. On rate increase filings for the COVID-19 lines of business, the CDI has been sending out a letter encouraging insurers to reconsider any rate increase given the changes in the insured’s behavior and the environment during the pandemic. As mentioned above, at this point in time, the CDI has put all rate increase filings for the COVID-19 lines on hold until more data is available on the impact of COVID-19. As more information does become available, the CDI will eventually be requesting updated data for these pending rate filings. Currently, the CDI is willing to consider revenue-neutral filings for the COVID-19 lines of business, i.e. filings with an overall rate impact of 0.0%. However, approval will depend on how this rate impact is distributed by policyholder. The CDI is also not approving new exclusions of loss due to virus or bacteria or revisions clarifying the language without a corresponding rate offset. Even with the rate offset, which has been requested by the CDI in some form filings that have been withdrawn, it is possible that the CDI may still not approve any new or revised exclusions related to the pandemic at this point in time.

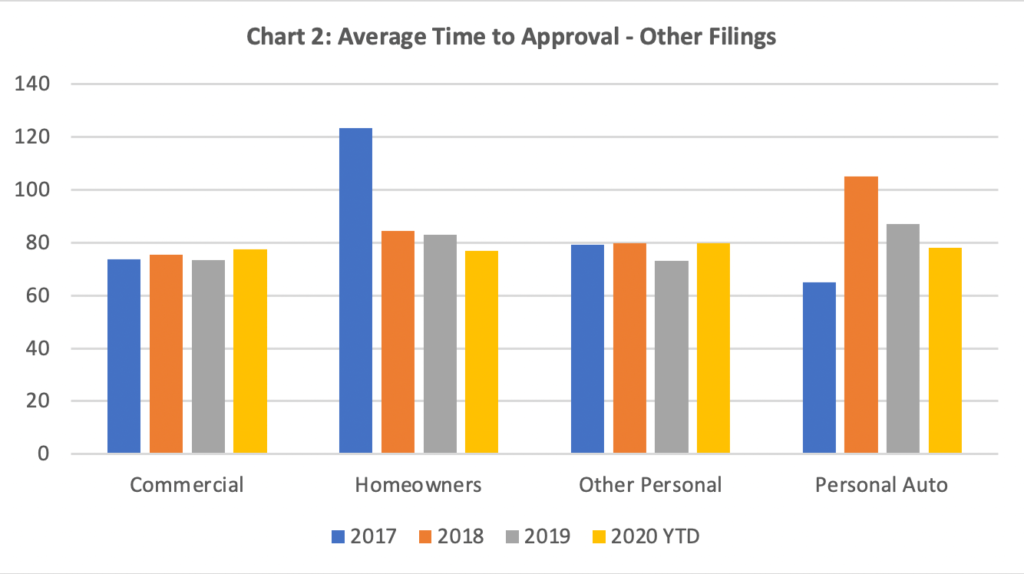

For rule and forms filings that do not include any rate impact, the approval time in California is much shorter than for rate filings. In Chart 2, we have displayed the time to approval for these filings. The average time to approval is generally around 75 to 80 days and has some variation by line of business and year. The earliest possible approval of most filings in California is approximately 60 days from the filing date due the mandatory waiting period of 47 days, which starts on the public notice date and allows time for a consumer to possibly intervene in a filing.

Source: Compiled from filings available through S&P Market Intelligence.

