In October of this year, California approved a regulation requiring rate filings from every personal and commercial property insurer that uses wildfire risk, explicitly or implicitly, in rating a policyholder or applicant. The California Department of Insurance (“CDI”) recently published FAQs to assist companies in complying with the regulations.

Below we have summarized the key information from the FAQs.

REQUIRED RATE FILINGS

Property insurers are required to submit a rate application by April 12, 2023. The rate application needs to include a complete rate filing that complies with the CDI’s Prior Approval Rating Filing Instructions. If a property insurer has an existing pending rate application, it may be amended to meet the requirements of the regulation. However, the CDI is not requiring this and a second rate application can be submitted with the wildfire mitigation credits, which will result in the property insurer having two pending rate applications at the same time. The CDI anticipates reviewing each rate application in the order that it is received, but it is possible the second rate application could be approved first.

For property insurers that do not use wildfire risk in the rating, no rate filing is required. However, to the extent a property insurer uses territorial rating, this may implicitly include wildfire rating and require a rate filing under the regulation.

LINES OF INSURANCE

The FAQs state the following, “The regulation applies to any line of insurance, personal or commercial, where the insurance company in rating the building being evaluated applies or uses a rate that is developed with, determined by or relies upon, in whole or in part, a rating plan that segments, creates a rate differential, or surcharges the premium based upon a policyholder or applicant’s wildfire risk.” Prior to the FAQs, the CDI indicated via communications with our actuarial consultants that renters (HO4) and condo (HO6) policies were subject to the regulations if there is a rate differential that is caused at least in part by the risk of wildfire.

MANDATORY AND OPTIONAL MITIGATION FACTORS

For each mandatory mitigation factor, property insurers are required to have separate, individual discounts or credits. The same applies to optional factors. Mitigation factors can be combined in the rating provided that the discount or credit is more than the sum of the individual discounts or credit.

Property insurers may need to update their underwriting guidelines depending on whether the new regulations result in a change in their underwriting process. Some of the mitigation factors require verification, which could be obtained through an inspection or through an insurer’s questionnaire or application if an insurer does not perform an inspection. The same applies to renewals.

WILDFIRE RISK MODELS USED BY INSURERS

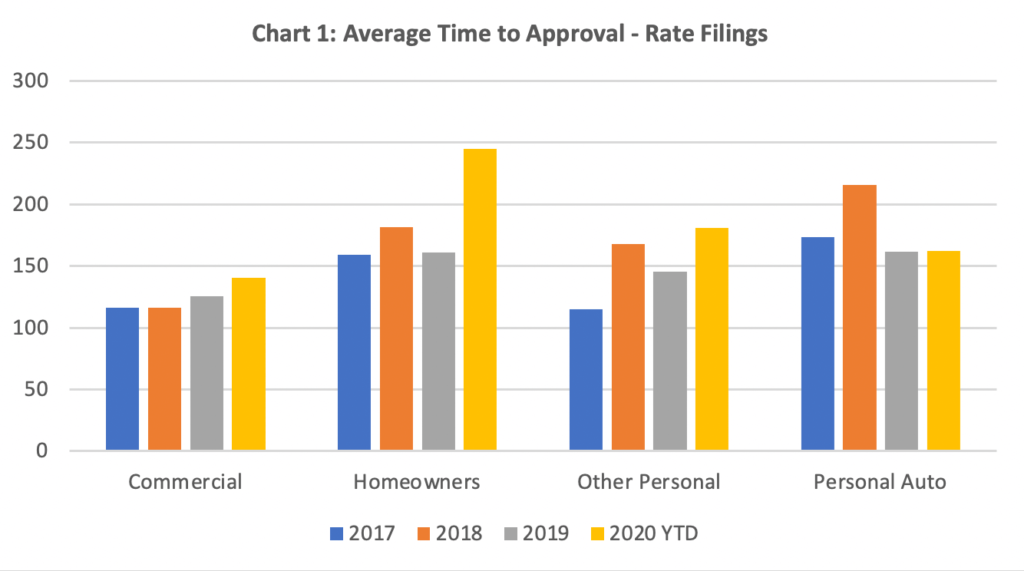

The CDI will review any wildfire risk model used in the rating. When a property insurer is adopting a new model not previously reviewed by the CDI, the time to approval for the rate filing will likely be longer than a typical rate filing. If a model is being adopted in a filing, the CDI’s Model Checklist should be included in the filing and the Model Disclosure in the CDI’s Prior Approval Rate Application should be completed.

NEED HELP WITH A CALIFORNIA RATE FILING

Perr&Knight is a leading provider of actuarial and state filing services to insurers in California. Our actuarial consulting team actively follows the California market and is very familiar with all the filing requirements in the state. We prepare and submit more California filings than any other company.

Please contact us for any insurance filings support that is needed with your California insurance products.