A WORKPLACE WHERE YOU MATTER

SHARE YOUR IDEAS

In an industry known for “business as usual,” our insurance consulting services break the mold. Insurance may move slowly, but we encourage you to contribute fresh thinking and new ideas to push the industry ahead.

MAKE YOUR VOICE HEARD

Our team members guide our priorities and our company trajectory. Employee-led committees play a major role in our decisions, actions, and the way we present ourselves in the industry.

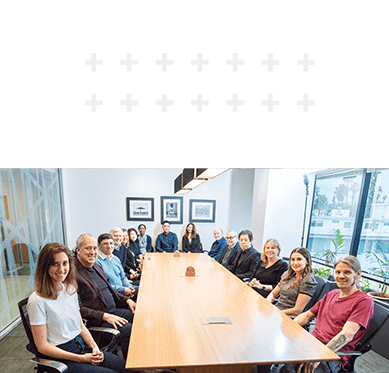

JOIN A DIVERSE TEAM

Our commitment to Diversity and Inclusion is more than a talking point—it’s a priority. We recognize that diversity means strength and we make sure everyone always has an equal seat at the table.

WORK ALONGSIDE EXPERTS

Accelerate your professional advancement by working with the best. Our experienced actuaries, technology specialists, and business process experts are always ready to share their insight.

STRENGTHEN YOUR CAREER

Unlike massive insurance consulting firms and carriers where you may get stuck in place, we provide ongoing opportunities to strengthen your skills and take your career to the next level.

Build a Rewarding Career at Perr&Knight!

Learn why Perr&Knight is a destination where insurance professionals thrive.

Open Positions

DEEPEN YOUR KNOWLEDGE

How Employees Drive Change at Perr&Knight

Perr&Knight’s strength comes from our flexibility–in the client services we provide as well as how we evolve internally. Here’s how our talented staff are helping to shape the future of Perr&Knight.

Read the Article