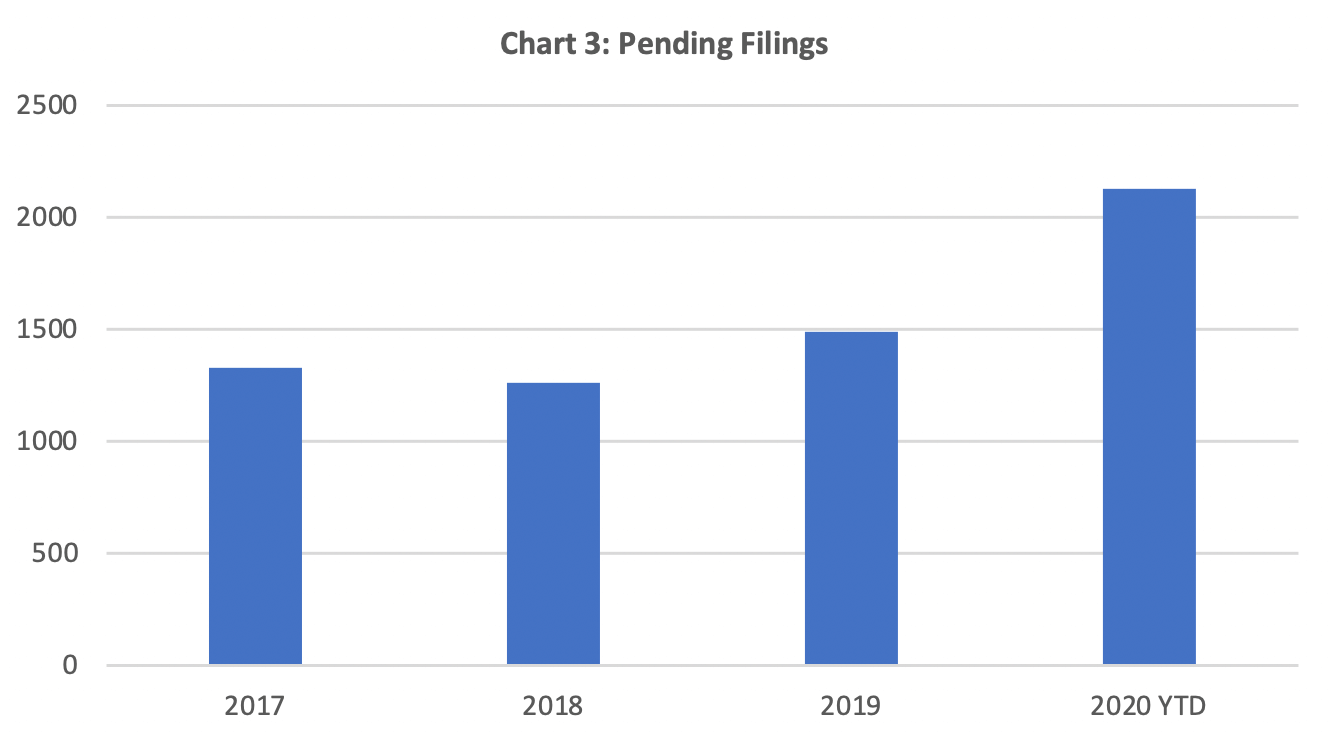

With the average time to approval increasing on rate filings, there has been an increase in the number of pending filings. Chart 3 displays the pending filings at year-end for 2017 to 2019 and year-to-date for 2020. The number of pending filings has decreased for personal auto compared to last year and the increases in the number of pending filings are related to filings for commercial lines and homeowners. Given the increase in the number of pending filings, we expect the average time to approval will continue to increase. Although the CDI has adapted well to working remotely, the telecommuting may be contributing some to the increase in the time to approval and the increases in the number of pending filings. The CDI is also short on staff and has a number of open positions in the Rate Regulation Division due to the normal turnover, including CDI employees retiring. This will likely contribute to an increase in the time to approval over the next year.

Source: Compiled from filings available through S&P Market Intelligence.

For insurers to achieve the shortest time to approval on their filings in California, they need to an understanding of the following:

- California’s filing requirements, which differ from other states;

- The CDI position on various issues;

- Actuarial support required for rate changes (trends, catastrophe loads, etc.); and

- Consumer intervention process and its impact.

When preparing and submitting filings in California, experience working with the CDI and responding to the CDI’s questions on filings is a must-have to reduce the time to approval. The above combined with actively following up with the CDI is the best approach to reduce the time to approval on filings in California.

Contact Perr&Knight

Perr&Knight is a leading provider of actuarial and state filing services to insurers in California. Our consultants actively follow the California market and are very familiar with all the filing requirements in the state. We prepare and submit more California filings than any other company. Our experience includes expert testimony on rating filings and providing guidance to industry associations.

Please contact us with any assistance that is needed with your California insurance products.

[1] Excluding workers compensation.

[2] Average number of days from submission to approval.

New Jersey Order – Premium Refunds, Credits and Reductions in Response to COVID-19

On May 12, 2020, the New Jersey Department of Banking and Insurance (“DOBI”) issued Bulletin 20-22 ordering insurers to make an initial premium refund or other adjustment to all New Jersey policyholders adversely impacted due to overstatement or misclassification of risk resulting from the COVID-19 pandemic. Insurers are directed to provide each affected policyholder with a notification or the amount of the refund or adjustments by June 15, 2020. Insurers who can demonstrate that its rates are not excessive, inadequate, or unfairly discriminatory, or otherwise contends it should not be subject to the terms of this Bulletin, are to provide information to the DOBI by June 1, 2020.

In addition, Order No: A 20-03 requiring various data reports was issued on the same date and is referenced in the bulletin. For insurer groups with more than $20,000,000 in 2019 written premiums, the order requires bi-weekly data reports, with the first report due by May 19, 2020. All insurer groups must provide to the Department a report containing all actions taken, and contemplated future actions, to reduce premium in response to or consistent with Bulletin No. 20-22 on a monthly basis, with the first report due by June 1, 2020.

Perr&Knight submits more filings to the DOBI than any other consulting firm. We are available to discuss any questions or unique situations with the DOBI on your behalf. We can also provide information on what other companies have done, to the extent this information is publicly available in New Jersey or other states. Finally, we can prepare and submit your required filing and reports to the New Jersey DOBI.

As we stated when the California Department of Insurance (“CDI”) Bulletin was released in April, we expected that other states may issue similar bulletins in the future. Those familiar with the CDI bulletin will see some similarities in the New Jersey bulletin. New Jersey’s Bulletin 20-22 requires the action of all companies who write the following lines of business in New Jersey:

- Private passenger automobile insurance;

- Commercial automobile insurance;

- Workers’ compensation insurance;

- Commercial multiple peril insurance;

- Commercial liability insurance;

- Medical malpractice insurance; and

- Any other line of coverage where the measures of risk have become substantially overstated as a result of the COVID-19 pandemic.

These are the same seven lines mentioned in the CDI bulletin. The DOBI bulletin is also consistent with the CDI bulletin in that it allows insurers to apply a uniform premium reduction for all policyholders in an individual line of insurance or reclassify risks in accordance with existing rating plans without prior approval. There are some key differences in the DOBI bulletin compared to the CDI bulletin:

- The CDI bulletin does not require any rate, rule or form filings to be submitted, while the DOBI bulletin requires all licensed and admitted insures to submit all components of their refund program via the System for Electronic Rates and Forms Filing (“SERFF”) no more than 15 days after implementation.

- The CDI bulletin specifies that initial premium refunds are to be made for the months of March and April while the DOBI bulletin orders the refunds “for each month that the public health emergency is in effect.”

In summary, based on Bulletin 20-22 as well as Order No: A 20-03, the following are the key dates for information required of insurers writing the lines listed above in New Jersey:

A. By May 19, 2020, insurer groups writing any of the enumerated lines with more than $20,000,000 in 2019 written premium for all property/casualty lines combined, must report the following information to the DOBI:

-

- New Jersey Claim data including measures of claim frequency and claim severity, and

- Premium collection activity including measures of premium billed or due and actual premiums collected.

This data is needed for the following three time periods:

-

-

- January 1, 2020 to March 21, 2020;

- March 22, 2020 to the date of the report; and

- the same time period as provided in b, however for 2019.

-

In addition to May 19, these data reports are to be provided bi-weekly on the following dates: June 2, June 16, June 30, July 14, July 28, August 4, August 18, September 1 and September 15; the data provided in each report shall be the most current available through the preceding week’s end. For the report due May 19, 2020, the data should be through May 15, 2020.

B. By June 1, 2020, all insurer groups writing any of the enumerated lines are to submit a report containing all actions taken, and contemplated future actions, to reduce premium in response to or consistent with the bulletin. The report is to include New Jersey-specific information and an explanation and justification for the amount and duration of any premium reductions based on the company’s claim and premium data.

The report shall also provide monthly and overall totals for the following:

-

-

- Aggregate premium prior to, and subject to, application of refunds or adjustments;

- Aggregate premium refunds and adjustments;

- The number of in-force policies, and

- Number of policyholders receiving refunds or adjustments.

-

In addition to June 1, the same reports are due on July 1, August 1 and September 1. The information provided in each report is to reflect activity through the preceding month’s end.

C. By June 1, 2020 any insurer, writing the enumerated lines, that can demonstrate its rates are not excessive, inadequate, or unfairly discriminatory, or otherwise contends it should not be subject to the terms of the bulletin, it shall submit its basis for such contention and supporting documentation to the DOBI.

D. By June 15, 2020, the following is to be provided to each affected policyholder:

-

-

- A notification of the amount of the refund or adjustment.

- An explanation of the basis for the adjustment, including a description of the policy period that was the basis of the premium refund and any changes to the classification or exposure basis of the affected policyholder.

- An opportunity to provide their individual actual or estimated experience.

-

E. No later than 15 days after implementation, licensed and admitted insurers must submit all components of their refund program, including but not limited to, a rate, rule, and/or form filing via the SERFF documenting the refund program.

If there is anything that Perr&Knight can do to assist your company to comply with the requirements in New Jersey or any other state, please complete our contact form.

Understanding the California Premium Refund Order for COVID-19 and the Report Due June 12, 2020

On April 13, 2020, the California Department of Insurance (“CDI”) issued a Bulletin ordering the refund of premium to drivers and businesses affected by the COVID-19 emergency. Based on our discussions with the CDI, they are expecting a report by June 12 from every company with California policyholders in any of the lines of business listed in the Bulletin.

With millions of dollars being returned to policyholders, it is important to have a thorough understanding of the CDI’s premium refund order. Perr&Knight has had multiple discussions with the CDI to gain a better understanding of the requirements, which will allow us to provide greater insight to companies on how to respond to the Bulletin. Our actuaries are assisting the insurance industry with the following:

- Estimating COVID-19 Impact on Losses: We can estimate the impact COVID-19 is having on a company’s losses. At this point, there is often limited data available, which makes estimating the impact difficult. Although frequencies may be decreasing, some lines such as personal and commercial auto may be seeing increasing severities due other factors, such as an increase in speeding due to less traffic congestion. It is important to have a clear understanding of all risk factors that are changing. Our actuaries are actively reviewing the trends in the marketplace for multiple carriers.

- Calculating the Premium Refund: There a number of factors that go into calculating the premium refund including the CDI’s expectations on how the refund should be calculated. We are helping companies take all these under consideration in determining the amount that will be returned to policyholders.

- Preparing the COVID-19 Report: Perr&Knight is assisting companies in preparing and submitting a COVID-19 Report to the CDI that meets the requirements in the Bulletin. This includes determining whether an applicable product line is subject to the Bulletin and requires a response.

If you need assistance with responding to the California premium refund order or have any questions on the Bulletin, please let us know.

Contact:

Scott Knight

Managing Principal

Chief Sales Officer

310.889.0947

sknight@perrknight.com

California Commissioner Orders Premium Refunds in Response to COVID-19

On April 13, 2020, the California Department of Insurance (“CDI”) issued a Bulletin ordering the refund of premium to drivers and businesses affected by the COVID-19 emergency. The implications of the Bulletin are complex and require consideration of various aspects of an insurer’s business model. Perr&Knight is having discussions with the staff at the CDI regarding their expectations for compliance with the Bulletin. We have extensive experience with rate, rule and form filings in California as we submit more filings to the CDI than any other consulting firm and will be assisting insurers with complying with the CDI requirements to ensure that the appropriate adjustments are made for the change in risk and/or reduction in exposure.

The Bulletin requires action of all companies who write the following lines of business in California:

- Private passenger automobile insurance

- Commercial automobile insurance

- Workers’ compensation insurance

- Commercial multiple peril insurance

- Commercial liability insurance

- Medical malpractice insurance

- Any other line of coverage where the measures of risk have become substantially overstated as a result of the pandemic.

The following is required of each California insurer writing the lines above:

- By June 12, 2020, report the following information to the CDI:

a. An explanation and justification for the amount and duration of any premium refund, and how those measures reflect the actual or expected reduction of exposure to loss.

b. Monthly and overall California-specific totals for the following:

i. Percentage of refund applied,

ii. Aggregate premium prior to, and subject to, application of refund,

iii. Aggregate premium refund,

iv. Average premium before and after refund,

v. Average percentage of refund, applied to each policyholder,

vi. Number of in-force policies, and

vii. Number of policyholders receiving refund.

- By August 11, 2020:

a. Provide each affected policyholder, if applicable, with a notification of the amount of the refund, a check, premium credit, reduction, return of premium, or other appropriate premium adjustment.

b. Provide an explanation of the basis for the adjustment, including a description of the policy period that was the basis of the premium refund and any changes to the classification or exposure basis of the affected policyholder.

c. Offer each insured the opportunity to provide their individual actual or estimated experience. For automobile policies, this includes an invitation to provide updated mileage estimates as appropriate.

Perr&Knight is available to discuss any questions or unique situations with the CDI on your behalf. We can also provide information on what other companies have done, to the extent this information is publicly available in California or other states. Finally, we can prepare and submit your required report to the California DOI.

We expect that other states may issue similar bulletins. If there is anything that Perr&Knight can do to assist your company in California or any other state, please complete our contact form.

California New Regulations – Filing Required to Remove Gender from Auto Insurance Rates

As you may be aware, the California Department of Insurance (“CDI”) issued regulations prohibiting the use of gender in automobile insurance rates. If insurance companies use gender in determining the rates for personal auto insurance, they will be required to submit a filing removing gender from the company’s class plan by July 1, 2019. The regulations only mention a filing deadline and do not specify a required effective date.

Companies have the option to submit a simplified revenue neutral class plan filing, which is described in Section 2632.11(c)(1) of the regulations. Companies may also comply by submitting a full class plan filing that includes a sequential analysis supporting the proposed changes and compliance with the factor weights. However, this approach has some drawbacks, which may result in most companies choosing the simplified filing approach.

If you need assistance with the class plan filing or have any questions on the new regulations, please let us know. We have discussed the regulations with the Division Chief of the Rate Regulation Branch at the CDI and understand the advantages and disadvantages of the simplified and full class plan filing approaches.

Contact us with any questions on new regulations or if you need assistance with the class plan filing.

Contact:

Scott Knight

Managing Principal

Chief Sales Officer

310.889.0947

sknight@perrknight.com

Reserving Services for Companies Considering a Change in Actuaries

If your company is contemplating a change in the actuary that issues the Statement of Actuarial Opinion on the company’s reserves, please consider obtaining a quote from Perr&Knight. We are one of the top 10 largest property and casualty actuarial consulting firms in the United States and employ more than 100 insurance professionals, including 25 Fellows and Associates of the Casualty Actuarial Society and the Society of Actuaries. Our actuaries have experience with nearly all property and casualty and accident and health lines of business.

Perr&Knight provides the following reserving services:

- Loss reserve analyses;

- Long duration contract unearned premium reserve testing;

- Statements of actuarial opinion; and

- Schedule P preparation/review.

Our actuaries understand that each company has unique characteristics associated with their operations. We work with our clients to obtain a complete understanding of their business so that we can produce the most accurate reserve analysis.

Contact us with any questions about Perr&Knight’s services or if you would like to obtain a quote.

Contact:

Brett Horoff, ACAS, ASA, MAAA

Principal & Consulting Actuary

Director | Consulting Services

310.889.0944

bhoroff@perrknight.com

Perr&Knight Recommends Predictive Analytics to Get the Most Out of Your Data

Are you getting the most out of your data? Whether it be in personal lines pricing, commercial lines underwriting, claims handling or fraud detection, your data should be helping you run an efficient, profitable organization. Through predictive analytics and your data, you can gain insights into your business, like:

- What is the most predictive rating variable?

- What policy/claim characteristics point to fraud?

- Which external data can help me better price my risks?

- On which claims should you place the most experienced claims managers?

- What variables outside the rating plan are predictive of underwriting results?

- What variables give insights to reduce litigation expense?

Let Perr&Knight’s Predictive Analytics team help you utilize your data to its fullest potential with our low-cost predictive analytics solutions using cutting edge technology and industry best practices.

Predictive Analytics: Data Science & More

Our data scientists work alongside our actuaries and other insurance experts to provide a tailored business solution. Perr&Knight is one of the top actuarial consulting firms in the United States with expertise spanning all lines of business and U.S. jurisdictions. Our Predictive Analytics team provides clear solutions using your data along with our industry knowledge to help you stay competitive and profitable.

InsurTech

With new InsurTech products available to the insurance industry, knowing how to integrate these tools into your business takes a specialized skill. Perr&Knight has experience merging new variables with company data and analyzing for insights tailored to your book of business. We work with InsurTech innovators to review predictive models and support insurance applications with regulators.

Let Perr&Knight incorporate big data into your insurance products to help you stay relevant in the ever-changing insurance market. Contact us today to learn more.

Perr&Knight Recommends Compliance Spring Cleaning

Are your operations due for some Spring Cleaning? It’s never a bad time to make sure your insurance operations are in order and ready to face an internal audit or market conduct exam. A little Spring Cleaning, in the form of a compliance audit, can help a company avoid fines, cease and desist actions or even loss of license.

- Do you record and respond to complaints in the required timeframe?

- Are your producers properly licensed?

- Are schedule rating debits and credits sufficiently documented by your underwriters?

- Do the rates in your system match your filed rates?

- Are you utilizing approved forms?

- Are claim files reserved according to established procedures?

We Can Help

Let Perr&Knight’s consulting team help you identify and correct compliance risks. If you’re looking for a full-scale review, our team of regulatory compliance professionals and operational and technology consultants will assess your current operations through a combination of staff interviews and documentation review in each of the NAIC’s seven areas of operation: operations/management, complaint handling, marketing and sales, producer licensing, policyholder service, underwriting and rating, and claims. We’ll draft “as is” process maps that document your current processes and use them to identify compliance risks and process inefficiencies. Then, based on our extensive subjective matter expertise and knowledge of best practices, we’ll draft “to be” process maps with proposed solutions for closing gaps and streamlining processes in a compliant manner. In addition, we can support you as you implement changes to processes.

If you’re looking for a more targeted review to help remedy a risk or compliance gap that you’ve already identified, Perr&Knight can help. Our regulatory compliance consultants can perform a more limited analysis, such as a compliance audit of a single area of operation, a sample file review of claims and/or policies, a rate manual compliance review, a certificate of authority inventory, etc. We will customize our services to meet your needs.

Contact Us

Contact us online or give us a call today to discuss how Perr&Knight can help you!

+1.888.201.5123 ext. 3 // www.perrknight.com